Veteran trader Peter Brandt, who gained legendary status after calling the 2017 Bitcoin collapse, believes BTC is in a position to surge and end its multi-month correction.

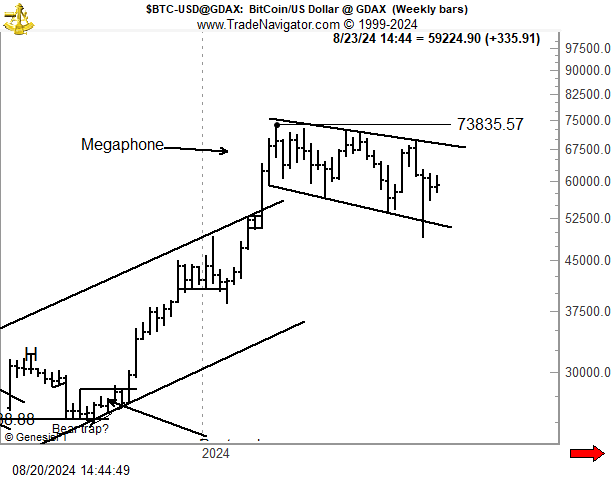

In a new blog post, Brandt says he opened long positions in Bitcoin as he thinks BTC may be gearing up to break out from a megaphone formation.

The technical formation may be viewed as a bullish continuation pattern if the price breaches its diagonal resistance.

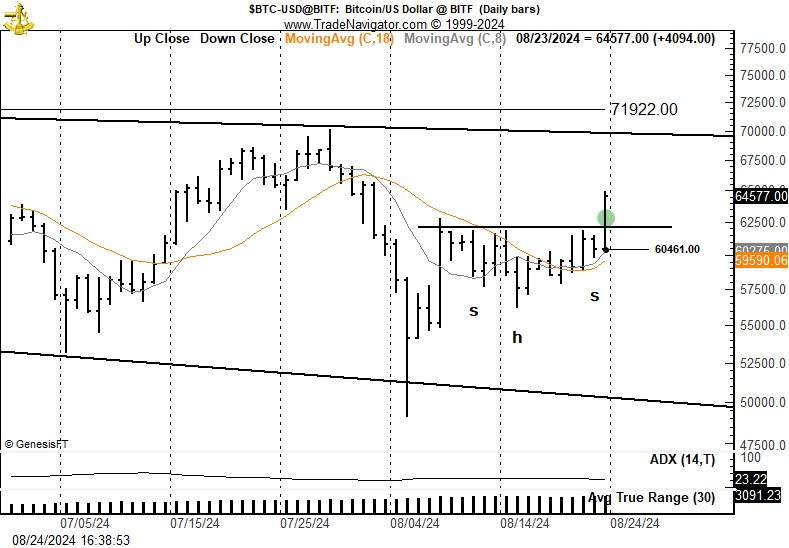

According to Brandt, Bitcoin looks bullish after breaking out from an inverse head and shoulders pattern within the larger megaphone formation.

“The dominant chart construction on the weekly graph is a five-month broadening triangle or megaphone. A major breakout could be pending.

The daily chart exhibits a possible completed inverted head and shoulders that is part of the broader congestion. I bought a 2.7 BTC position with a risk of 40 basis points and a protective stop under Friday’s low. This is an anticipatory position of a pending larger breakout.”

An inverse head and shoulders pattern suggests that an asset is bullish as traders are no longer waiting for the price to revisit recent lows before accumulating. Based on the trader’s chart, he appears to suggest that BTC will break out from the large megaphone pattern if it takes out its resistance at around $72,000.

Last week, Brandt told his 736,200 followers on the social media platform X that Bitcoin’s trend is uncertain as long as it trades within the megaphone pattern.

“Weekly and daily graphs continue to form a megaphone or broadening triangle pattern in BTC. No declaration of the next trend yet BTC.”

At time of writing, Bitcoin is trading for $63,046, down over 1% on the day.

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney