New data from a crypto insights platform reveals that Bitcoin (BTC) exchange-traded funds (ETFs) saw the largest net outflows in one day since they launched in January.

In a new thread on the social media platform X, market intelligence firm Spot On Chain says that Bitcoin ETFs witnessed hundreds of millions of dollars worth of outflows on December 19th as the price of the crypto king dipped below the $100,000 mark.

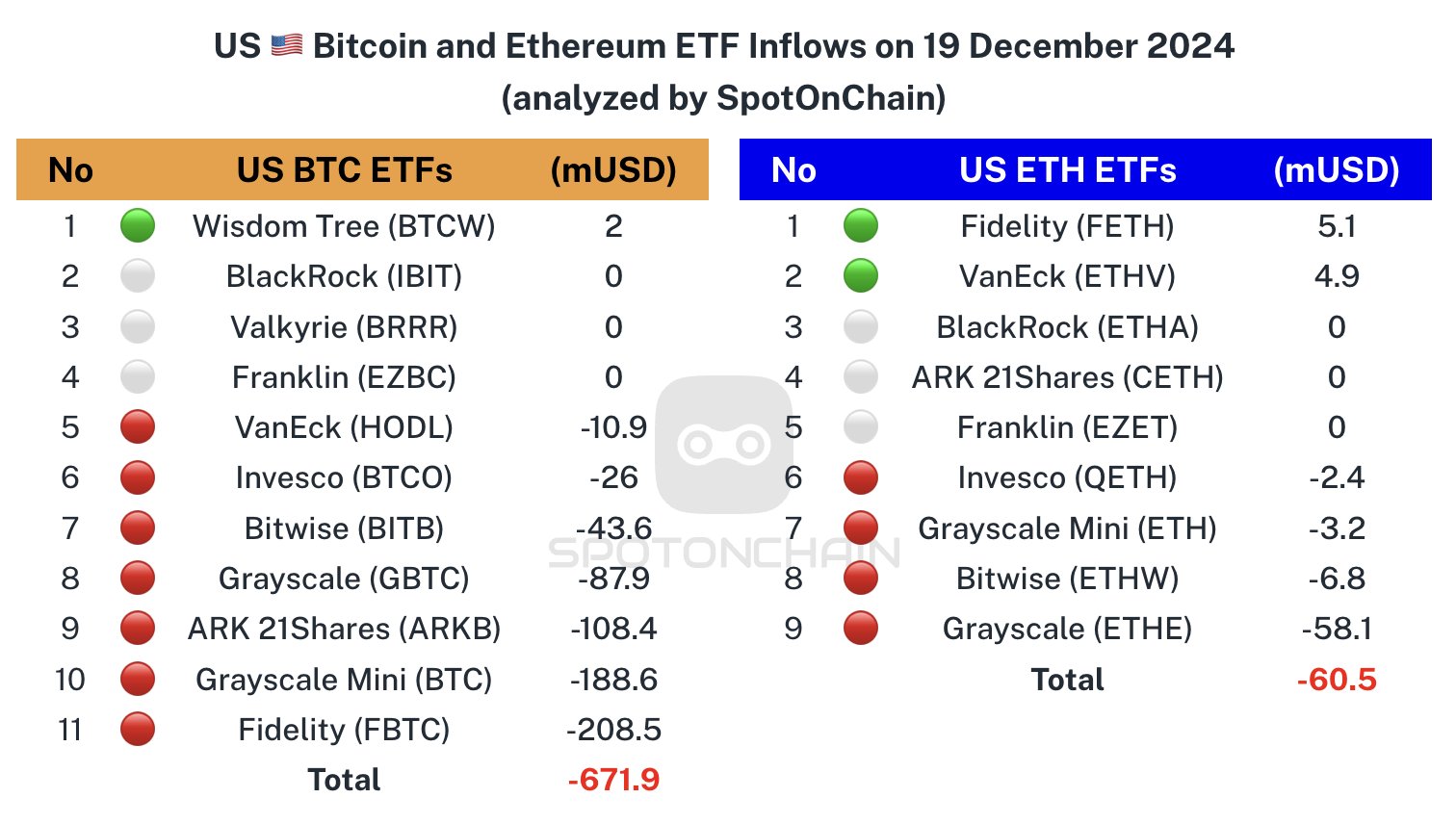

According to Spot On Chain, the ETF that led the way in terms of overall outflows was Fidelity’s FBTC while BlackRock’s IBIT ETF remained sideways. December 19th also marked the end of a 15-day inflow streak for Bitcoin ETFs.

“The US BTC ETFs just experienced their LARGEST net outflow since launch: $671.9 million. Fidelity’s FBTC led the outflows with a record $208.5 million, while BlackRock’s IBIT stayed steady with a $0 net flow.

This also marked the end of a 15-day inflow streak for BTC ETFs and an 18-day streak for ETH ETFs. In the last 24 hours, BTC dropped 4.22%, and ETH fell 7.97%.”

According to blockchain tracker SoSoValue, other BTC ETFs that witnessed notable outflows include Grayscale’s GBTC, which saw $87.86 million; ARK Invest’s ARK 21Shares ARKB, which saw $108.35 million; VanEck’s HODL, which saw $10.91 million and Invesco’s BTCO, which saw $25.97 million.

The top crypto asset by market cap is trading for $97,417 at time of writing. On December 17th, it peaked at around $108,000.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Athitat Shinagowin/Andy Chipus