In a new 65-page report dated October 31, Morgan Stanley maps out its “rapidly morphing thesis” on Bitcoin, cryptocurrencies and blockchain. From “digital cash” to “store of value,” researchers conclude that Bitcoin is a bona fide institutional asset class.

Morgan Stanley’s research reflects the changing landscape among traditional financial institutions that are becoming increasingly engaged in the cryptocurrency market.

The report reveals that Bitcoin’s classification as a “new institutional investment class” was adopted in 2017, with crypto assets under management increasing since January 2016. Of the estimated $7.11 billion currently being stored, 48% are in hedge funds, 48% are in venture capital and 3% are in private equity.

The number of cryptocurrency funds has soared from 31 in 2014 to an estimated 220 in 2018.

Morgan Stanley’s 7 Phases of Morphing Classification

- Digital Cash: Untraceable but full Confidence – 2009-2016

- Incumbent Financial System Antidote – 2010-2017

- Replacement Payment System – 2010-2017

- New Fundraising and Capital Allocation Mechanisms – 2015-2018

- Store of Value – 2017-2018

- Disruption Advantaged Refuge for Depreciating Currency – Spring 2018-Summer

- New Institutional Investment Class – 2017-Present

Bitcoin Hard Forks

The report notes that Bitcoin’s seven hard forks are “like stock splits or new class creations.” But, researchers conclude, “unlike a stock split, the fork is not lowering the price per Bitcoin.”

- 1 Aug 2017 – Bitcoin Cash

- 24 Oct 2017 – Bitcoin Gold

- 24 Nov 2017 – Bitcoin Diamond

- 12 Dec 2017 – UnitedBitcoin

- 12 Dec 2017 – Bitcoin X

- 12 Dec 2017 – Super Bitcoin

- 28 Feb 2018 – Bitcoin Private

Response to Hacks

According to the report, the Wall Street Journal flagged 271 initial coin offerings (ICOs) for having plagiarized investment documents and missing/fake executive teams. These ICOs raised a total of over $1 billion and claimed $273 million worth of losses for investors. The response has been for Coinbase, among others, to “assume bank type responsibilities.”

Emergence of Bitcoin as a New Institutional Class

Key factors

- Fidelity Digital Asset Services: Crypto trading and storage service

- Bain Capital: Led $15M Series B in Seed Cx Institutional Trading Platform

- Genesis Trading: Has lent more than $500M in cryptos since March to institutions – $130M outstanding now

- Goldman Sachs & Galaxy Digital (Novogratz crypto bank): Invest part of $58.5M round in BitGo (crypto custodian)

- SETL: Granted license by France to operate CSD

- Vertex: Invests in Binance for a Singapore-based crypto exchange

- Coinbase: Raises $500M at $8B valuation to be crypto’s Charles Schwab/Fidelity/Nasdaq

- Gemini Trust: Hires Nasdaq to conduct market surveillance

What’s preventing more institutional investors from getting involved?

- Underdeveloped regulation so asset managers don’t want to take on the reputational risk

- Lack of a custodian solution to hold the cryptocurrency and private keys

- Lack of large financial institutions and asset managers currently invested

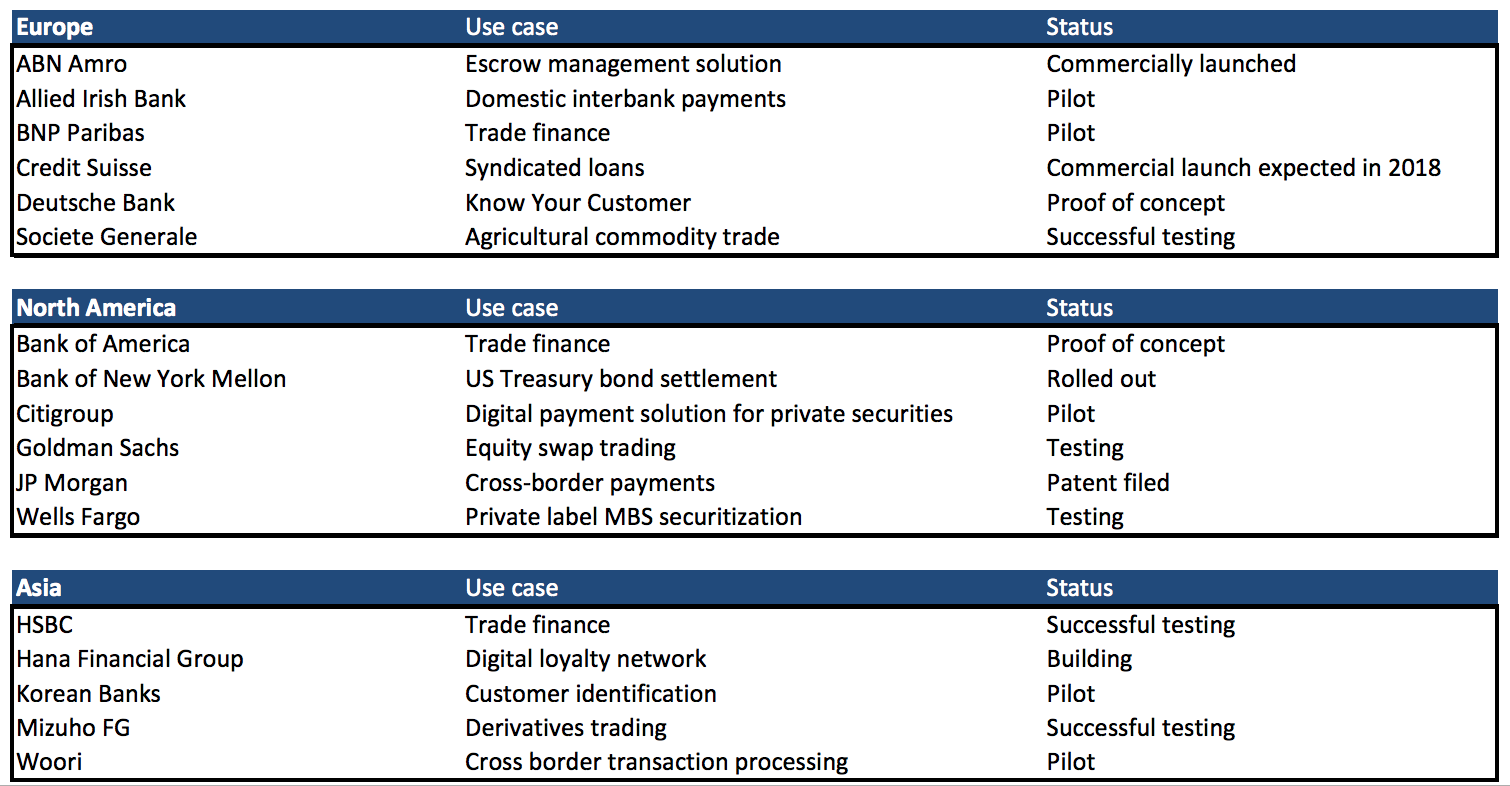

Banks Testing Blockchain

The report lists several banks around the world that are testing blockchain.

The researchers do not weigh in on RippleNet, a network of banks and payment providers that are using Ripple’s solutions to send and receive payments around the world.

You can read the full report here.

[the_ad id="42537"] [the_ad id="42536"]