Real Vision analyst Jamie Coutts says that altcoins may be close to repeating the explosive mania of 2020 and 2021.

Coutts says on the social media platform X that the crypto market cycle is currently at a point “where selective high-quality assets are bottoming and will outperform when the bull resumes.”

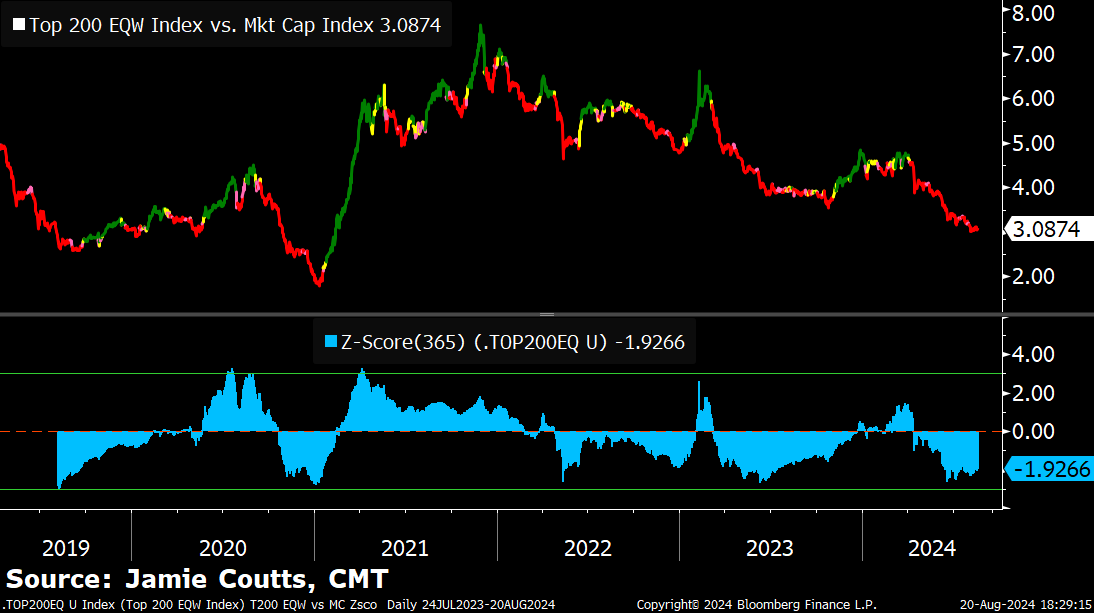

The analyst shares a chart that compares the performance of the top 200 crypto assets versus the total market cap of crypto, which he uses to gauge altcoin strength.

He notes the metric is similar to late 2020 when Bitcoin (BTC) outran the rest of the market for months on end, while at the same time, a rise in global liquidity appears to be underway – two things Coutts says are bullish for altcoins.

“I have posted this chart before. Top 200 equal weight index (EQW) vs. Market cap ratio chart (Mkt Cap). The insane altcoin rally of 2020/21 occurred after a severe underperformance (aka BTC rally). The setup is similar as we start to see global liquidity move higher …which should drive BTC to new ATHs (all-time highs). BTC is lagging global M2, which is starting to accelerate to the upside after a long pause.”

The analyst elaborates further on his outlook for the next altcoin cycle, saying that “high quality” layer-1 (L1s) will outperform much of the market in an upcoming expansion

“The ingredients and progression for a broad altcoin rally are usually;

1. Be extremely oversold, unloved, under-owned

2. Global liquidity turns higher in a meaningful way

3. BTC must generate outsized returns for weak holders to recycle profits into Alts

4. These profits will likely supercharge the already outperforming Alts…

This is not an endorsement of investing blindly in the speculative end of the market; it is just how I see things playing out based on the current setup.

Some assets are going to outperform ahead of the broader shitcoin rally. These are the high-quality L1s that are growing and building novel and sticky use cases.”

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Comdas/INelson