Nexo redesigns its innovative solutions for long-term digital wealth building with 24/7 advanced client care on Bitcoin Whitepaper Day.

Nexo, a leading digital assets institution, today announced its major rebrand and platform redesign, marking its evolution from a crypto lending pioneer to the first comprehensive and compliant digital assets wealth platform.

Unveiled on Bitcoin Whitepaper Day, this step reflects Nexo’s growth and broader strategic vision for empowering forward-thinking investors to grow, preserve and utilize their wealth.

Following 20 months of client research across 5,000 users in 23 countries, Nexo’s revamped platform with a new logo, website and enhanced user interface esponds to the growing demand for sophisticated, yet flexible digital asset solutions.

This evolution aligns with the needs of those who recognize the power of cryptocurrencies to create long-term value, as Nexo continues on its mission to drive the next generation of wealth.

Nexo evolves with the maturing crypto landscape

Kosta Kantchev, co-founder and executive chairman of Nexo, said,

“Our ‘wealth forward’ philosophy positions us as the first major crypto company to make a strategic move to a comprehensive digital asset wealth platform.

“We focus on providing independent, savvy investors with smarter and more flexible ways to grow and access their wealth in the digital asset space.”

The digital asset landscape has rapidly evolved from a niche to a transformative force in the financial sector, underscored by the approval of Bitcoin spot ETFs.

This momentum is reflected in the growing interest in digital assets 65% of institutional investors are ready to enter the market while 72% of retail investors view digital assets as essential for wealth-building.

Nexo has been at the forefront of this evolution. With a robust business model and diverse offerings, Nexo has earned the trust of both retail and institutional investors across more than 200 jurisdictions.

Its impressive track record over $320 billion in processed transactions, $8 billion in crypto credit issued and $945 million in interest paid out cements its new direction shaping the next generation of wealth.

A new look for a new era

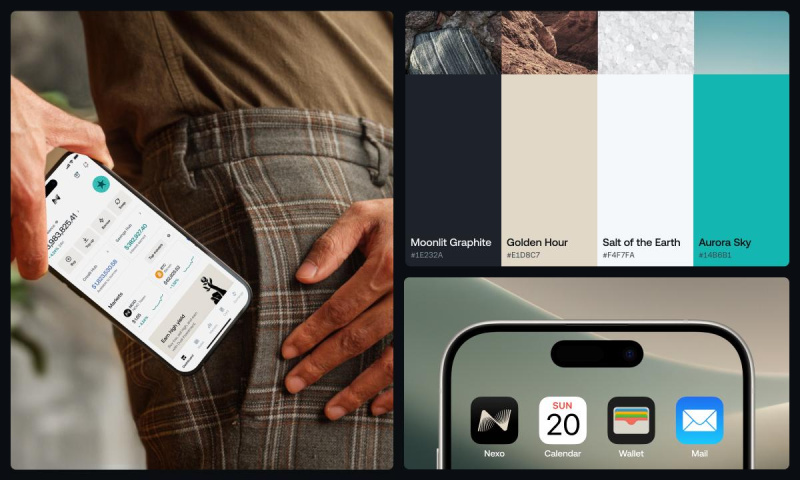

Nexo’s new brand and visual identity reflect its mature, focused direction, namely, “Driving the next generation of wealth” n line with the discerning nature of crypto holders.

The revamped identity integrates movement and precision, symbolizing Nexo’s commitment to client prosperity and forward-thinking solutions.

Central to the upward-flowing logo pattern are two key concepts human resilience represented by a spiral nods to the perseverance and adaptability inherent in human DNA, and exponential growth captured by mathematically precise diagonals shows the boundless opportunities of digital assets.

Inspired by the modern, active lifestyle of Nexo’s clients, the new identity blends soft greys and beiges with energetic greens to capture today’s opportunities.

Flowing patterns and precise elements convey both flexibility and security, resonating with Nexo’s clientele, which demands innovation and reliability in managing their wealth.

Elitsa Taskova, CPO of Nexo, said,

“Our new visual identity mirrors Nexo’s evolution into a sophisticated digital assets wealth platform.

“Going forward, we are focusing on hyper-personalized, white-glove service, offering autonomy and flexibility within an intuitive product suite with the tools and expertise to help you thrive.

“As digital assets merge with traditional investments, Nexo stands ready to guide you, providing compliant opportunities for growth and long-term value.”

Platform evolution a suite for the forward-thinking investor

After 20 months of client research, Nexo’s survey of 5,000 users across 23 countries revealed that 68% of HNWIs (high-net-worth individuals) view digital assets as long-term wealth solutions, while 69% of Bitcoin holders see it as a durable store of value.

This reflects a significant shift in how sophisticated investors approach wealth, increasingly favoring digital-first tools and a seamless, omnichannel ecosystem for 24/7 access.

Nexo’s 360-degree product suite aligns perfectly with these demands and offers.

- Savings growth Flexible and fixed-term yield options, including dual investment, are accessible 24/7 across all devices.

- Advanced crypto tools rypto-backed credit lines, 1,500 market pairs, crypto futures, target price swaps and advanced analytics enable alternative growth opportunities.

- Global access Liquidity and seamless spending options, ensuring access to funds via the Nexo Card.

In addition, the Nexo platform empowers its clientele with tiered loyalty rewards and bespoke services for high-net-worth clients with 24/7 client care teams.

Looking ahead, Nexo is evolving its suite of digital asset wealth tools with a strong focus on compliance and security systems built for long-term stability.

The company continues to pursue strategic partnerships and international expansion, solidifying its position as the world’s leading digital assets wealth platform.

For more information about Nexo’s ‘wealth forward’ strategy, users can visit here.

About Nexo

Nexo is a premier digital assets wealth platform empowering clients to grow, manage and preserve their crypto holdings.

Our mission is to drive the next generation of wealth by prioritizing customer prosperity and delivering tailored solutions for building long-term value, supported by 24/7 client care.

Since 2018, Nexo has been delivering unmatched opportunities to forward-thinking clients across more than 200 jurisdictions.

Our all-in-one platform combines cutting-edge technology with a client-centric approach, offering high yields on flexible and fixed-term savings, crypto-backed loans, advanced trading tools and liquidity solutions through the first debit/credit crypto card.

Backed by deep industry expertise, a sustainable business model, robust infrastructure, security and global licensing, Nexo champions innovation and long-lasting prosperity.

Note ome of the products and services are unavailable to citizens or residents of certain jurisdictions, including where restrictions may apply.

Contact

This content is sponsored and should be regarded as promotional material. Opinions and statements expressed herein are those of the author and do not reflect the opinions of The Daily Hodl. The Daily Hodl is not a subsidiary of or owned by any ICOs, blockchain startups or companies that advertise on our platform. Investors should do their due diligence before making any high-risk investments in any ICOs, blockchain startups or cryptocurrencies. Please be advised that your investments are at your own risk, and any losses you may incur are your responsibility.

Follow Us on X Facebook Telegram