HodlX Guest Post Submit Your Post

The last two parts of this series cover Litecoin’s development history, working mechanism, the transaction speed of the Litecoin network, and mining distribution including the block reward halving.

In the final segment of this series, we will take a deep dive into Litecoin’s market performance, network performance, and its ecosystem building.

1. Market Performance

As of now, commercial transactions and settlements have to go through multiple procedures, involving many organizations, and this becomes even more complicated when it comes to cross-border payments. Cryptocurrency payments led by Bitcoin (BTC), on the other hand, present an alternative for people through a peer-to-peer exchange, eliminating the middleman and cutting down costs.

However, Bitcoin payment is still in its nascent phase and is grappling with the challenges of slow confirmation speeds, limited throughput, concentrated hash power, scalability dilemma, and other issues. To put it simply, Bitcoin is still struggling to meet people’s demands for payment. Litecoin was developed to solve these dilemmas like other altcoins. Enlightened by Bitcoin’s whitepaper, Charlie Lee developed a lighter version of Bitcoin that enhanced Bitcoin’s confirmation speed thanks to its unique technologies in Scrypt algorithm and Segwit mechanism. As of this writing, Litecoin ranks in the top five coins on CoinMarketCap with a market cap of up to $5.012 billion, 5.4% of Bitcoin’s value.

2. Technology Analysis

2.1 Lighting Network and SegWit

Both Lighting Network and SegWit (short for Segregated Witness) were hailed as the solutions to scalability issues. Segwit was activated on Litecoin on May 10, 2017, and on Bitcoin on August 23, 2017. SegWit’s initial intention was to fix a bug in the Bitcoin code called transaction malleability. SegWit fixed transaction malleability by removing the signature information and storing it outside the base transaction block. In fact, SegWit does not increase the block size but only increases the number of transactions within the 1MB blocks, thus improving the scalability to some extent.

The Lighting Network, on the other hand, is a protocol where frequent and small transactions will be carried out of the main blockchain. Litecoin has successfully implemented both Lighting Network and SegWit.

As per the data analysis on 1ml.com, the carrying capacity of the Lighting Network has reached 302.9 LTC, with 184 nodes, up 6.36% in the past 30 days. Plus, channels have reached 1,339, surging by 21% in the past 30 days, and the staked LTC also amounts to 291.09. In comparison, the Bitcoin network carrying capacity has reached 1,063.42 BTC, and the number of nodes has reached 8065, up 7.48% in the past 24 hours. Plus, channels in the Bitcoin network have declined to 38,637, down by 1.6%. In a word, Bitcoin’s Lighting Network is performing far better than that of Litecoin.

2.2 Scrypt Algorithm

Scrypt is a memory intensive POW algorithm. Litecoin, however, was not the first coin to use Scrypt algorithm. Tenebrix is the first coin to pioneer Scrypt algorithm which was only proven more successful by Litecoin.

The Scrypt algorithm uses the idle time of the CPU to mine blocks. Scrypt algorithm generates an array with several block elements. Each block element must first perform a series of operations to generate a hash value and then operate the entire array to get the final result.

Scrypt is memory intensive because it carries out both the functions of requiring miners to generate numbers rapidly and storing these generated numbers in the Random Access Memory (RAM) of the processor, which then needs to be accessed before submitting a result. The Scrypt hash function was initially implemented by the Litecoin development team to Application-Specific Integrated Circuits (ASICs) which makes the mining power easily concentrated in the large mining pools. However, Scrypt algorithm makes the hash power more distributed, thus reducing the possibility of 51% attacks.

Scrpyt’s memory intensive design makes it hard for ASIC miners to exert more power in the Litecoin ecosystem, which aligns with blockchain’s core principle of decentralization and distribution. Scrypt algorithm makes people work towards a more decentralized direction and was generally recognized among the Litecoin community.

3. Network Performance

3.1. TPS/Block

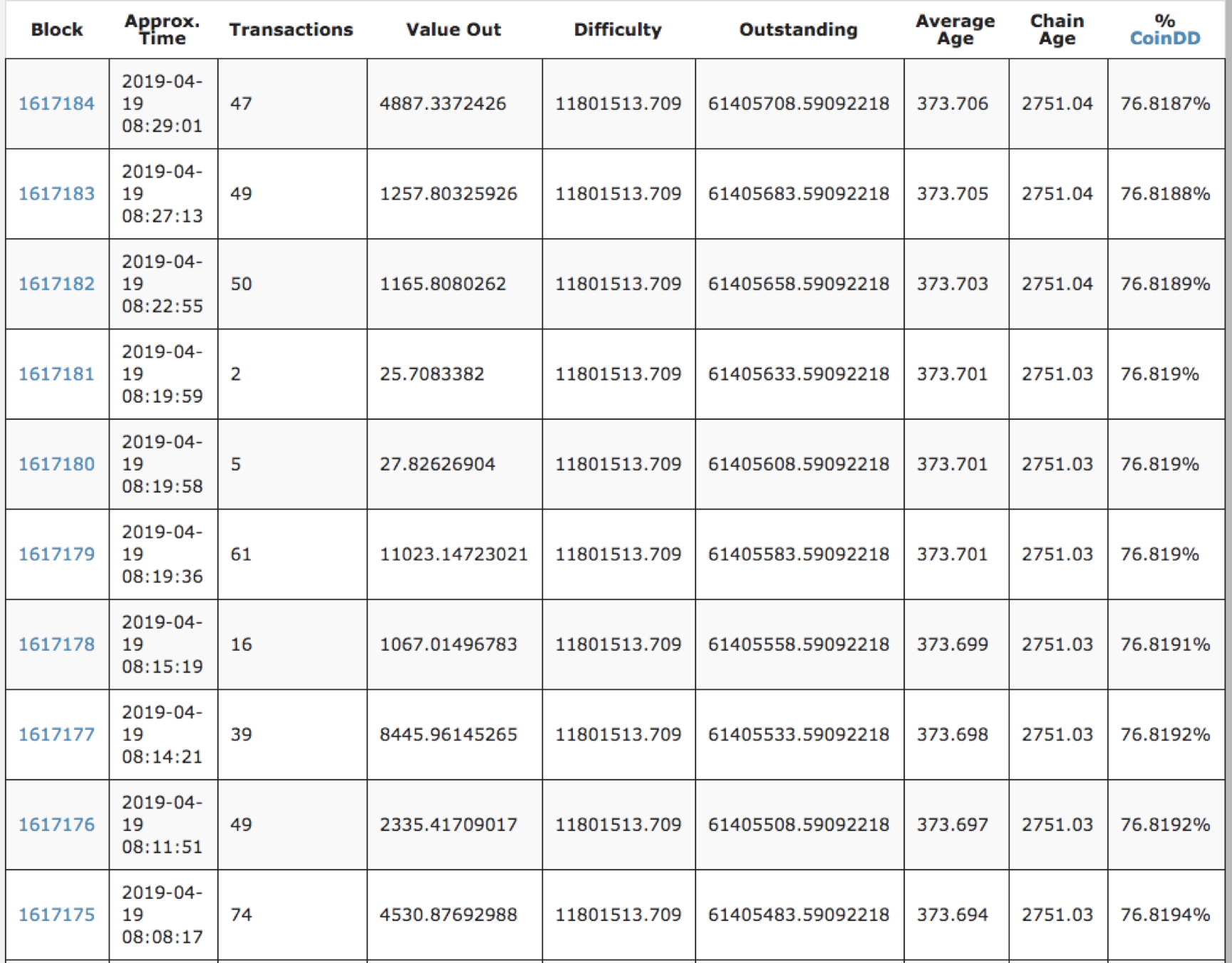

Source: Litecoin Explorer

According to the above chart, transactions per Litecoin block have not yet reached the full limit of the block size.

3.2. Block Size

Block Size (Byte)

Latest Data

22921,49

Source: LTC Block Explorer

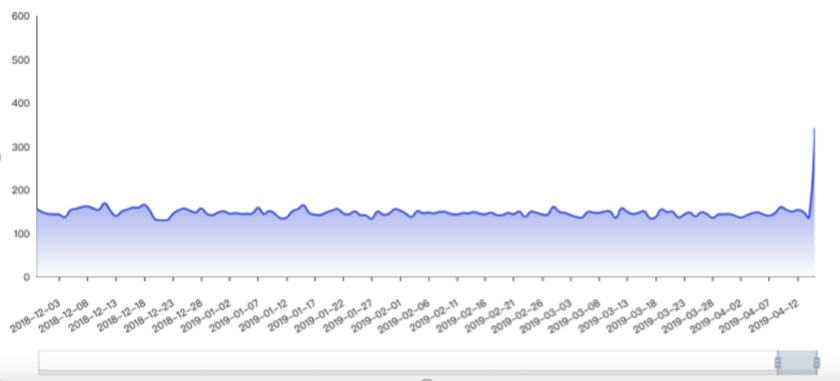

The block size of LTC stays within 50,000 bytes and has witnessed two marked rises pre and post April 7th.

3.3. Time Consumption for Block Generation

Block Generation (S)

Latest Data

344.2

Source: LTC Block Explorer

Litecoin block was generated about every 200s and is delivered at a stable rate.

3.4. Transaction Fees

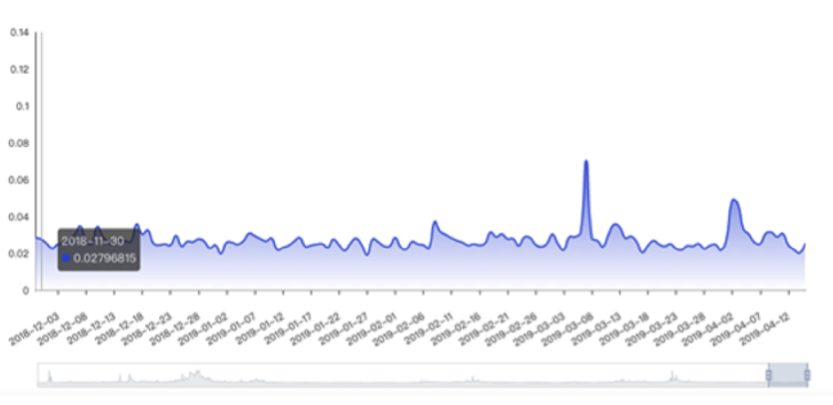

Average Transaction Fees Per Block

Latest Data: 0.02582571

The graph shows the average daily miners’ fee curve. A miner’s daily income partly comes from transaction fees for packing the blocks. After the block reward halving event, miners’ rewards from mining news blocks will decrease and their dependence on transaction fees will increase as a result. In addition, miners’ income will entirely come from transaction fees. The transaction fee of Litecoin is mostly below 0.04 at the moment.

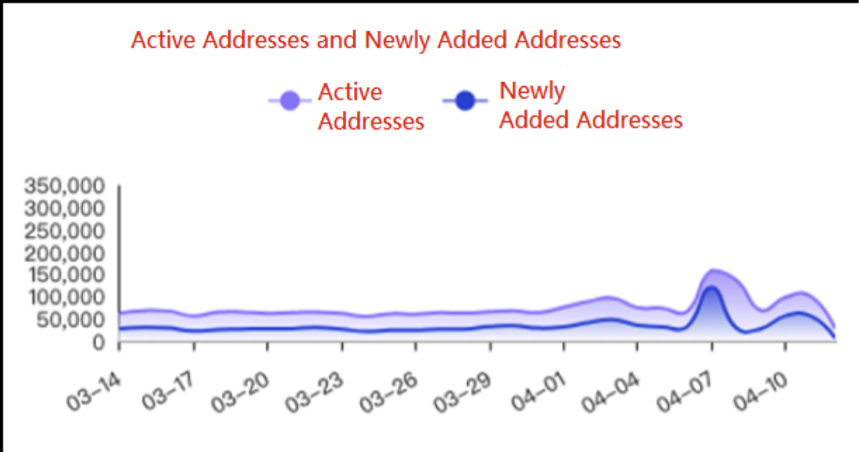

3.5. The Active and Newly Added Addresses

Source: LTC Block Explorer

The active addresses on the Litecoin network are increasing steadily, with more users joining the network on April 7th, thanks to its relatively lower transaction fees and faster confirmation speeds than Bitcoin.

4. Token Analysis

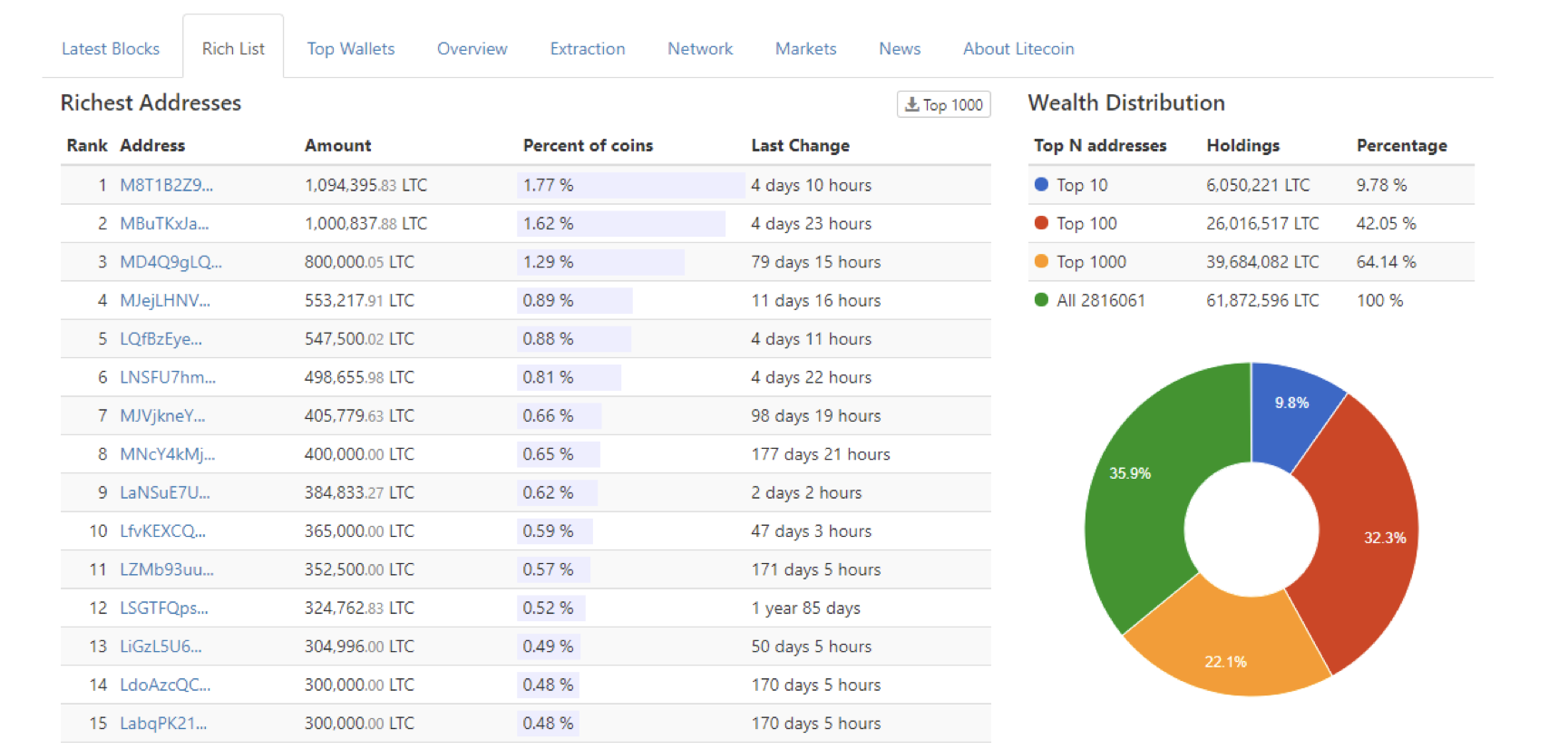

4.1. Distribution of Litecoin Holders

Regarding the distribution of Litecoin holding, the top 100 addresses cover 42% of the total supply, displaying concentration issues just like other mainstream altcoins. The top 10 Litecoin addresses account for about 9.4% of the total supply and the biggest holder accounts for about 1.57%.

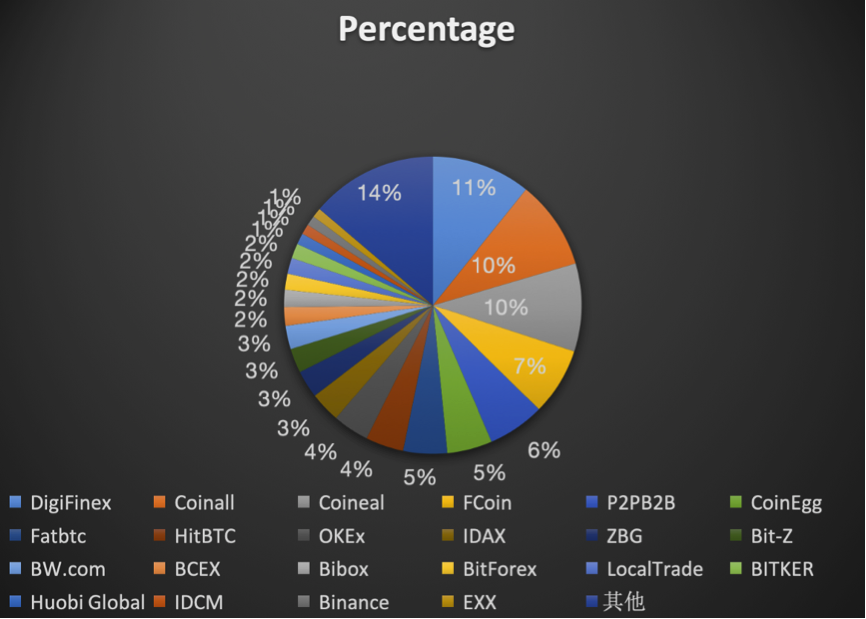

4.2. Exchanges that List Litecoin

According to data from CoinMarketCap, on April 19 a total of 400 LTC trading pairs are currently on 164 exchanges. Of these 164 exchanges, 86 have LTC records and are listed among the top 10 exchanges by volume.

Litecoin Transaction on Major Exchanges

5. Ecosystem Building

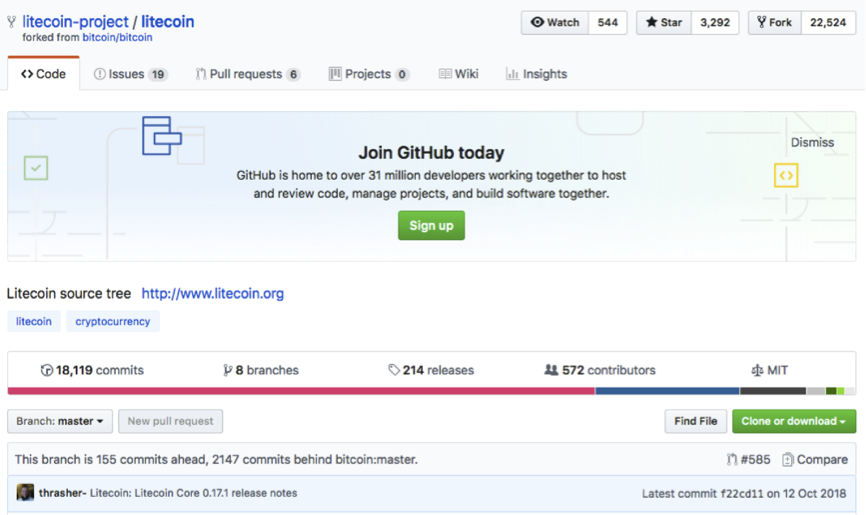

5.1 Code Commits

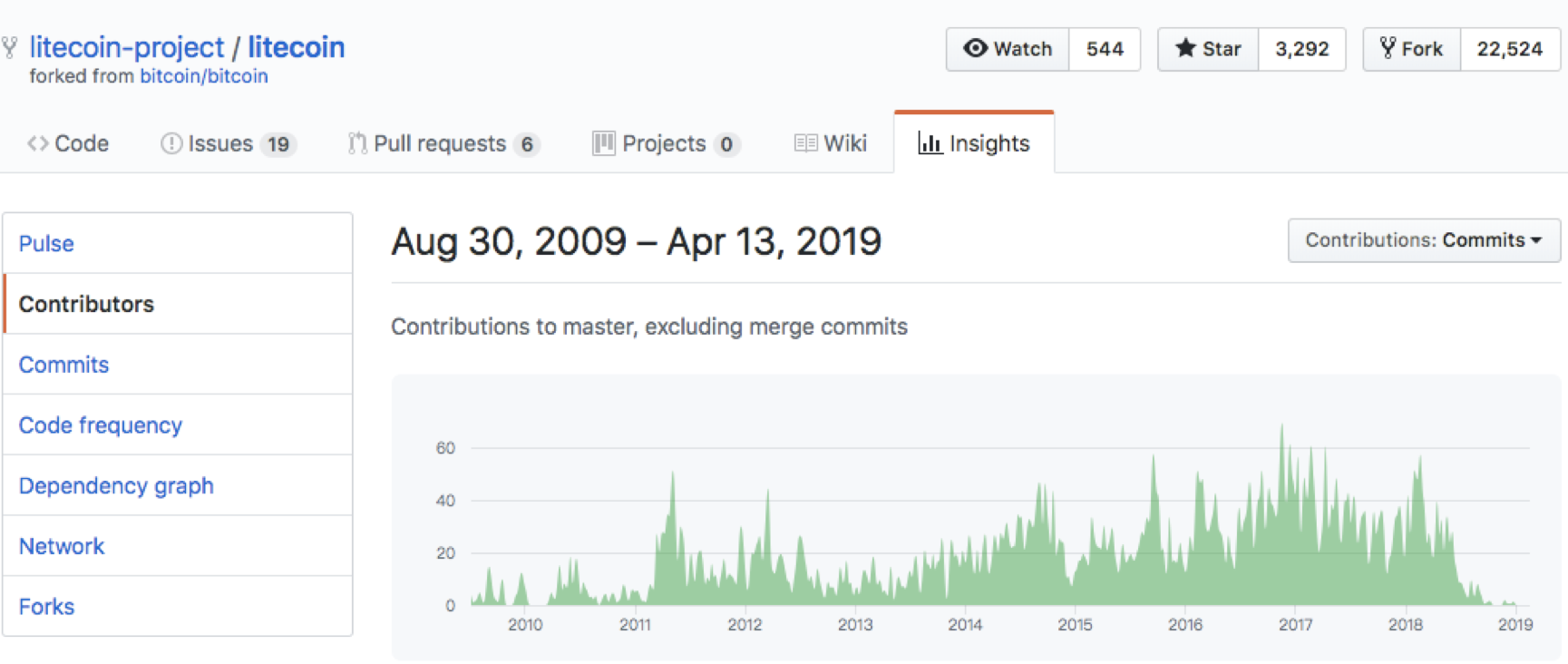

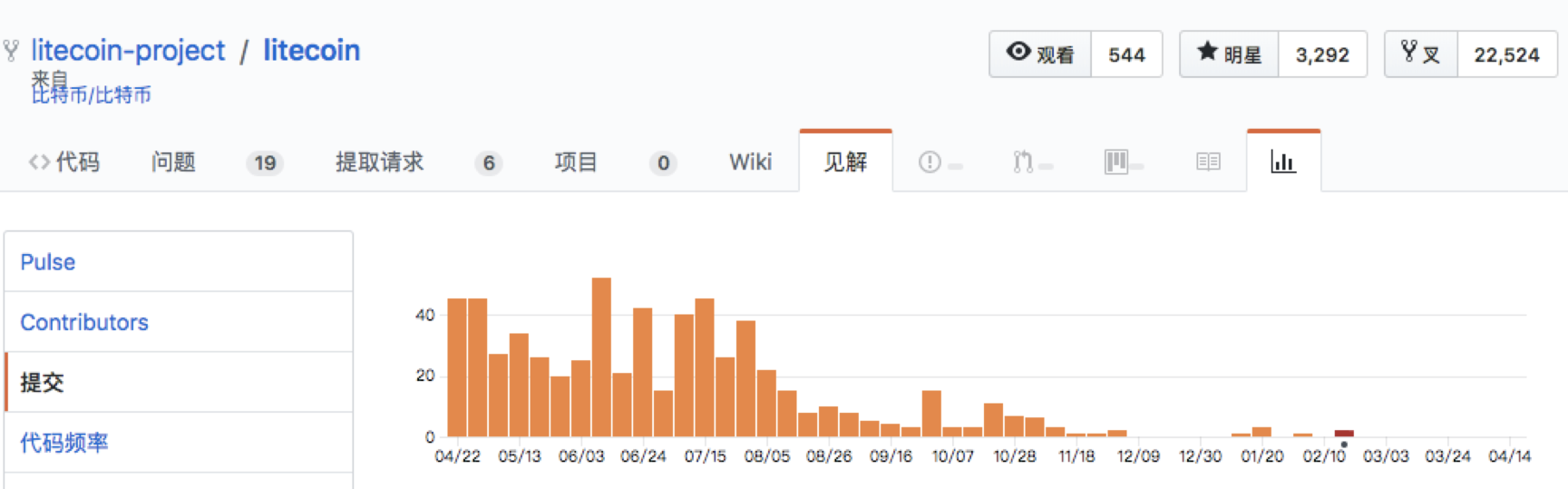

Code commits show a technology development and iteration of a project. Till April 19, Litecoin has a follower base of 3,292, showcasing a high level of interest among the community. Litecoin has reached 18,119 commits as of this writing, with 572 contributors.

