The English physicist, mathematician and astronomer Sir Isaac Newton is widely credited for developing the foundations of modern physics. But despite his incredible mind, even he was not immune from what cryptocurrency investors call FOMO – the Fear of Missing Out.

The term is used to describe an emotional and irrational investment made by a trader who is afraid he or she will miss out on potential profits.

Although the term has emerged in the crypto era, FOMO is a timeless feature of the human condition, exemplified in Benjamin Graham’s classic book The Intelligent Investor.

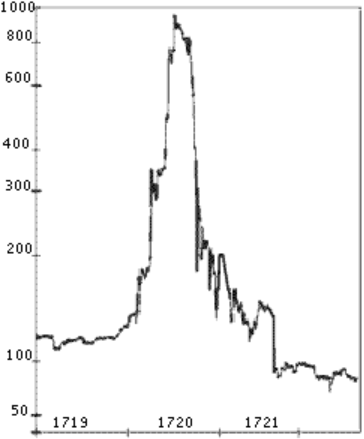

“Back in the spring of 1720, Sir Isaac Newton owned shares in the South Sea Company, the hottest stock in England. Sensing that the market was getting out of hand, the great physicist muttered that he ‘could calculate the motions of the heavenly bodies, but not the madness of the people.’

Newton dumped his South Sea shares, pocketing a 100% profit totaling £7,000. But just months later, swept up in the wild enthusiasm of the market, Newton jumped back in at a much higher price — and lost £20,000 (or more than $3 million in [2002-2003’s] money. For the rest of his life, he forbade anyone to speak the words ‘South Sea’ in his presence.”

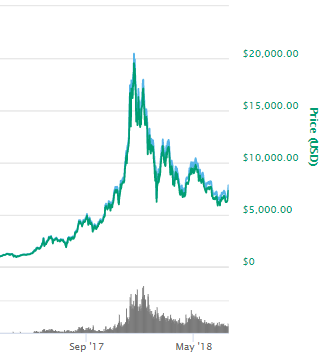

[the_ad id="42537"] [the_ad id="42536"]FOMO at 20,000 might already sound familiar to a number of cryptocurrency traders out there.

Bitcoin reached its all-time high at nearly $20,000 on December 17th of 2017, before a precipitous drop that saw the price fall below $6,000 in the first half of 2018.

The fall of the South China Sea company was decidedly more dramatic than the bear market that hit Bitcoin, as can be seen by comparing the historical record to the current data on CoinMarketCap.

South Sea Company

Bitcoin