A widely followed on-chain analyst thinks that a big price move is incoming for Bitcoin (BTC) following months of consolidation.

Pseudonymous analyst Checkmate tells his 91,900 followers on the social media platform X that a key on-chain metric for Bitcoin suggests it’s almost time for BTC to escape its consolidation phase.

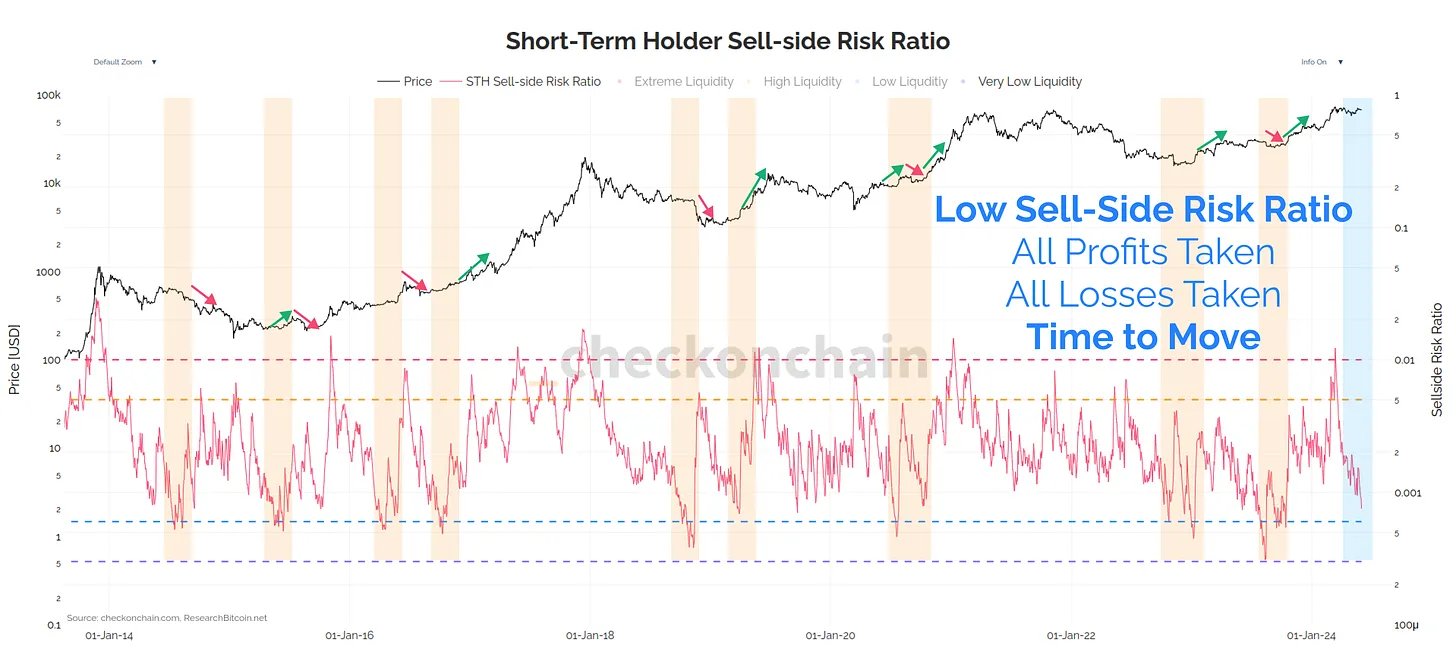

According to the analyst, BTC’s sell-side risk ratio for short-term holders is rapidly declining, indicating that sellers are losing ammunition. Checkmate notes that he’s looking at the short-term holder cohort or entities that have been holding BTC for less than 155 days because they are the ones driving near-term price action.

“Range contraction (consolidation) leads to Range Expansion (trending).

Bitcoin is coiled like a spring, and it usually doesn’t sit still like this for long.

Sell-side risk ratio for short-term holders is dropping like a stone, telling us it is time to move.”

As to what could catalyze the next big Bitcoin move, Checkmate says he’s keeping an eye on the US bond market. According to the analyst, the rate for 10-year yields (US10Y) is in an uptrend and conditions may turn sour for Bitcoin and crypto if it trades close to 5%.

Checkmate highlights that “higher yields mean tighter conditions, less valuable collateral, and a reduced overall risk tolerance.”

“I’ve flagged in red the severe sell-off we saw in bonds between August and October 2023 on the chart below. During this time, US-10y yields approached 5.0%, equities sold off by -10%, and Bitcoin sold off -12% in one day. That said, BTC then consolidated for two months, and ripped +30% higher.

10y yields trading up towards 5% is where the Fed and Treasury have previously become concerned about treasury market dysfunction, and stepped in to arrest the fall in prices. This is a reasonable argument for why Bitcoin sold off initially, but then rallied higher afterwards.

The bond market is the one that gets to ‘call time’ on risk assets and financial stability. Should yields accelerate higher from here, it starts getting close to the territory where things could get hairy, and fast.”

Bond prices and yields tend to move in the opposite direction. When yields soar, the prices of older bonds plummet as they have to compete with newer bonds that offer higher interest.

At time of writing, US10Y is hovering at 4.394% while BTC is trading at $68,643.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3