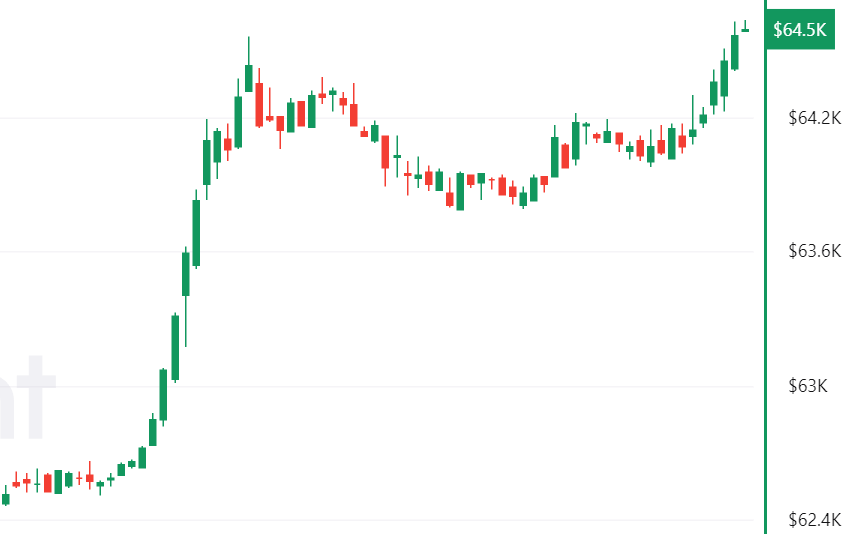

Bitcoin kicked off a rally early on Monday, triggering hundreds of millions of dollars in liquidations as BTC climbed above the $66,000 mark.

According to crypto data aggregator Coinglass, over $238 million in positions have been liquidated in the last 24 hours – mostly traders attempting to short BTC.

According to Ki Young Ju, the CEO of blockchain analytics firm CryptoQuant, Bitcoin has just gone through an eight-month long “retail shakeout.”

“There is a saying in Korea: ‘The bus only departs when you get off.’

Everyone on board, right?”

Pseudonymous crypto trader Dave the Wave says that he’s surprised by anyone bearish on BTC. He shares a chart suggesting that Bitcoin is gearing up to smash resistance at around $70,000 while the MACD indicator – which pinpoints market reversals by looking at moving averages –appears to be in the midst of an uptrend.

“Monthly BTC MACD.

Frankly, all the bearishness I see suprises me.”

And widely followed crypto analyst Benjamin Cowen tells his 865,000 followers on the social media platform X that a late October seasonality effect could push BTC to the $68,000 for its next short term leg up.

“BTC has held the bull market support band for the last couple of weeks.

Seems like the next hurdle will be the lower high structure that has been in place since March.

If late-October seasonality kicks in (which is usually bullish), then the $67k-$68k area could be next.”

At time of writing, Bitcoin is trading at $65,873.

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3