Real Vision analyst Jamie Coutts says that the stage is being set for a crypto bull market as multiple indicators turn bullish.

On the social media platform X, Coutts says nearly every metric he uses to measure the health of the Bitcoin market cycle is no longer in “overheated” territory, boding well for BTC.

“Over the past seven months, Bitcoin’s consolidation has significantly cooled valuation metrics that were overheated in Q1.

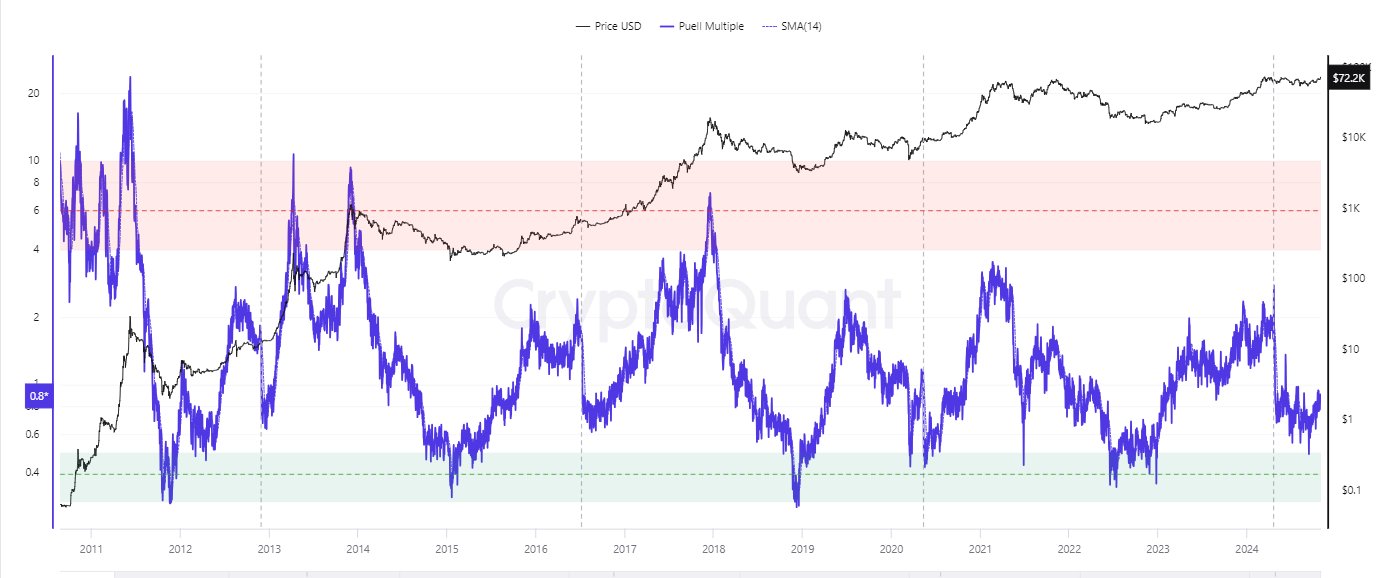

With the exception of Open Interest at an all-time high (100th percentile), nearly every metric – from MVRV (market value to realized value) and Puell to LTH SOPR (long-term holder spent output profit ratio) and Network Value to Addresses – has reset below the 50th percentile.

Much of the sell-off was driven by excess leverage in the derivatives market, mainly on the long side, and that overhang has finally cleared.

In September, we saw a classic reload signal with the Puell Multiple briefly hitting oversold, while network security reached new highs.

Let’s not forget that global liquidity is accelerating to the upside.

The stage is set.”

The Puell Multiple indicator, MVRV, LTH SOPR and Network Value to Addresses are all on-chain metrics designed to gauge the health of Bitcoin.

At time of writing, Bitcoin is trading for $69,173.

Beyond Bitcoin, Coutts says that Ethereum (ETH) rival Solana (SOL) is leading the smart contract platform (SCP) race, and may be gearing up to break out in its USD and BTC pairs.

“This cycle, SOL has led the major SCP L1s (layer-1s). Equity momentum factor strategies, like deploying a 12-month filter, also interestingly tend to work well in crypto despite magnitudes higher volatility.

The SOL/BTC ratio is the one to watch (bottom). Hasn’t broken out, yet.”

At time of writing, Solana is trading for $165.

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney