Digital assets-focused investment firm Pantera Capital is highlighting key reasons for why they believe the altcoin market is depressed.

In its latest Blockchain Letter, Pantera Capital portfolio manager Cosmo Jiang says that macroeconomic conditions are hurting the crypto market along with fears over a supply overhang and an increase in altcoin projects.

Jiang also says that the U.S. Securities and Exchange Commission’s (SEC) recent actions against blockchain development company Consensys and decentralized exchange (DEX) Uniswap (UNI) over alleged securities law violations created regulatory uncertainty for alt projects.

“We point to a few macro-related and crypto-specific reasons for the decline. The main macro headwind in early April was the markets began repricing a scenario of higher-for-longer rates due to a still-strong economy and high inflation, in contrast to the prior view that there would be a rapid cut in rates.

On the crypto side, the markets were weighed down primarily due to fears of a supply overhang. For Bitcoin, the German government began liquidating its $3 billion position and the timeline of the $9 billion Mt. Gox distributions was confirmed. Long-tail tokens have faced supply headwinds both from the increase in new token launches, diversifying investors’ attention and limited capital, as well as ongoing vesting of private investors from newly-launched tokens over the last year.

In addition, SEC investigations into Consensys and Uniswap created some uncertainty for certain protocols.”

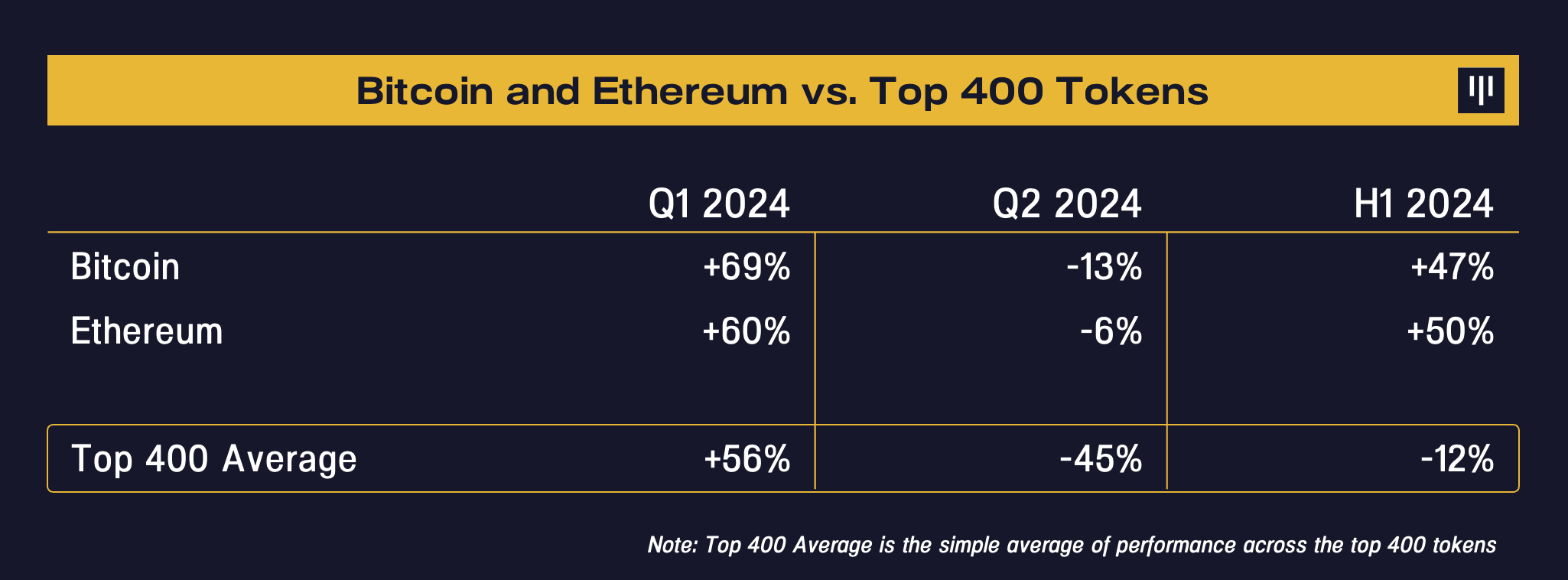

Jiang says that Bitcoin (BTC) and Ethereum (ETH) have significantly outperformed the broader crypto market so far in 2024.

“Overall, breadth has been narrow and there has been meaningful underperformance year-to-date across the broader crypto landscape relative to Bitcoin and Ethereum, which is analogous to the dynamic in equities this year, the Magnificent 7 versus the rest. To help illustrate this point, we have included below the distributions of returns for the top-400 tokens by market capitalization this year.”

Bitcoin is trading for $65,314 at time of writing, up 1.6% in the last seven days. Meanwhile, Ethereum is trading for $3,327 at time of writing, down nearly 2% in the last week.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3