A dozen Wall Street firms including JPMorgan Chase, Wells Fargo and Bank of America are revealing their 2025 targets for the S&P 500.

The financial companies collectively expect the US stock market to reach fresh all-time highs next year amid expectations that a Trump presidency will create a favorable macroeconomic environment for equities, reports Yahoo! Finance.

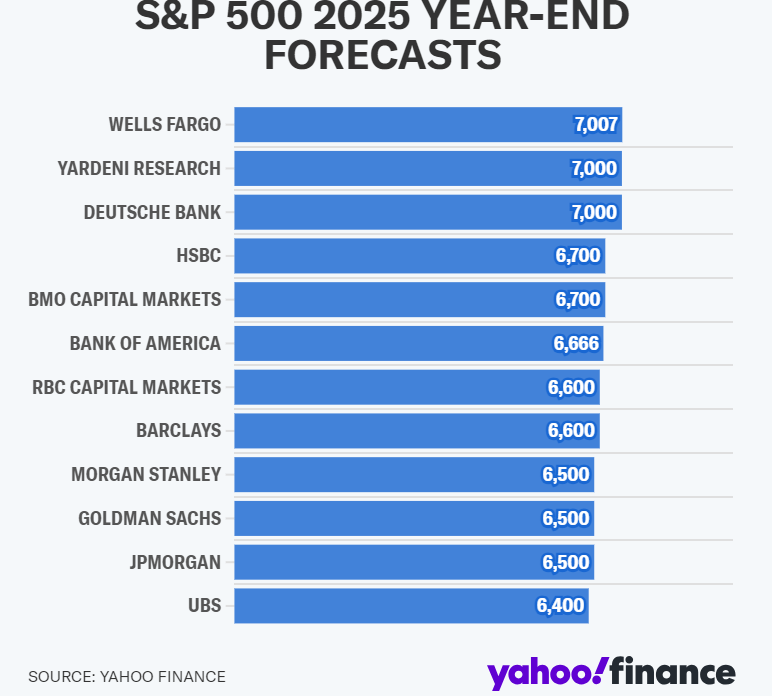

Wells Fargo is the most bullish among the group, believing that the S&P 500 could skyrocket to as high as 7,007 by the end of next year.

Says Wells Fargo equity strategist Christopher Harvey in an investor note,

“On balance, we expect the Trump Administration to usher in a macro environment that is increasingly favorable for stocks at a time when the Fed will be slowly reducing rates.

In short, a backdrop where equities continue to rally.”

Harvey also notes that the stock market will be boosted by rising corporate profits as well as the US economy growing faster than expected and a supportive regulatory environment.

“2025 is likely to be a solid-to-strong year.”

Meanwhile, market research firm Yardeni Research and Deutsche Bank see the SPX climbing to a high of 7,000 next year. HSBC and investment banking firm BMO Capital Markets expect the stock market to increase to 6,700 in 2025.

Other Wall Street firms have a more conservative target for the S&P 500 next year. BofA believes the index can rise to 6,666. RBC Capital Markets and Barclays have a target of 6,600.

JPMorgan Chase, Morgan Stanley and Goldman Sachs predict the SPX ascending to 6,500 within the next 12 months. UBS has the lowest target among the group, forecasting 6,400 for the S&P 500 next year.

As of Friday’s close, the S&P 500 is trading at 6,090.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney