The venture capitalist Arthur Cheong thinks the decentralized finance (DeFi) sector is in the midst of a “renaissance.”

The DeFiance Capital CEO tells his 177,800 followers on the social media platform X that both internal infrastructure improvements and external macroeconomic developments are driving DeFi’s resurgence.

“As global interest rates shift, risk assets like crypto, including DeFi, become more attractive to investors seeking higher returns.

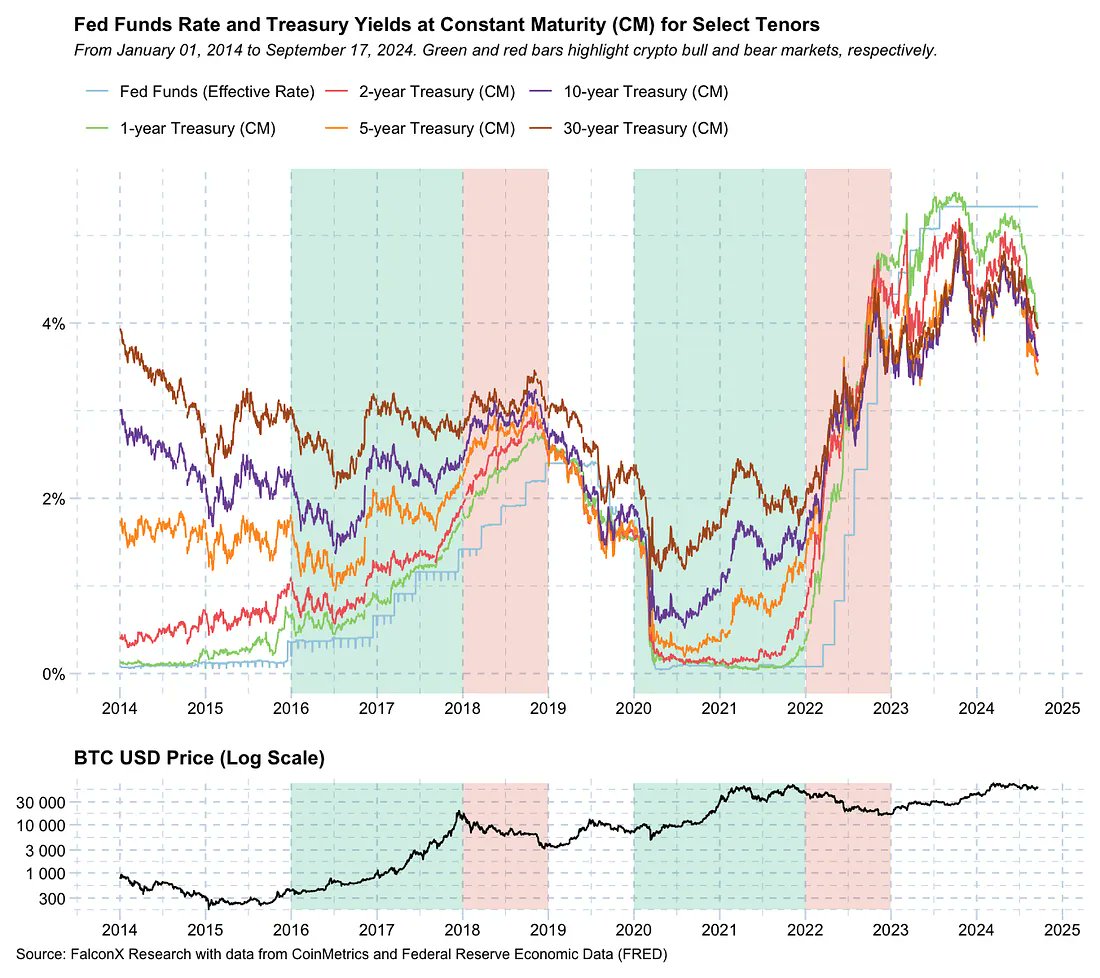

With the Federal Reserve implementing a 50 basis points rate cut in September, the stage is set for what may be a period of lower interest rates, similar to the environment that fueled the crypto bull markets of 2017 and 2020, as shown in the chart below. Bitcoin (and crypto) bull markets are highlighted in green, historically in a low-interest-rate regime, whereas bear markets are highlighted in red typically during a time of spiking interest rates.”

Specifically, Cheong says DeFi benefits from lower interest rates because Treasury bills and traditional saving accounts offer lower returns. That convinces more investors to turn to DeFi protocols for higher yields, according to the venture capitalist.

The DeFiance Capital CEO also notes that lower financing costs can encourage DeFi users to take out loans and direct them toward the sector’s ecosystem, driving activity increases.

“While interest rates may not drop to the near-zero levels seen in past cycles, the reduced opportunity cost of engaging DeFi will be lowered significantly. Even a moderate decrease in rates is enough to make a big difference given the difference in rates and yield can be amplified with leverage.

In addition, we foresee the new interest rate cycle to be a large driver for stablecoin growth given it significantly lowers the cost of capital for yield-seeking TradFi funds moving over to DeFi.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney