The chief crypto analyst at Real Vision says the global money supply (M2) metric is showing a “perfect” scenario for Bitcoin (BTC).

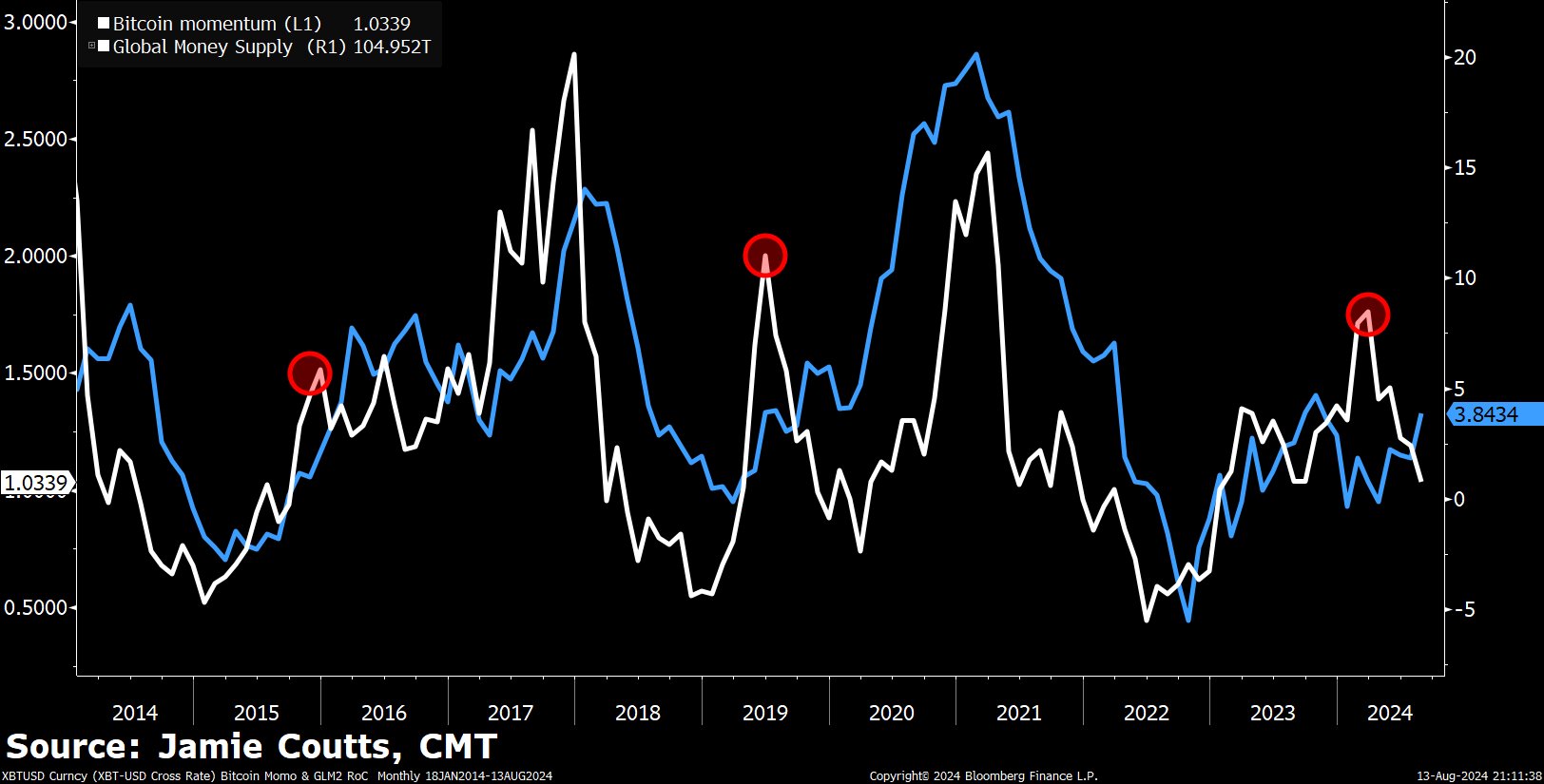

Jamie Coutts says on the social media platform X that a historical relationship between Bitcoin and M2 suggests that the flagship cryptocurrency is in the midst of a consolidation phase while an increase in the money supply sets the stage for BTC’s next leg up.

“Over the past decade, Bitcoin has had a tendency to trough several months before the bottom in global M2. Then it rips, gets way ahead of the move in liquidity, and has a mid-cycle correction.

Now, momentum in global liquidity is starting to accelerate higher while all the froth from ETF launches and excess leverage has left the Bitcoin market.

The perfect set up.”

Coutts reiterates the link between Bitcoin and the money supply, sharing a chart suggesting that BTC rises with M2, and then corrects once M2 reaches a short-term top.

“In a debt-based fractional reserve financial system, the money supply must continually expand to support the outstanding debt. Otherwise, everything will collapse. This is the natural state.”

BTC is worth $61,323 at time of writing, up 7% on the week.

Last month, Coutts’ boss at Real Vision, Raoul Pal, made similar suggestions about liquidity flooding the markets.

“We also think that globally, the Japanese might intervene in their currency selling dollars which adds dollars into the global system. We also think that most countries will be adding liquidity as well. We think China needs to increase its liquidity.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Bryan Vectorartist/Sensvector/pikepicture