Litecoin Performance on Github, April 19th

From the above chart, you can see that the number of commits of Litecoin between 2010 and 2011 stayed under 20, and saw a rise after 2011 above 20. However, from mid-2018 its code commits show only the downtrend to barely any commits in a few months, with the last commit occurring on February 20, 2018.

In fact, the commit numbers are highly correlated with the development of the Lighting Network technology. So far, Litecoin seems to have been stuck in a period of stagnation in its public chain development and is countering with competition from other emerging public blockchains.

Source: Github, Apr.19th, 2019

Source: Github, Apr.19th, 2019

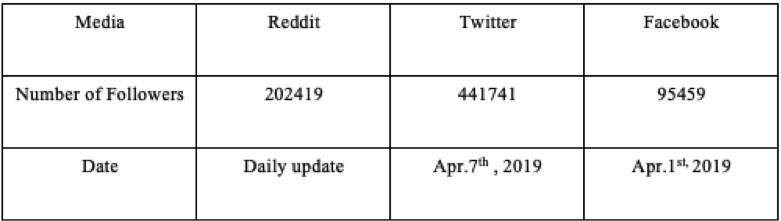

5.2 Litecoin’s Media Attention

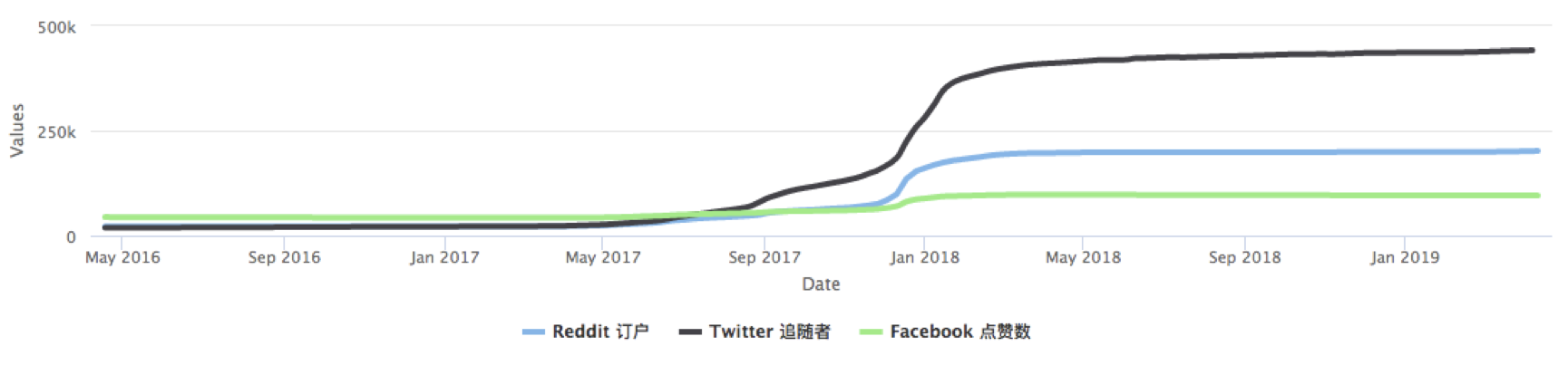

Litecoin’s followers on Reddit, Twitter and Facebook totaled 73,891 (with the possibility of overlaps). Litecoin’s media attention pumped from the end of 2017 through early 2018, and has become flat since the latter half of 2018, which coincides with the bear and bull cycle switches.

Litecoin’s Media Attention: CoinGecko

5.3 Offline Payment Ecosystem

Integrating Litecoin into the merchant’s payment system and other applications is a necessary step for achieving mass adoption. As a utility token, LTC’s offline payment ecology is a key part of the focus. According to the information on Litecoin.com, Litecoin has partnered with institutions, including cryptocurrency payment gateways, debit card institutions, other blockchain projects, and brick and mortar retailers. We will analyze Litecoin’s adoption from the perspective of its partner institutions, merchants and ATMs.

