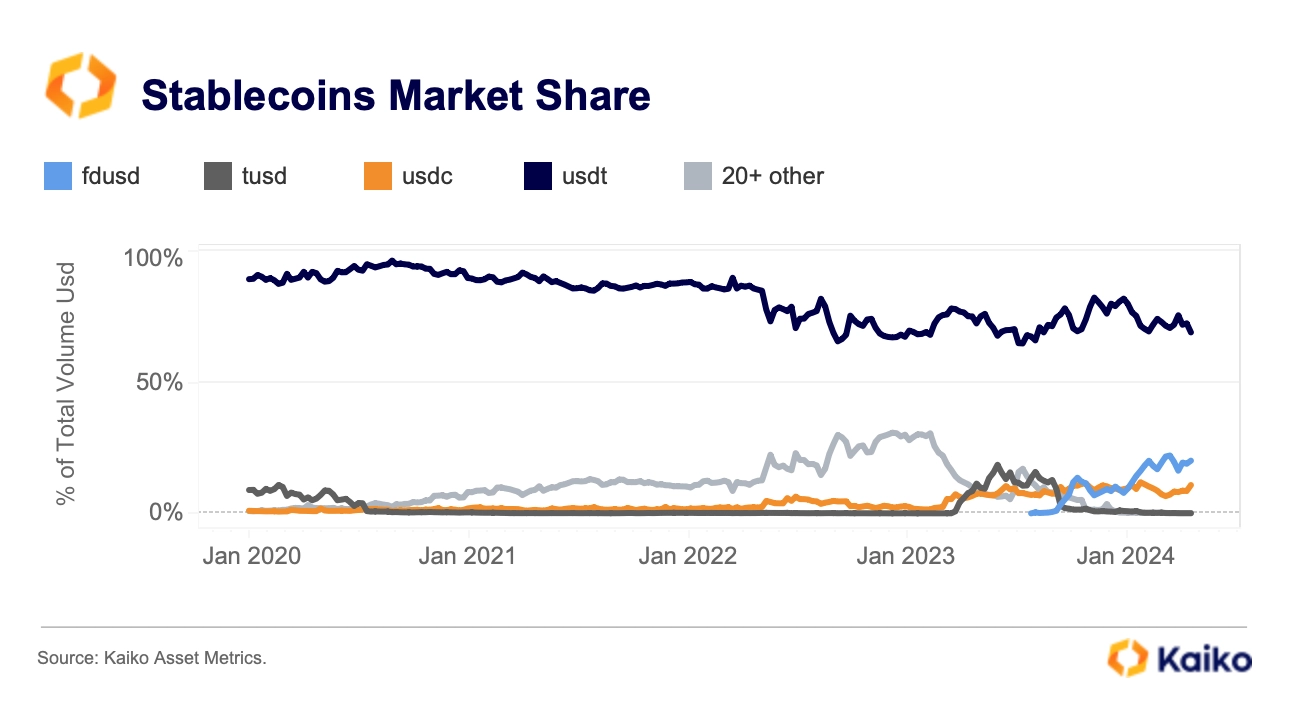

Market intelligence platform Kaiko Analytics reports that new competitors are chipping away at Tether’s (USDT) stablecoin dominance.

In a new report titled “Tether Loses Market Share,” Kaiko Analytics says that the stablecoin issuer’s market share over centralized exchange platforms (CEXs) has dipped 13% year-to-date (YTD) due to the growth of rival dollar-pegged digital assets, such as FDUSD and USDC.

“Despite its dominant market position, USDT’s market share on CEXs has been trending downwards, declining from 82% to 69% YTD. This decrease can be partly attributed to growing competition from stablecoins like FDUSD which benefit from Binance’s zero-fee promotions.

USDC has also experienced a rise in its market share, signaling a growing preference for regulated alternatives. At present, stablecoins issued in the US make up 10% of the overall stablecoin trade volume.

Only one of the top five stablecoins by market cap, Circle’s USDC, is regulated under state US money transmitter frameworks. Nevertheless, its share has increased from less than 1% in 2020 to 11% today.”  According to Kaiko, other rivals such as Ethena (USDe), which uniquely offers yield, could also be cutting into Tether’s market dominance.

According to Kaiko, other rivals such as Ethena (USDe), which uniquely offers yield, could also be cutting into Tether’s market dominance.

“Another reason for Tether’s declining market share could be linked to the emergence of innovative yield-bearing alternatives such as Ethena’s USDe. Since its launch in February, USDe’s volume has grown significantly, although it has retreated from April’s all-time high of more than $800 million following Ethena’s ENA airdrop.”

According to Tether’s 2024 Attestation Report, the firm posted a record-breaking $4.52 billion in profits during the first quarter of the year.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/balabolka