The company behind the first public stock tied to the price of Bitcoin is pressing the gas on its #DropGold campaign.

Unveiled in May, the campaign is designed to show consumers that gold is old-school and not built for mobile millennials, the internet or anyone who recognizes that money and data can be digitalized.

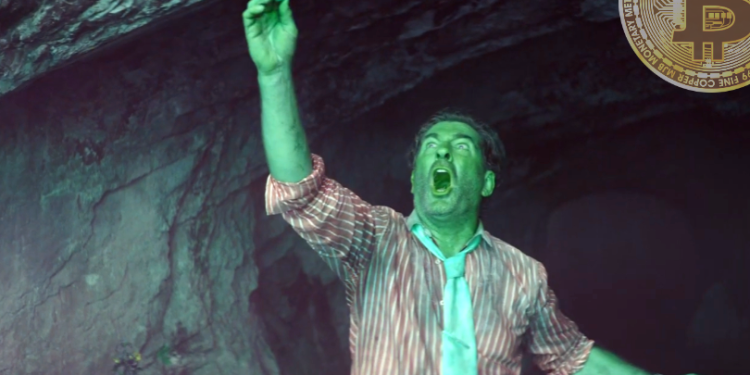

In the latest advertisement for its Bitcoin-based fund GBTC, digital asset management firm Grayscale shows a diehard goldbug with a pick in a cave, mining a rock of the precious metal.

The hard physical labor leaves Bob, the gold miner, out of step with his sweat-free colleagues who are promoting Bitcoin as the sleek, modern and more convenient way to store wealth.

Says Grayscale,

“There’s no other way to put it: gold is overrated, outdated, and inflated. Gold’s own update is long overdue.”

ANNOUNCEMENT: Our second commercial goes live TODAY as we double down on #DropGold with our next chapter of educating investors about the investment-case for #Bitcoin and $BTC access products like $GBTC: https://t.co/k4v29jjob9 pic.twitter.com/VgxCY04AYR

— Grayscale (@Grayscale) October 23, 2019

As for investors who are trying to get clear guidance from financial advisors about Bitcoin investment opportunities, Grayscale points out that many financial advisors acknowledge gaps about cryptocurrency.

“Digital currencies are a prime example of a new asset class for which many advisors lack an understanding. The complexity and unique properties of this new asset class can sometimes feel overwhelming to both investors and even the most seasoned financial advisors, which can discourage even an exploratory conversation about digital assets.”

The company’s ‘toolkit’ on how to broach the Bitcoin topic with a financial advisor is a stark reminder of the challenges the industry is facing in reaching retail and institutional investors en masse — enough to reignite the enthusiasm for Bitcoin and cryptocurrency that swept across dinner tables during the holiday season two years ago when Bitcoin was on its way to an all-time high of nearly $20,000.

The reality is more stark. Bitcoin is not an easy sell and the professionals in the financial investment industry are not necessarily sparking the conversation. That’s compelling asset management firms in the space to devise new methods of growing Bitcoin’s appeal, past the early adopters and tech-heads to reach mainstream investors.

Grayscale’s list of questions for mainstream investors to propose to their financial advisors

- Does my portfolio include exposure to digital currencies? If not, why is that?

- What are the benefits of investing in digital currencies? What are the risks?

- How well would my portfolio have performed if I had invested a small percentage in Bitcoin five years ago?

- Could you explain the investment thesis behind Bitcoin? What about the thesis behind gold?

- What are the benefits of investments that give me exposure to Bitcoin’s price, compared to directly owning Bitcoin?

- Considering when I plan to retire, will my portfolio benefit from an allocation to digital currencies?

- I’m a conservative investor; can I allocate a small amount toward digital currencies and see how it performs over time?

You can check out Grayscale’s resource page for investors here.

[GoogleDTR]

[the_ad id="42537"] [the_ad id="42536"]