Ethereum

A crypto whale surfaced soon after Ethereum developers announced a delay on the platform’s Constantinople upgrade.

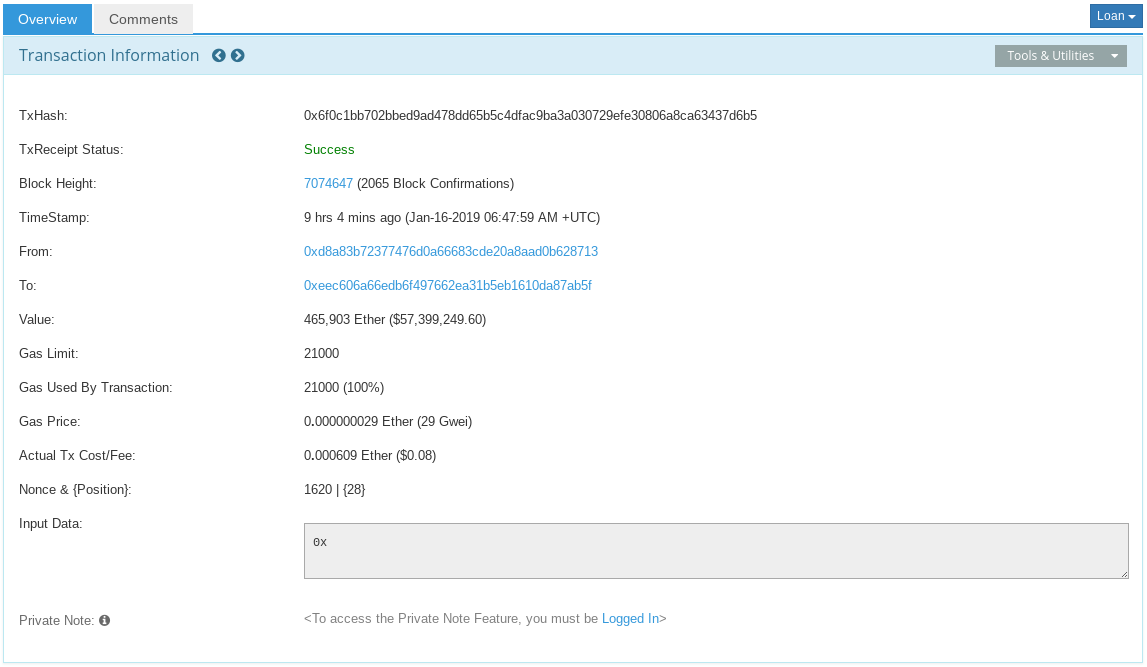

Whale Alert traced a transfer of 465,903 Ethereum (ETH) worth $57,399,249, with a transaction fee of only 8 cents. So far, the crypto has moved between two unknown wallets and does not appear to be on its way to an exchange, indicating the whale is not looking to sell.

The price of Ethereum has dropped nearly 4% since the delay of Constantinople, according to the latest data on CoinMarketCap.

Binance

Binance has launched a new fiat-to-crypto exchange on the island of Jersey, a British crown dependency between France and England.

The exchange is called Binance Jersey, and pairs Bitcoin and Ethereum with the British pound and the euro.

Binance Jersey is open to traders in Argentina, Eswatini, Latvia, Romania, Armenia, Finland, Liechtenstein, Singapore, Australia, France, Lithuania, Slovakia, Austria, Germany, Luxembourg, Slovenia, Azerbaijan, Gibraltar, Macau, South Africa, Belgium, Greece, Malta, South Korea, Brazil, Hong Kong, Mauritius, Spain, Bulgaria, Hungary, Mexico, Sweden, Canada, Iceland, Monaco, Switzerland, Chile, Ireland, Netherlands, Turkey, Croatia, Israel, New Zealand, United Arab Emirates (UAE), Cyprus, Italy, Norway, United Kingdom (UK), Czech Republic, Jamaica, Peru, Uruguay, Denmark, Japan, Poland, Estonia, Jersey and Portugal.

Bakkt

Despite a new delay in its upcoming launch, the upcoming crypto platform Bakkt says it’s not backing down.

The project, which is backed by Intercontinental Exchange, the owner of the New York Stock Exchange, says it’s working to help create nothing short of the full mainstream adoption of crypto.

Our vision is to bring digital assets into the mainstream by enabling efficient transactions between consumers and merchants

— Bakkt (@Bakkt) January 15, 2019

Our mission is to build the first integrated, institutional grade exchange-traded markets and custody solution for physical delivery of digital assets

— Bakkt (@Bakkt) January 16, 2019

Bakkt aims to launch its physically-backed Bitcoin futures market in the first quarter of this year, pending regulatory approval from the Commodities Futures Trading Commission (CFTC).

The startup announced its first acquisition on Monday.

Bakkt is buying “certain assets” from the independent futures commission merchant Rosenthal Collins Group (RCG). The move is designed to help Bakkt improve its risk management and treasury operations.

[the_ad id="42537"] [the_ad id="42536"]