Sui Network is addressing “misleading” posts about its token supply being unfavorable to retail investors.

In a post on the social media platform X, Sui Network says that third-party custodians safeguard locked SUI tokens, and they cannot be moved until they are unlocked according to the project’s token emission schedule.

Sui Network also clarifies that Mysten Labs, the developer behind the project, is not involved with the Sui Foundation’s treasury, community reserve, stake subsidies or any other tokens allocated to investors.

“Sui Foundation is the largest holder of locked tokens, which will be unlocked in accordance with the public emissions schedule. These tokens are used to support builders, advance the Move programming language, increase network security, and grow the ecosystem through initiatives like developer grants, hackathons, bug bounties, academic research, and more.

Staking rewards are already in circulation because they are composed of stake subsidies and network fees. Furthermore, 100% of staking rewards earned by the Sui Foundation are returned to the community, and included in the public emission schedule.”

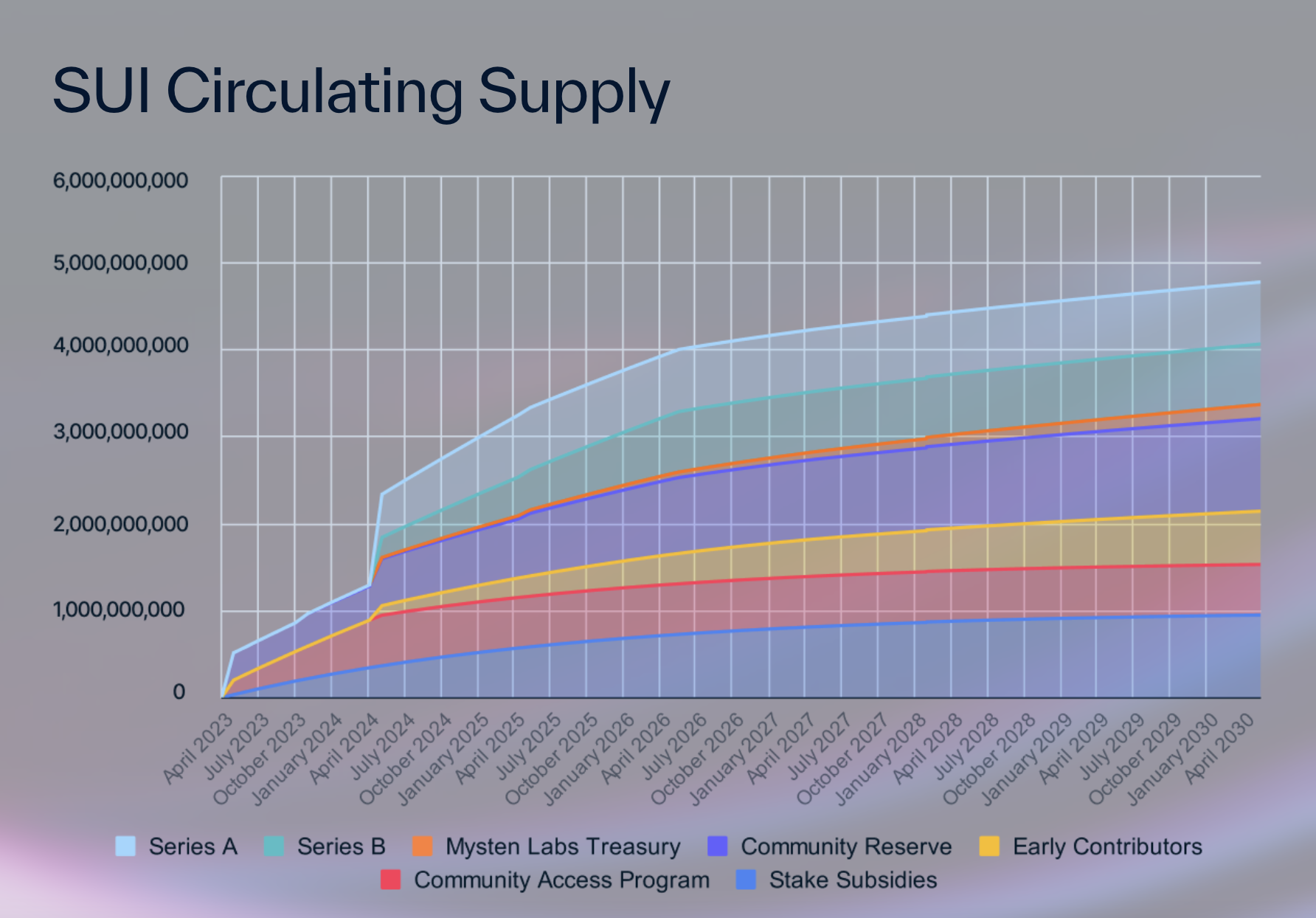

At time of writing, SUI currently has a max supply of 10 billion with a circulating supply of 2.33 billion. The circulating supply is expected to grow to roughly 3.6 billion over the next year, according to TokenUnlocks.

SUI is trading at $1.13 with a market cap of $2.64 billion and a fully diluted valuation (FDV) of $11.318 billion.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney