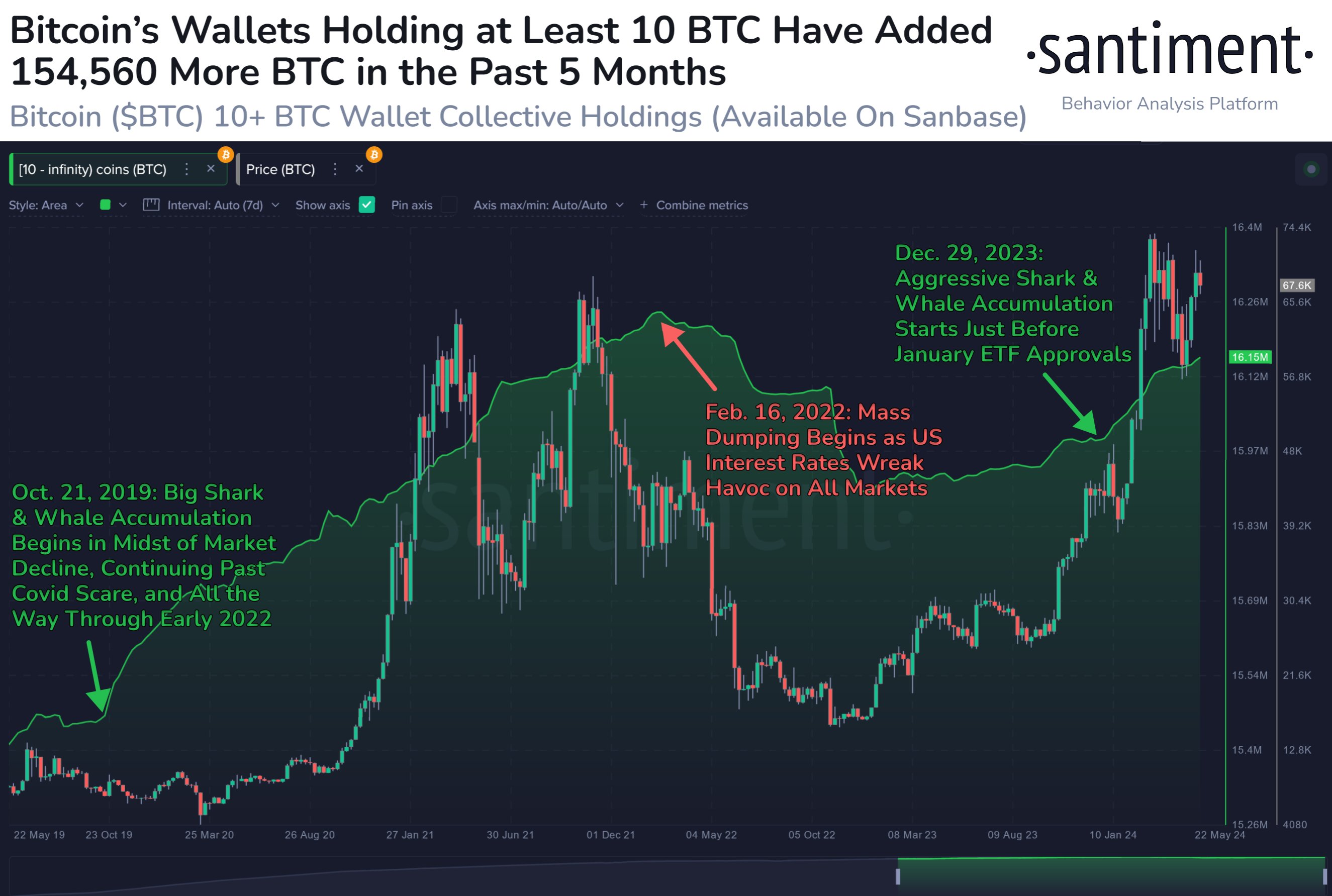

New data from market intelligence platform Santiment reveals that one Bitcoin (BTC) indicator that has historically predicted price rallies is flashing a bullish signal.

In a new post on the social media platform X, Santiment says that when crypto wallets holding at least 10 BTC are accumulating, the price of BTC tends to go up.

However, when they sell, the crypto analytics platform says that elongated bear markets tend to follow.

“Historically, one of crypto’s top leading indicators is the collective holdings of wallets with at least 10 Bitcoin (exchanges or otherwise). When they accumulate, cryptocurrencies rise. When they dump, extended bear markets come.”

According to Santiment, the activity of deep-pocketed crypto investors and the price of digital assets tend to be correlated.

“We can often see price reversals when looking at just how many overall whale transactions ($100,000+ or $1 million+) there are on the BTC network on a daily basis. The general rule of thumb for whale transactions, among other key on-chain metrics is:

- If prices are moving up at the time of a big whale transaction spike, then there is an increased likelihood that prices are about to correct and drop back down.

- If prices are moving down at the time of a big whale transaction spike, then there is an increased likelihood that prices are about to bounce and rise back up.”

Santiment also notes that while many whale investments are genuine, sometimes, whales may not even have a good reason to raise a market but choose to do so anyway.

“Whale and shark behavior plays such a vital part of an asset’s present and future. Sometimes there are genuine accumulations due to excitement about the tech or the prospects of added exposure (from, say, an exchange-traded fund approval). Other times, the accumulation may have no reason, and a whale just decided it was time for them to pump markets.”

Bitcoin is trading for $67,383 at time of writing, a 1.6% decrease during the last 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong/Sensvector