Popular on-chain analyst Willy Woo is updating his outlook on Bitcoin (BTC), suggesting that the market is starting to look bullish.

Woo tells his 1.1 million followers on the social media platform X that Bitcoin may be forming a bull flag pattern, setting the stage for a breakout.

In technical analysis, a bull flag is viewed as a continuation pattern, indicating that an asset is consolidating and gearing up for a fresh rally.

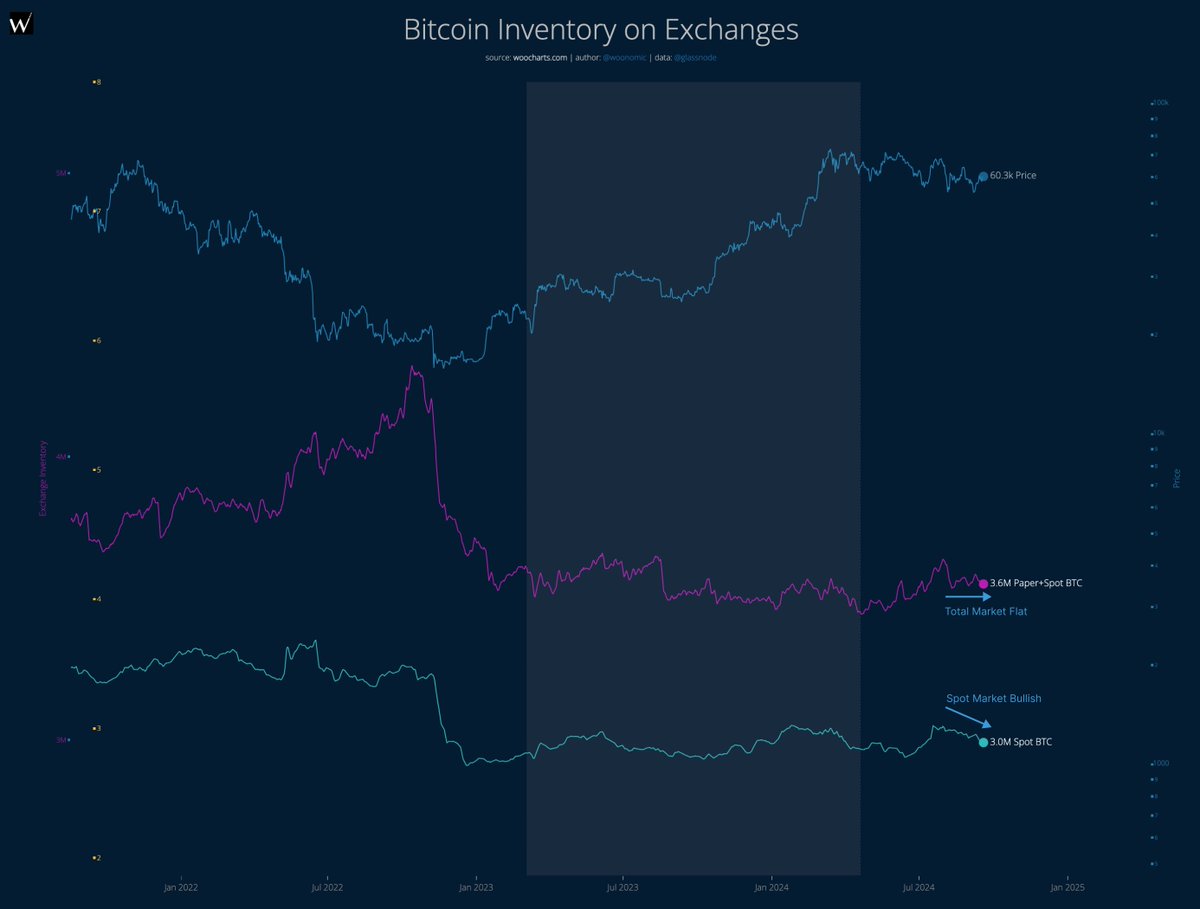

He also says that supply available on crypto exchanges is declining, often a bullish sign. When supply shrinks on exchanges, demand could soon overwhelm supply, pushing up BTC’s price tag.

“Bitcoin signals:

- Short term: continuation of bullish swing, likely one week left in play.

- Medium term: we’re seeing lots of spot BTC being scooped up, exchange inventory accounting for derivatives remains flat, but this could change quickly if we get a short squeeze. Chart pattern is forming a bull flag.”

However, the analyst warns that current demand has yet to flip bullish.

“Current demand and supply is neutral bearish, but signs of moving into a bullish structure if we get some liquidations. Cautiously optimistic.”

The analyst also warns of a risk that all markets could suddenly plummet in the near term due to worsening macroeconomic conditions and then enter recovery rallies.

“Traditional finance risk: bond rates are dropping, can be a bad omen of staving off a potential crash, past examples 2020 COVID crash, 2008 [Global Financial Crisis]. In past cases this leads to a crash before a long term liquidity fueled (money printer goes brrrrr) rally in all asset classes.”

Bitcoin is trading for $59,495 at time of writing, down 2.5% in the last 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DreamStudio