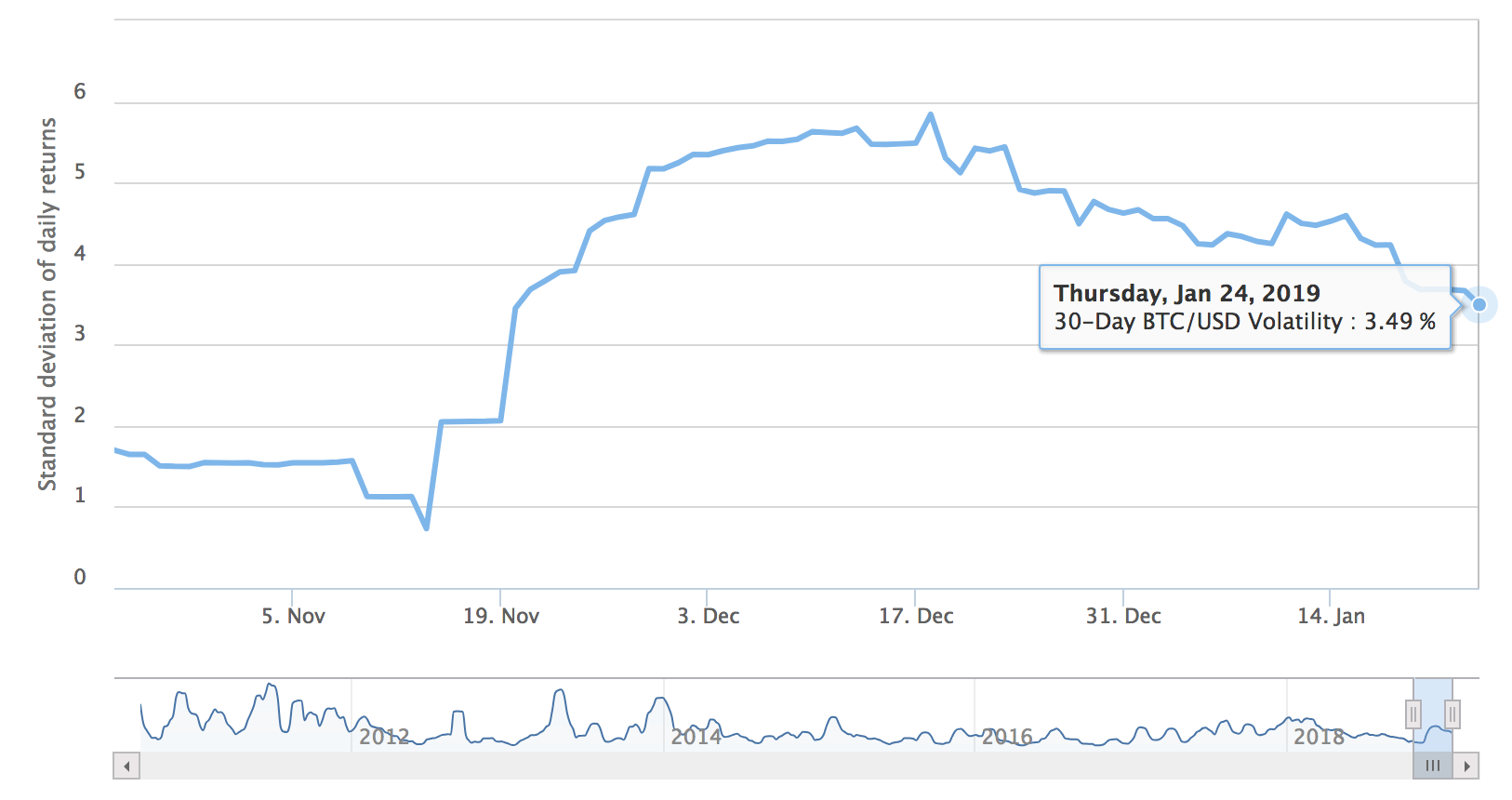

Bitcoin’s price has been fluctuating in a $540-range over the past 30 days, with a high of $4,086 and a low of $3,547. Currently trading around $3,595, BTC volatility has dropped to its lowest levels since the end of last November.

The index shows the latest 30-day volatility estimate at 3.49% and the latest 60-day estimate at 4.24%.

Bitcoin Volatility Index

Reports FX Street,

“While the market is snoozing in tight ranges, investors should be on the alert, as prolonged periods of low volatility are usually followed by strong movements.”

Indications as to which way the markets will move are unclear. There are a range of narratives, from bullish to bearish.

CNBC reports that in a note to clients, JP Morgan managing director and analyst Jan Loeys wrote,

“Even in extreme scenarios such as a recession or financial crises, there are more liquid and less complicated instruments for transacting, investing and hedging, in part due to the scale afforded by fiat currencies’ legal tender status.”

Loeys believes Bitcoin may have value when all else crumbles, adding,

“We have long been skeptical of cryptocurrencies’ value in most environments other than a dystopian one characterized by a loss of faith in all major reserve assets.”

Conclusion: Bitcoin could plummet to $1,260 “if a bear market persists.”

Ran NeuNer, host of CNBC’s Crypto Trader, suggests the perception of Bitcoin and its inherent value is largely shaped by different narratives, many of which are polarizing. These broad crypto narratives challenge the soundness of the technology, test real-world uses cases and the speed of adoption, and question the long-term competitive advantages that cryptocurrencies profess to have over fiat and gold.

What we see:

More lightning nodes

More adoption

Decreased fees

Multiple new fast Blockchains

Increasing demand for Blockchain developersWhat they see;

No ETF anytime soon

Bakkt delayed

Eth Constant. delayed

PayPal CEO not bullish on Bitcoin

“Bitcoin may go to zero” on CNBC— Ran Neuner (@cryptomanran) January 24, 2019

Crypto-vs-fiat narratives also challenge perceptions that fiat currencies can withstand a rapidly transforming global economy that favors smartphone adoption, digital content, online check-outs, Millennial spenders and mobile transactions.

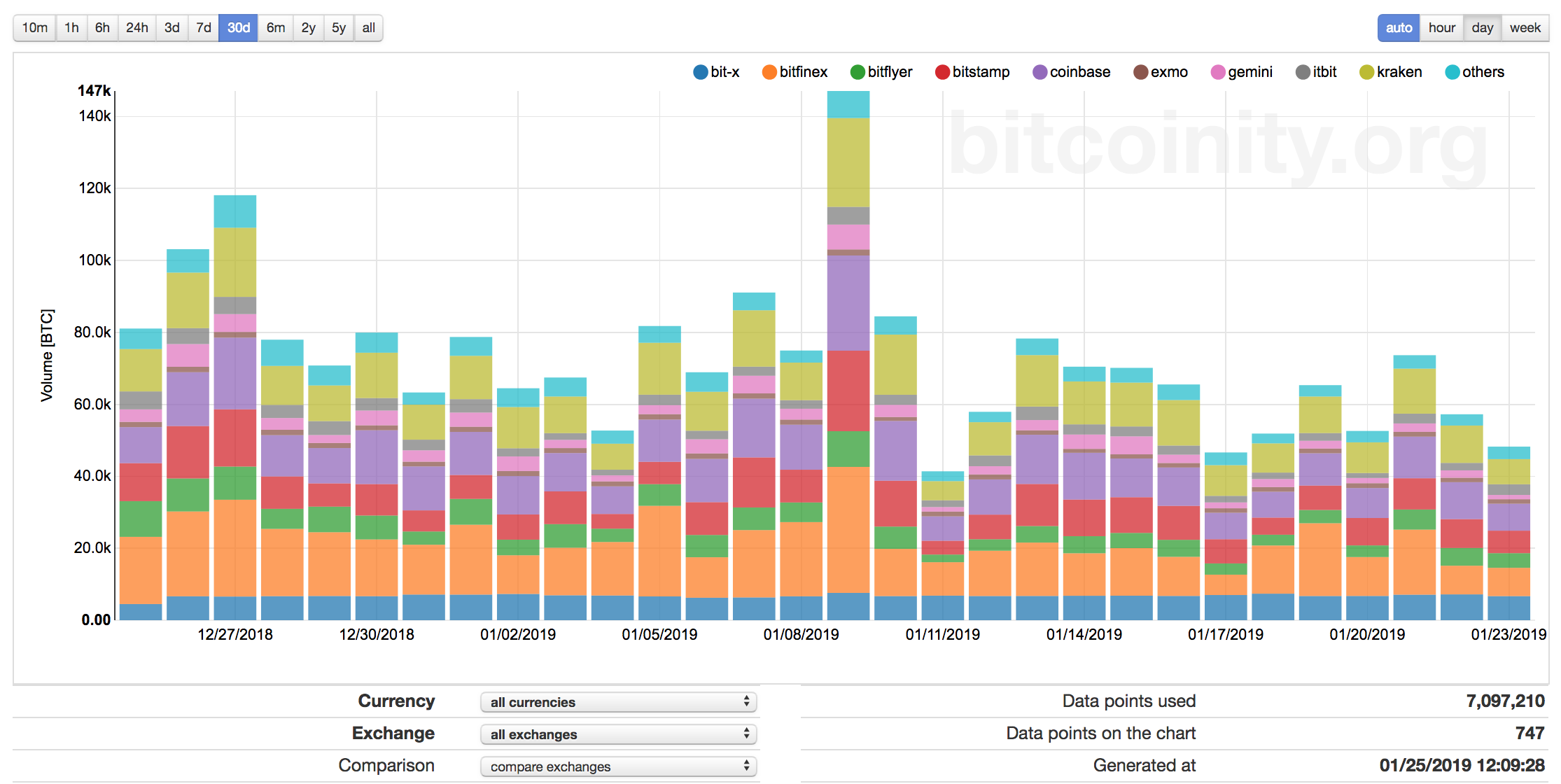

Despite crypto adoption, relatively low Bitcoin price volatility and price consolidation, trading volumes remain down.

The crypto winter has generated a lot of pain among blockchain developers who are trying to bring products to market. According to Business Insider, Mike Novogratz, CEO of Galaxy Digital, is planning to ease the financial burden by creating a lending fund for crypto and blockchain entrepreneurs who have burned through their cash reserves.

According to the report, companies that want to tap into the new $250-million fund to secure US dollar loans will be able to offer real estate and mining equipment, in addition to cryptocurrencies, as collateral. Two people familiar with the launch, say that the firm plans to close a first round of fundraising in March.

[the_ad id="42537"] [the_ad id="42536"]