A widely followed crypto analyst is issuing an alert about Ethereum (ETH), saying that the top altcoin appears to be forming a bearish pattern.

In a new strategy session, crypto trader Justin Bennett tells his 113,200 followers on the social media platform X that the second largest digital asset by market cap could be forming a diamond reversal pattern that could land it below the $2,500 price tag if confirmed.

“It’s not a pattern I trade, but ETH could be forming a diamond reversal pattern. The objective is $2,485 if it confirms with a close below support. Nothing is confirmed yet.”

A diamond reversal pattern is a technical analysis indicator that signals a potential trend change for the price of an asset.

Ethereum is trading for $2,642 at time of writing, a fractional increase during the last 24 hours.

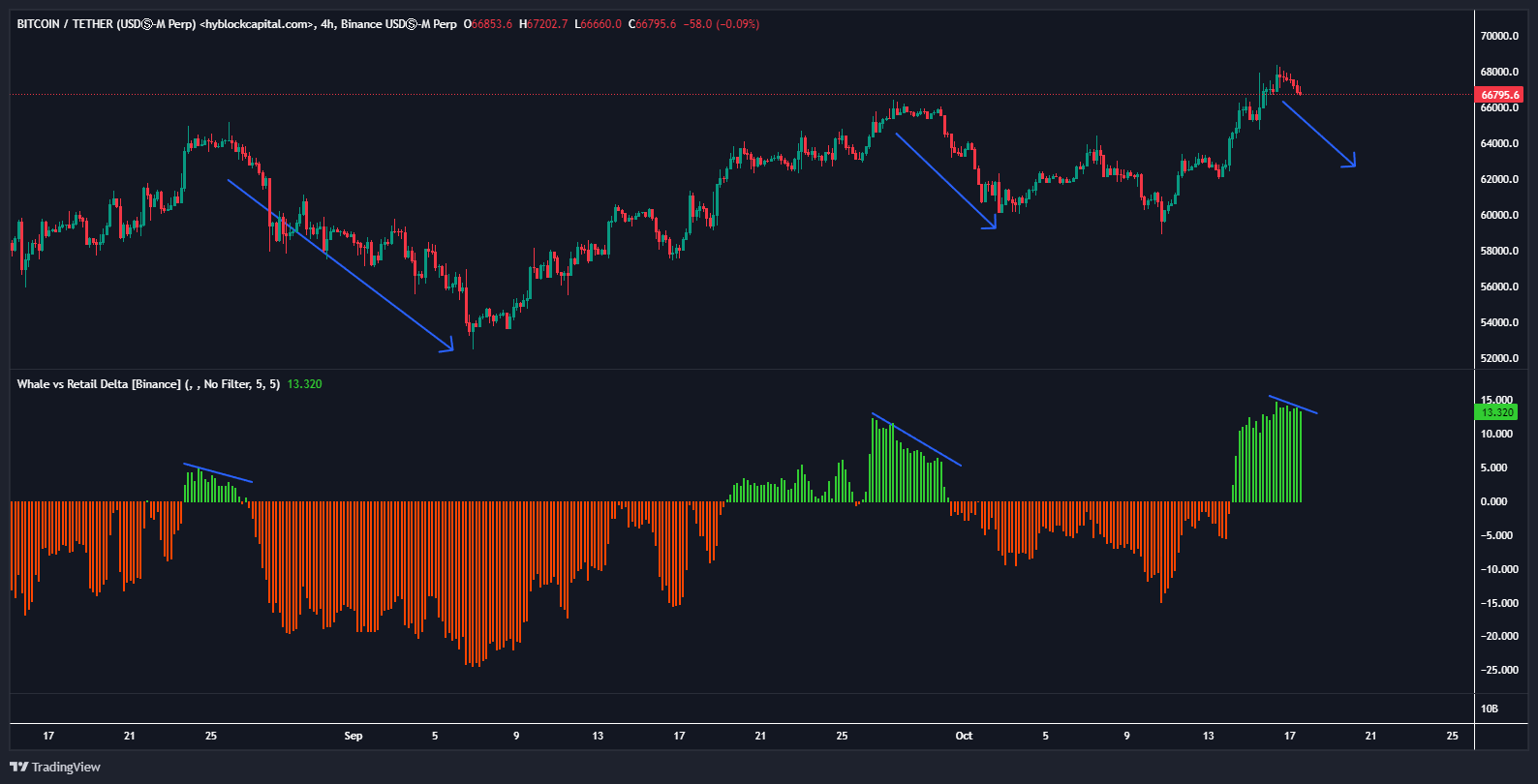

Moving on to Bitcoin (BTC), Bennett says that its open interest (OI) – or the total number of derivatives contracts taken out for an asset – is the highest it has been since August and identifies the $65,800 level as a “must hold” for BTC bulls.

However, Bennett goes on to note that Bitcoin whales now appear to be cutting their long positions vs. retail, which historically has caused the flagship digital asset to see a 10% dip in price.

“I hate to be the ‘bear’ of bad news, but BTC whales are trimming longs vs retail. The last few times we saw this, Bitcoin dumped over 10%. It’s early, so this could change, but it’s worth noting.”

Bitcoin is trading for $67,505 at time of writing, a 1% decrease on the day.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/IM_VISUALS/monkographic