Options on investment titan BlackRock’s spot Bitcoin (BTC) exchange-traded fund (ETF) debuted on the Nasdaq on Wednesday.

In a post on social media platform X, Bloomberg Intelligence ETF analyst James Seyffart says options on BlackRock’s iShares Bitcoin Trust ETF (IBIT) saw nearly $1.9 billion in notional exposure on day one of trading.

Option contracts give the holder the right to buy or sell the underlying asset, such as Bitcoin in this case, at a specified price within a given period.

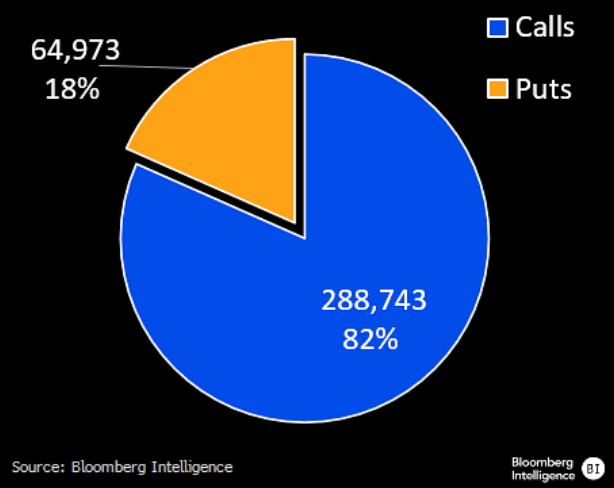

According to Seyffart, most of the IBIT trades were call options, which give the holder the right to buy Bitcoin at a specified value and period. Put options give the buyer the right to sell.

“Final tally of IBIT’s 1st day of options is just shy of $1.9 billion in notional exposure traded via 354,000 contracts. 289,000 were Calls & 65,000 were Puts. That’s a ratio of 4.4:1.”

The ratio of puts and calls suggests a bullish sentiment for Bitcoin. Traders who buy calls bet that the price of the underlying asset will rise while those who buy put options are bearish.

Bitcoin also inches closer to breaching the six-digit mark with a new all-time high of over $95,000. The top crypto asset is now trading for $94,765.

Says Seyffart,

“These options were almost certainly part of the move to the new Bitcoin all-time highs today.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney