The crypto-focused investment firm Blockchain Capital just released a retrospective on the crypto market in 2019, as well as a set of bold Bitcoin and crypto predictions for the new year.

The report cites Bitcoin’s emerging street cred as an uncorrelated asset and a broad recovery in the crypto market at large as two of the main highlights of 2019.

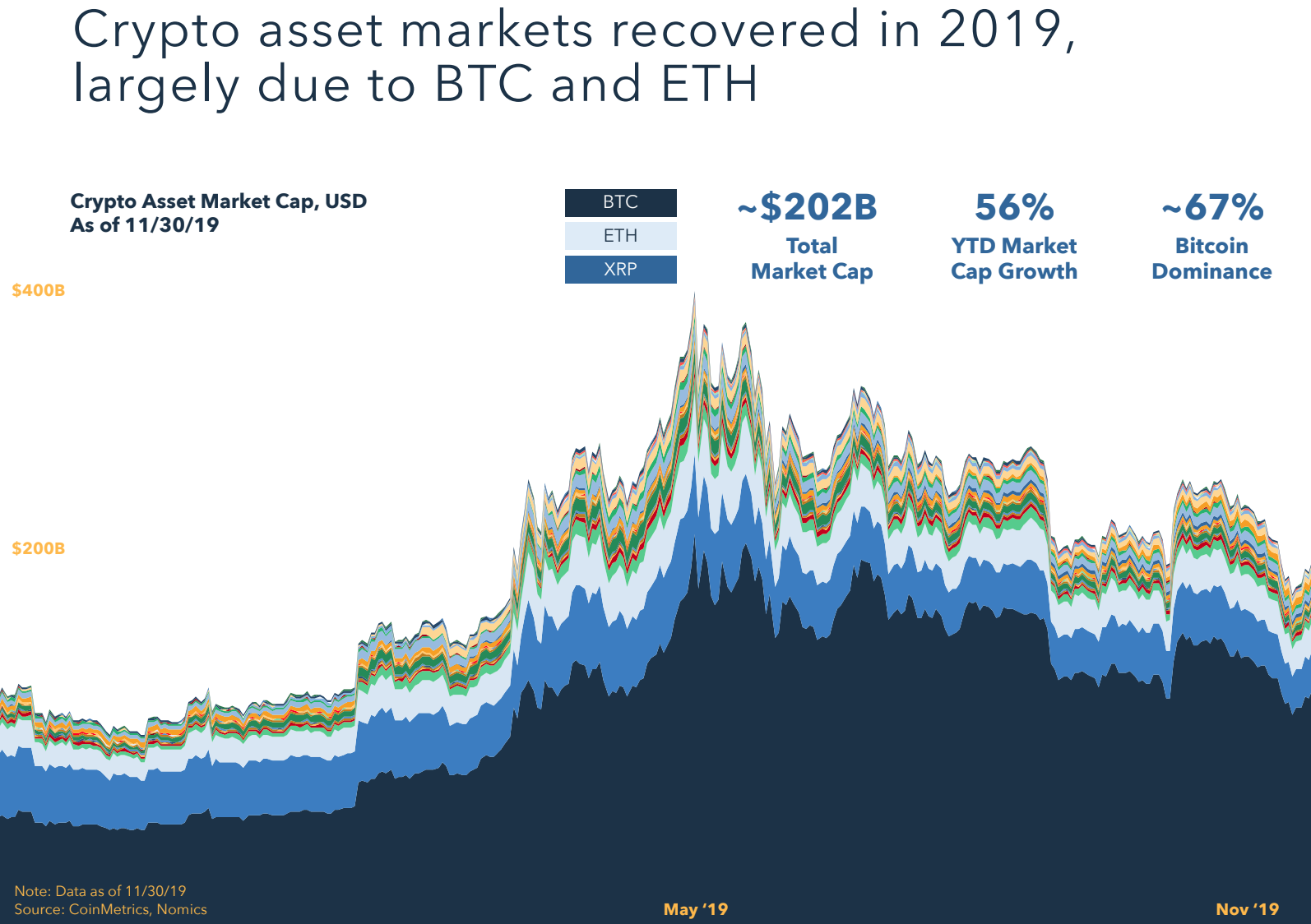

“The crypto asset market recovered in 2019, up ?56% as of 11/30. Major Major token themes include the continued dominance of Tether among stablecoins and the rise, and subsequent, fall of IEOs.

Conviction in Bitcoin grew as the narrative shifted from store of value to potential ‘safe haven asset.’ Ethereum held its position as the leading smart contract platform, with ‘Decentralized Finance (DeFi)’ emerging as the strongest use case.”

The report cites Ethereum in addition to Bitcoin as one of the biggest drivers of the broader market recovery, while XRP has struggled throughout 2019.

BTC is currently up 94% this year, from $3,739 to $7,271 at time of publishing, according to CoinMarketCap. ETH has witnessed an 8% increase year-to-date, from $133.57 to $144.50. XRP is down 60% this year, from $0.3520 to its current price of $0.2197.

As for its 2020 predictions, the firm says BTC will likely “blow past” its all-time high of nearly $20,000, which was set at the height of the 2017 crypto market frenzy.

2020 Prediction Highlights

- Target amount for capital locked in DeFi: $5 billion

- Libra gets approved to launch a dollar-backed stablecoin due to increasing competition from China

- Bitcoin bull and entrepreneur John McAfee is wrong about BTC hitting $1 million

- Major crypto exchange steer clear of privacy coins, de-listing them

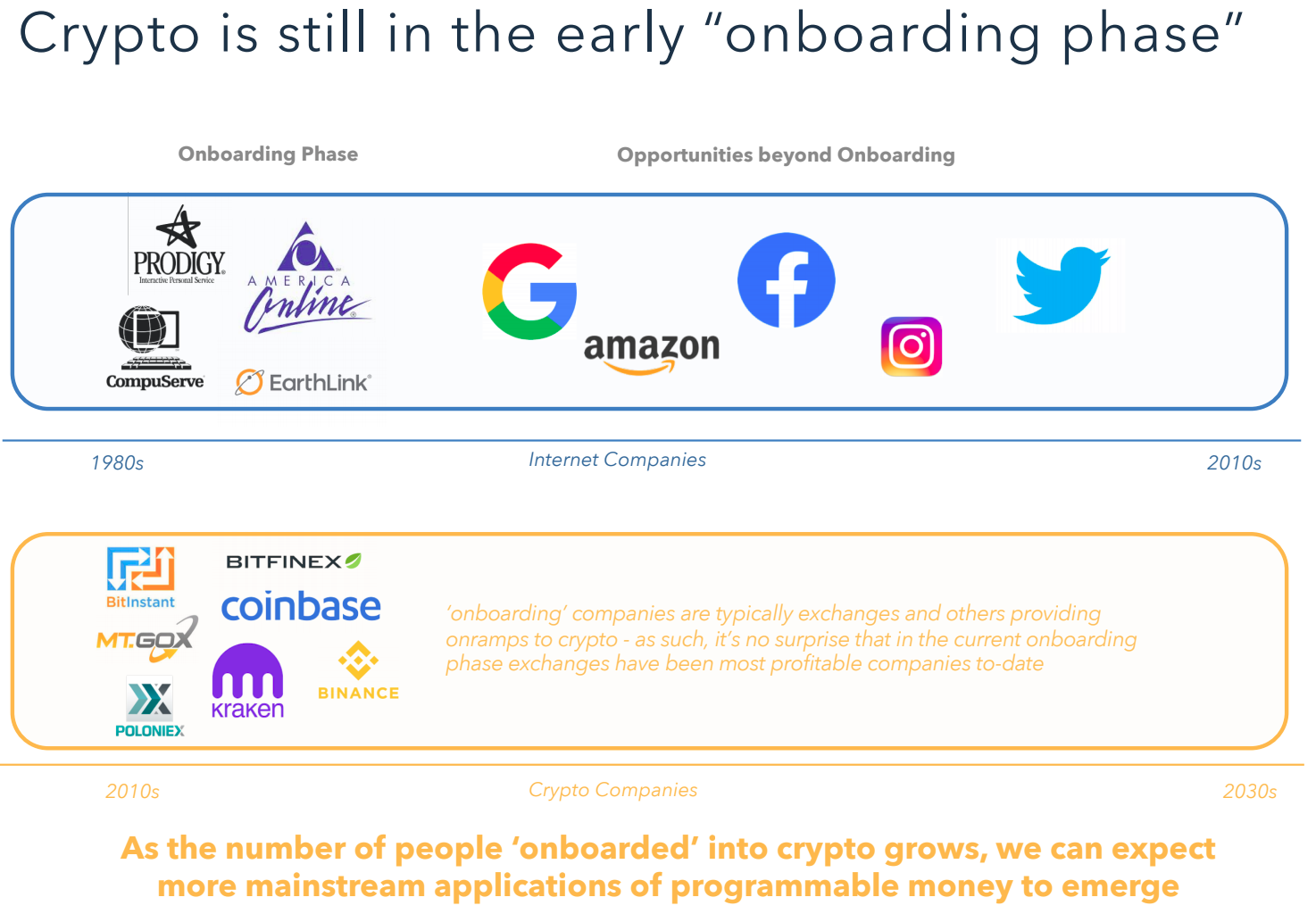

Blockchain Capital compares the blockchain and crypto industry to the early days of the internet.

An onboarding phase is currently underway, says the firm, with most of the traction and use of cryptocurrency happening in the realm of crypto speculation and trading on exchanges.

The report compares crypto exchanges to Prodigy and AOL, two of the first companies that gave mainstream consumers an easy way to access the web.

The report highlights improving price discovery due to Bakkt and CMC’s futures as signs of further institutionalization of the crypto markets.

As for global regulation of crypto assets, Blockchain Capital says the situation remains extremely complex as countries try to grapple with the emerging technology.

You can check out the full report here.

Featured image: Shutterstock/Larich