Venture capitalist Arthur Cheong believes that one decentralized finance (DeFi) altcoin may be gearing up for a massive breakout.

The DeFiance Capital CEO tells his 176,400 followers on the social media platform X that several factors are signaling bullishness for lending platform Aave (AAVE).

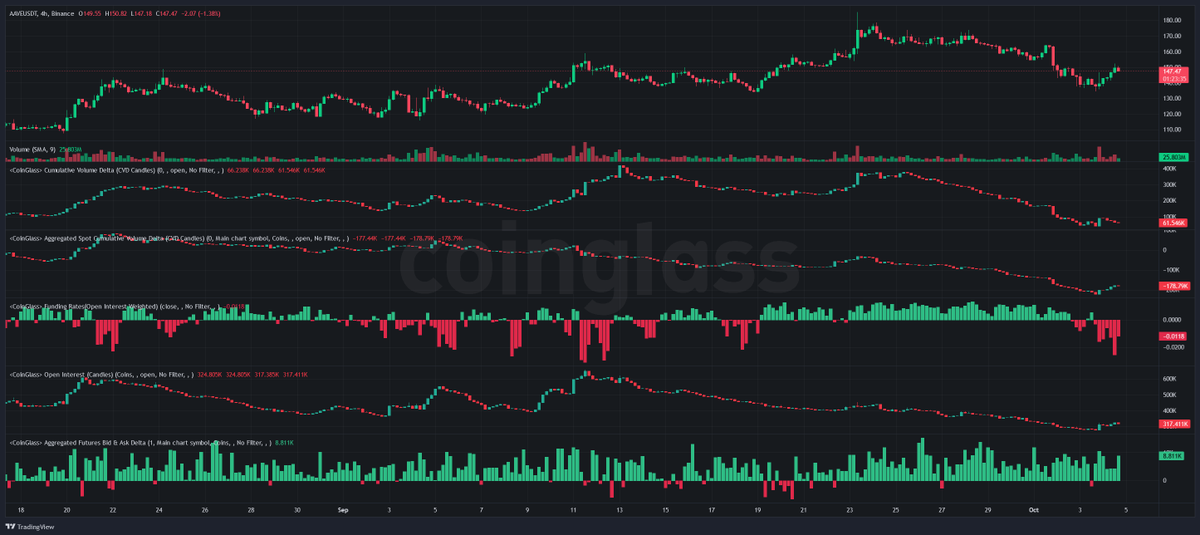

He suggests Aave’s open interest (OI), which is the total number of outstanding derivatives contracts for a given asset, may have bottomed after a large decline in the last month.

“AAVE price is holding up very well despite the leverage flush on the perps over the past few weeks:

1. Open Interest at 30 days low, dropped by 50% compared to September 11th.

2. Funding rate negative.

Set it up very well for the next leg of rally.”

A negative funding rate means there are more short positions than long positions on AAVE, which some traders perceive to be a bullish indicator.

He also suggests that that Former President Donald Trump using Aave for the launch of World Liberty Financial, his new DeFi crypto project, may be a bullish catalyst.

“If you tell me in 2020 we will have a former and potential future President of the USA supporting the launch of a separate instance on Aave, even the biggest DeFi bull wouldn’t believe it. But here we are. ‘We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.'”

Last month, he said Aave appeared to be breaking out of a multi-year consolidation pattern on the weekly timeframe.

“AAVE is trading at the highest level since May 2022 and seems to be breaking out from a two-year consolidation pattern. Expect ATH (all-time high) reclaim to further solidify DeFi Renaissance.”

Aave is trading for $148.88 at time of writing, up 7.4% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/iurii/AtlasbyAtlas Studio