Billionaire venture capitalist Chamath Palihapitiya believes that the US economy is already in the midst of a downturn.

In a new episode of the All-In Podcast, Palihapitiya explores why more than half of Americans believe the economy is in a recession even though the GDP rose by 1.6% last quarter.

According to Palihapitiya, the negative sentiment may have something to do with the components used to measure the GDP, which he notes may be giving an inaccurate sense of the state of the US economy.

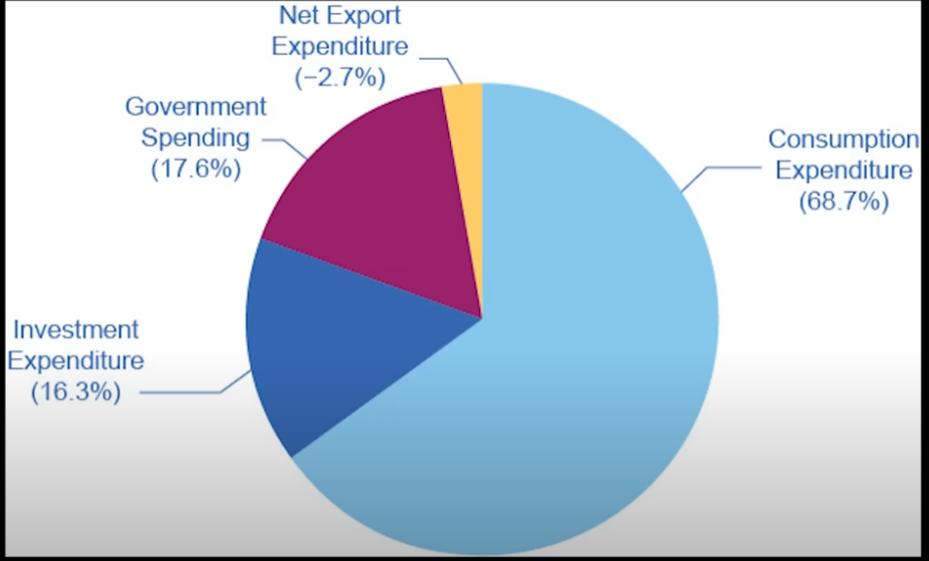

“[The GDP] is the sum of four things. Most of it is what people spend. Then the next big chunk is what companies and governments spend and the last is what we export to other countries.”

The billionaire explains that consumers and companies tend to save and scrimp when interest rates are high. Palihapitiya says consumers would rather keep their money sitting in banks to generate interest while companies limit their investments because borrowing money is expensive.

When interest rates are low, the venture capitalist says consumers and companies are incentivized to spend. The cost of capital is cheaper and money sitting in banks is not generating interest.

But the same dynamic doesn’t appear to apply to the government. According to the billionaire, the government spends regardless of prevailing rates.

“Unfortunately, it turns out our governments in America, they just keep spending more and more. So even if net interest income is small, even if net interest income is high, they’re just like, ‘Forget it, the taps are on.’

So what does this all mean? I think what it really means is that we do a very poor job of measuring all these dynamics together. So I actually trust the survey data of these individuals more than I trust the GDP report in the sense that I think it more accurately captures this dynamic.

Rates are at 6%, people are saving more, they’re not getting paid more, things are costing more. The government is giving you free money so you kind of feel like everything is moving so that the GDP measurement, the way that it’s classically done, shows that, ‘Wow we grew at 3% of 4%,’ but the average individual American isn’t feeling that. They’re actually feeling that they have less money.

I would actually go with them and actually say if we don’t revisit this thing from first principles, we’re going to get this dynamic where we think one thing is happening but the actual exact opposite is happening. In this case, I do think we’re in a quasi-synthetic recession.”

Palihapitiya appears to suggest that the economy is already in a recession but GDP numbers do not reflect that state due to sustained government spending.

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney