Coinbase Institutional says a rough November may have created a strong setup heading into the end of the year.

The firm says open interest across Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) perpetual futures has fallen 16% month over month.

In addition, US spot Bitcoin ETFs (exchange-traded funds) saw $3.5 billion in outflows and spot Ethereum ETFs recorded $1.4 billion in redemptions, reflecting broad risk reduction.

Meanwhile, Bitcoin perpetual funding rates also dropped two standard deviations below their 90-day average before stabilizing.

“A rocky November may have set the stage for a December to remember…

So…why the cautious optimism? Because speculative excess has been flushed out.

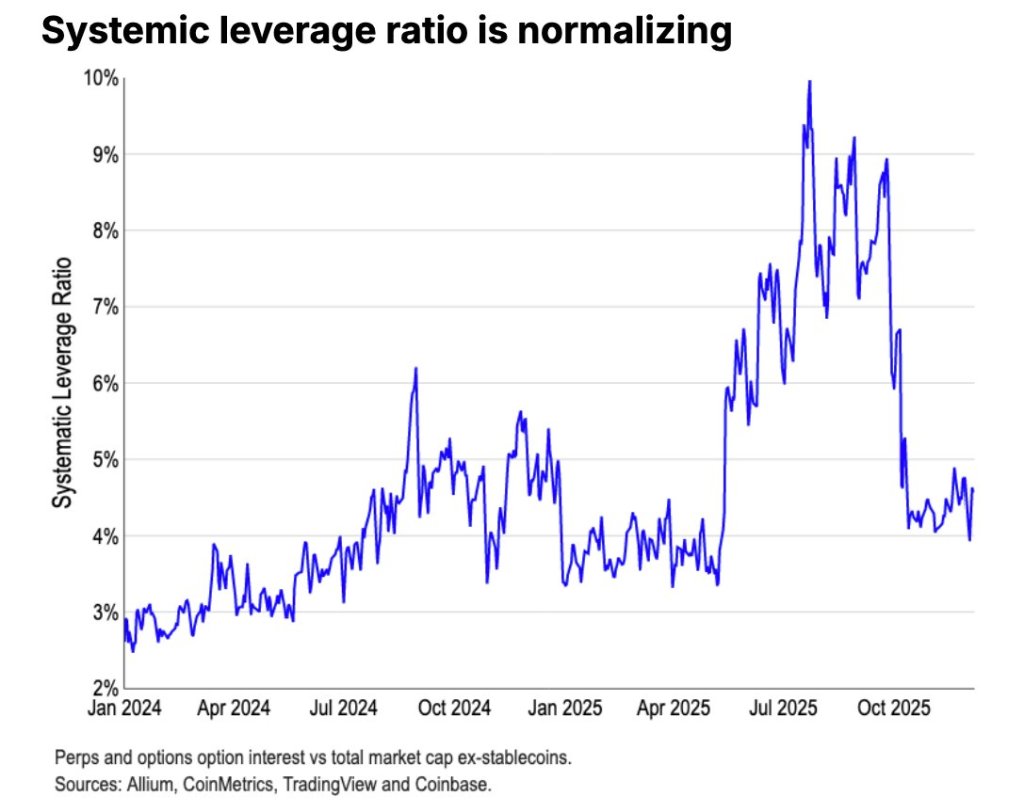

Our systemic leverage ratio, which tracks purely speculative positioning, has stabilized at ~4%–5% of total market cap, down from ~10% this summer.

Lower leverage = healthier market structure + less vulnerability to sharp drawdowns heading into year-end.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/robert_s