5.3.1 Debit Card

In May 2018, Wirex, a longtime cryptocurrency debit-card provider, announced that they would begin supporting Litecoin.

In September, Bitnovo launched a Litecoin debit card, which allows users to easily deposit cryptocurrencies and immediately receive euros that can be used at any traditional institution. TenX, another provider of cryptocurrency debit cards, announced plans for Litecoin’s future on its blog.

5.3.2 Cooperative Merchants

Hundreds of e-commerce sites and brick-and-mortar locations have accepted Litecoin payments in the past year, according to data compiled by cryptocurrency enthusiasts on Reddit. Litecoin merchants offer a wide range of goods and services, including art, clothing, food and beverage, precious metals, electronics, and other services across multiple industries. However, payment adoption is still very limited, with some stores closed due to various factors. Obviously, Litecoin still has a long way to go before becoming a large-scale application.

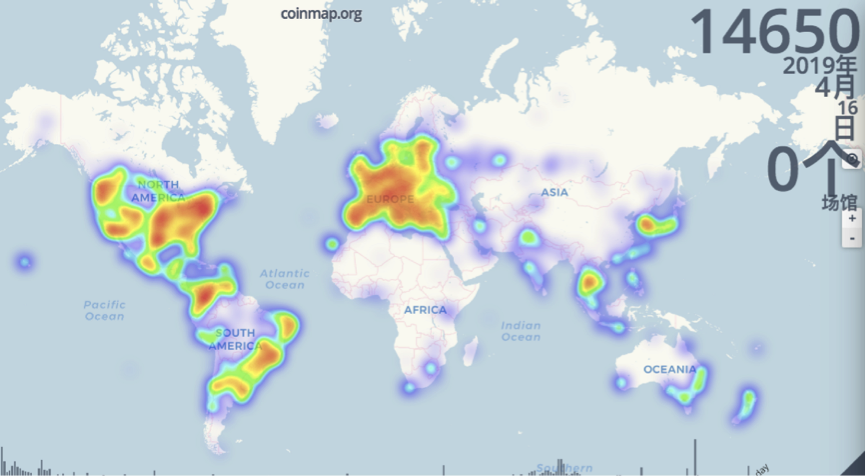

5.3.3 ATM Machines

Crypto ATMs help users with fiat-crypto exchanges and crypto-to-crypto exchanges. As of April 19th, 2019, there are 4,607 crypto ATMs worldwide, spreading across 81 countries, most of which are concentrated in North America and Europe, covering 72.6% and 23.1% respectively.

ATM Supported Cryptocurrencies

Source: coinatmradar.com

Number of ATMs as of April 19, Coinatmradar

The world’s first Litecoin-enabled ATM was put into operation in May 2017. At present, there are 2,999 ATMs around the world providing Litecoin deposit and withdrawal services, accounting for 65.1% of all cryptocurrency ATMs, ranking third in the total number of all cryptocurrency ATMs. Litecoin ATMs are also mainly distributed in North America and Europe.

Litecoin ATM Map

Litecoin ATM Map, as of Apr.19th, 2019

According to Coinmap.org, there are 14,650 brick-and-mortar stores around the world where Bitcoin is accepted as a payment method. These include merchants and ATMs that support Bitcoin payments. Though Litecoin’s payment ecology is constantly enriched and its ATMs are increasingly expanding, Litecoin is not the top choice for merchants in most cases due to the common consensus of the flagship cryptocurrency Bitcoin.

Bitcoin Payment Ecology as of April 16th, CoinMap

6. Conclusion

Using POW consensus, faster confirmation speeds and advanced technologies such as SegWit and Lightning Network give Litecoin the edge over Bitcoin and have helped it gain traction in the community.

This post originally appeared on Medium. Read more.

About OKEx

OKEx is a world-leading digital asset exchange headquartered in Malta, offering comprehensive digital assets trading services including token trading, futures trading, perpetual swap trading and index tracker to global traders with blockchain technology. Currently, the exchange offers over 400 token and futures trading pairs enabling users to optimize their strategies.

Follow Us on Twitter Facebook Telegram