Bitcoin

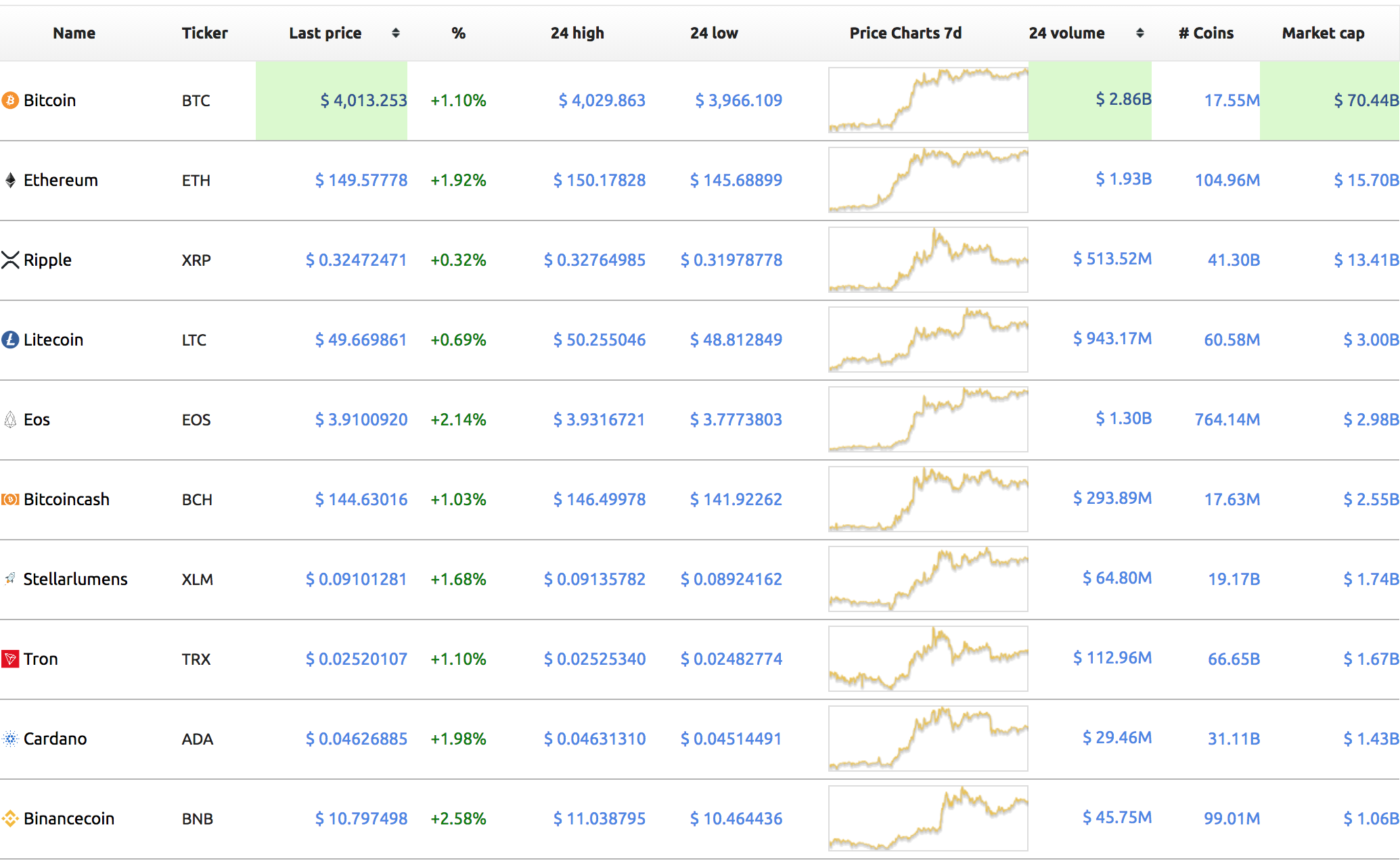

The crypto markets are a sea of green, with Bitcoin once again breaking through $4,000 for the fourth time this year.

Bitcoin is currently up around 1.06% at $4,013 at time of publishing, according to the price tracker WorldCoinIndex.

Ripple and XRP

Ripple has released 100 million XRP from escrow, sending the funds to one of its distribution wallets.

The transfer, worth about $32 million, indicates the cross-border payments startup may be about to sell some of its reserves. Ripple owns about 60% of the total supply of XRP and sells portions of its holdings throughout the year to keep the lights on and to reinvest in the XRP ecosystem.

? ? ? 100,000,000 #XRP (32,062,080 USD) transferred from Ripple Escrow wallet to Ripple OTC Distribution wallet

— Whale Alert (@whale_alert) February 21, 2019

Latin America’s Biggest Bank Launching Token

Brazil’s BTG Pactual is the latest bank to join the world of crypto. BTG is creating a platform that will let people buy its new digital asset with Gemini Dollars, and plans to raise up to $15 million, reports Bloomberg.

The token is called ReitBZ. The bank says it will be backed by distressed real estate assets in Brazil, and will pay yearly returns to investors that are expected to range from 15-20%.

The bank’s chief technology officer Gustavo Roxo says BTG is using its own money to power the token.

“BTG is deploying its own capital to provide liquidity because it really believes in the crypto business. We came up with this structure because we think investors in the digital world have a higher risk-taking appetite.”

Last week, JPMorgan Chase announced it will launch JPM Coin, a new digital asset that will be used to power a private, permissioned blockchain for cross-border payments.

[the_ad id="42537"]

[the_ad id="42536"]