Bitcoin (BTC) is in an accumulation phase, according to the chief executive of CryptoQuant.

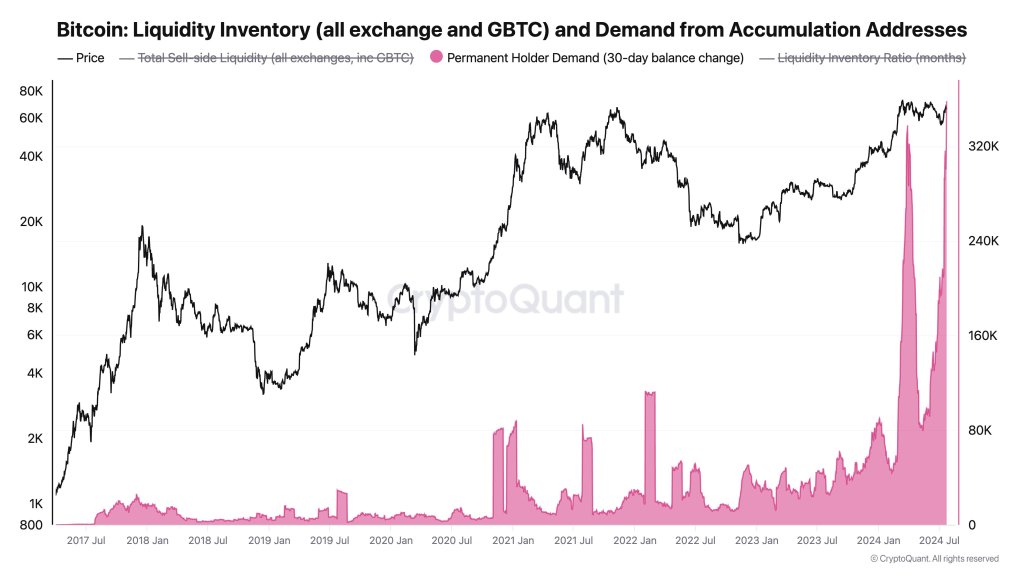

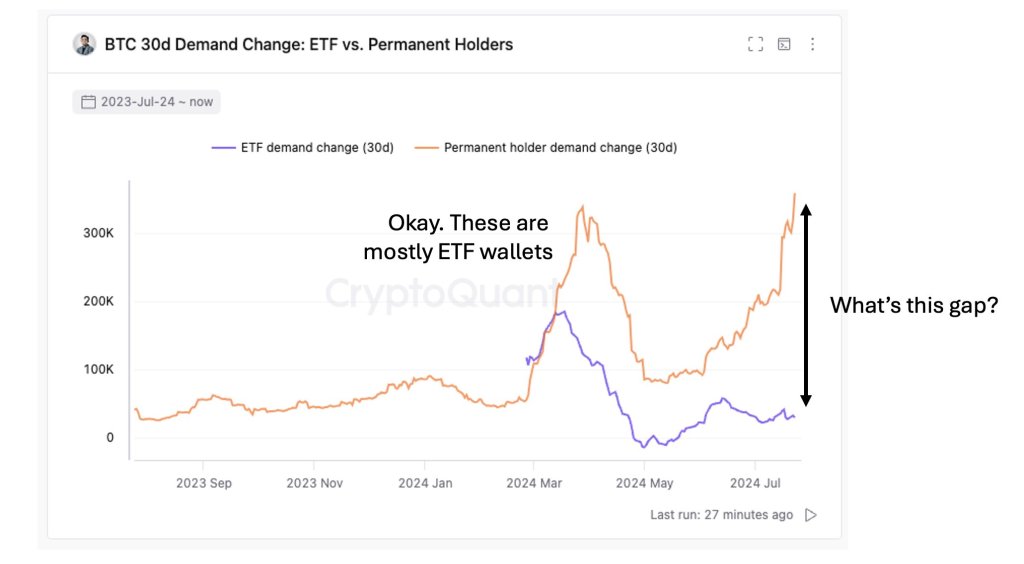

Ki Young Ju tells his 356,900 followers on the social media platform X that 358,000 BTC moved to permanent holder addresses in the past month.

The CEO notes global spot exchange-traded (ETF) inflows in July were only 53,000 BTC.

“Though not all remaining BTC is in custody wallets, whales are clearly accumulating. And it’s an unprecedented level.

The recent Bitcoin inflows to permanent holder addresses are not due to ETF wallets. These wallets are neither exchange nor miner wallets and have no outflows; they are mostly custodial wallets.”

Young Ju also details what he looks for as signs of the early stages of a transition between an accumulation environment and a distributive one.

“To gauge retail distribution on-chain, I use indicators capturing the increase in realized cap within a month. If there are low inflows to accumulation addresses and a high realized cap for under a month, driven by retail activities like deposits to exchanges, I would say it’s a distributive environment.”

The realized cap metric records the price of each Bitcoin when it last moved and aims to gauge how many holders are in profit or at a loss.

BTC is trading at $65,720 at time of writing.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney