Crypto analyst Willy Woo estimates that the Bitcoin accumulation bottom is underway. Using on-chain volume estimates from Coinmetrics and Unchain Capital’s one-day HODL Wave chart, Woo writes,

“Both my 1 day HODL, and the new CM Pro volume estimates suggests the accumulation bottom is now well under way.”

He compares various predictions about the Bitcoin bottom from both bears and bulls, noting that Adaptive Capital founder and Bitcoin maximalist, Murad Mahmudov, gives the bottom a 75% probability compared to Woo, who gives it a 95% probability, and crypto researcher and derivatives trader, Tone Vays, who sets the likelihood of a bottom at 40%.

Is the bottom in, final figures…

% probability Bitcoin has bottomed:

BULLS@MustStopMurad 75% @kenoshaking 80%@woonomic 95%

BEARS@ToneVays 40%@venzen 39%@LucidInvestment 20%https://t.co/k77hCnGAuR https://t.co/97O1eeixq7

— Willy Woo (@woonomic) April 20, 2019

However, in a new live stream debate, Bitcoin bull Woo and Bitcoin bear Vays, switch places, with Woo becoming more bearish and Vays becoming more bullish in the near term, in a show of just how unpredictable Bitcoin is.

In the short term, Vays believes BTC will break out and challenge $6,000. Meanwhile, Woo believes Bitcoin will retest $4,300, and says the zone between $4,300 and $6,000 is very unpredictable.

Says Vays,

“So here’s what makes this funny. This entire five-hour show was Willy being the bull and myself being the bear. But right now, Willy thinks $4,300 before $6,000, while being a bull, and I’m actually thinking the opposite – $6,000 before $4,300. So on a short-term scale, I am more bullish than Willy, and that’s all because of technical analysis. On a longer-term scale I am more bearish than Willy, and that’s mostly because of fundamental analysis, because we have different views of fundamental analysis.”

Responding to a question about the potential news of a Bitcoin exchange-traded fund and how a groundbreaking approval, if and when it comes to pass, could affect the market, Vays says to stop confusing news with fundamental analysis because they are not the same thing.

“The ETF being approved or not approved will be irrelevant. If the ETF is approved in a bull market, it’ll be great for the price of Bitcoin. If the ETF is approved in a bear market, it’ll be irrelevant and no one’s going to buy it.”

In the long term, Vays maintains that Bitcoin could head south after reaching $6,000 with a pullback below $4,000 and maybe below $3,000. And in the longer long term, Vays says Bitcoin will struggle in the next bull run to surpass $50,000. He doesn’t see it reaching that level until after the Bitcoin halving, when the block reward for miners will be cut in half to keep Bitcoin inflation in check.

Says Vays,

“I’m thinking about $50,000 around the 2024 halving. After that it can actually start to take off.”

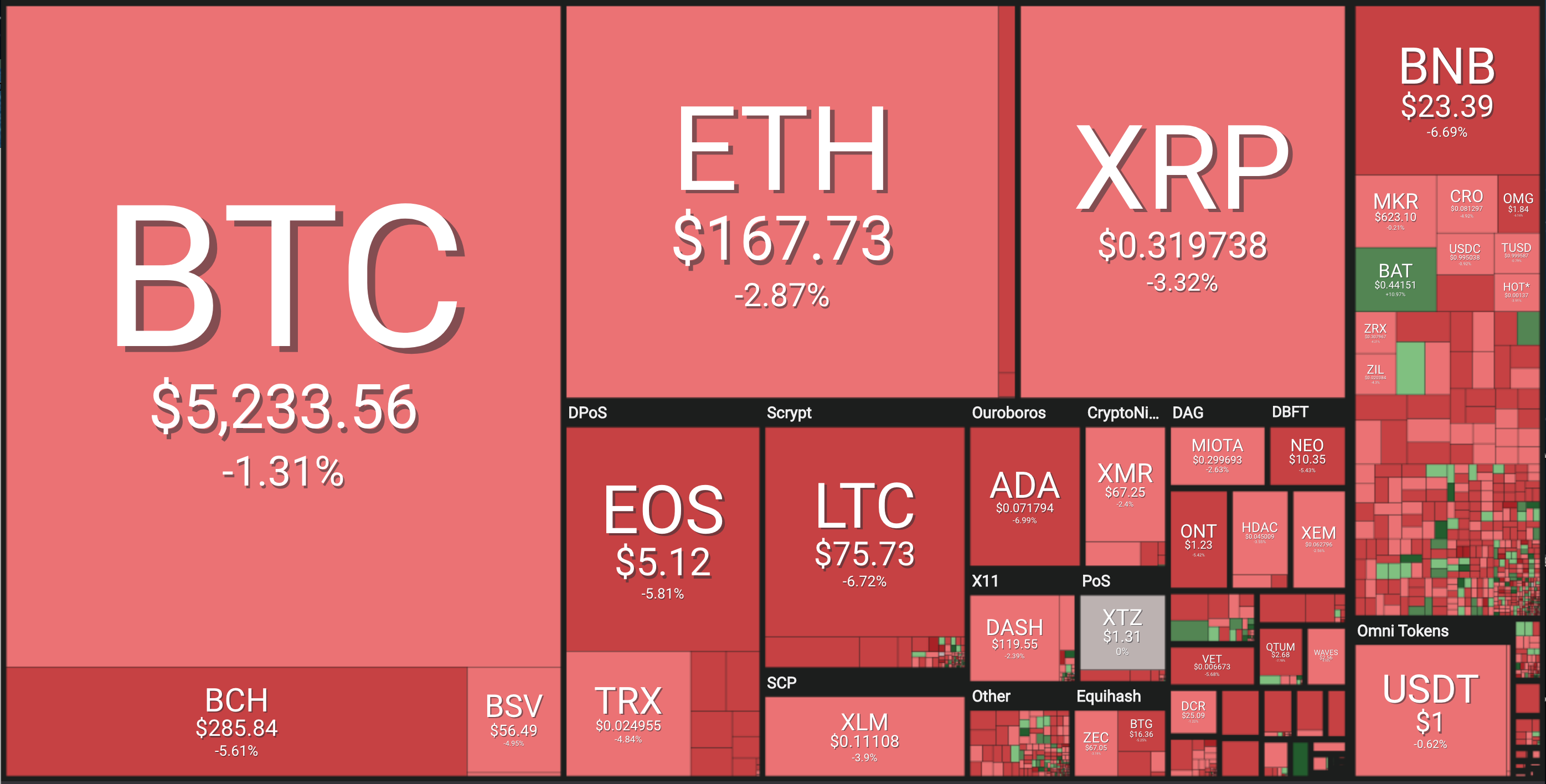

The market is currently a sea of red with Bitcoin down 1.31% at $5,233. ETH is down 2.87% at $167.73 and XRP is down 3.32% at $.31.