HodlX Guest Post Submit Your Post

Summary

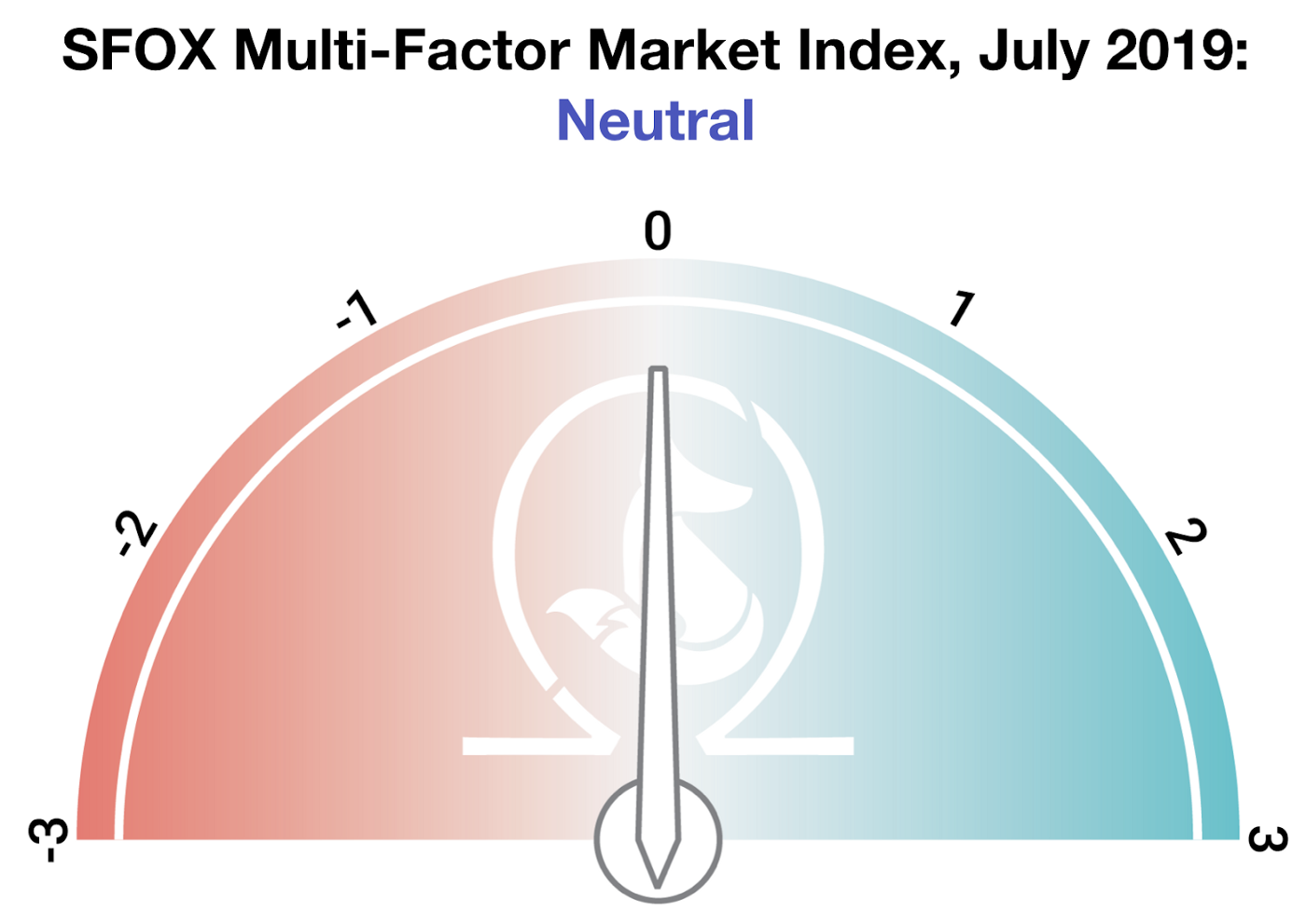

- The SFOX Multi-Factor Market Index has moved from mildly bullish to neutral as of August 5th, 2019.

- The S&P 500 is currently negatively correlated with all leading cryptocurrencies.

- Bitcoin was the only major cryptoasset with positive month-over-month returns as of August 5th, 2019.

- Bitcoin dominance is currently at its highest level since April 2017.

- As the US-China trade war persists and more regulatory clarity is being achieved around Bitcoin, BTC appears to be emerging more and more as a global hedge.

- Watch for further trade war developments and futures expirations to potentially impact crypto volatility in the coming month.

In the July 2019 edition of our monthly volatility report, the SFOX research team has collected price, volume, and volatility data from eight major exchanges and liquidity providers to analyze the global performance of 6 leading cryptoassets – BTC, ETH, BCH, LTC, BSV, and ETC. The following is a report and analysis of their volatility, price correlations, and further development in the last month.

Current Crypto Market Outlook – Neutral

Based on our calculations and analyses, the SFOX Multi-Factor Market Index, which was set at mildly bullish as of July 9th, 2019, has been moved to neutral as of August 5th, 2019.

We determine the monthly value of this index by using proprietary, quantifiable indicators to analyze three market factors – price momentum, market sentiment, and continued advancement of the sector. It is calculated using a proprietary formula that combines quantified data on search traffic, blockchain transactions, and moving averages. The index ranges from highly bearish to highly bullish.

It’s possible that we may be seeing broader macroeconomic uncertainty affect the market’s outlook on the crypto sector at this juncture. Data have suggested for months that investors may be using Bitcoin as a hedge against global markets; with many uncertain about the impact of rising tariffs and global currency instability on the market, it may be the case that traders are equally unsure of crypto’s future.

Analysis of July 2019 Crypto Performance

As traditional markets and the global economy has faced the challenge of an ongoing US-China trade war, Bitcoin appears to be further maturing as a hedge against global market instability. Perhaps further legitimized in some people’s minds – or at least popularized – by the Senate and Congressional hearings on Facebook’s proposed cryptocurrency, Bitcoin has proven itself in the last few weeks as the dominant cryptocurrency that increasingly appears to wax as traditional markets wane.

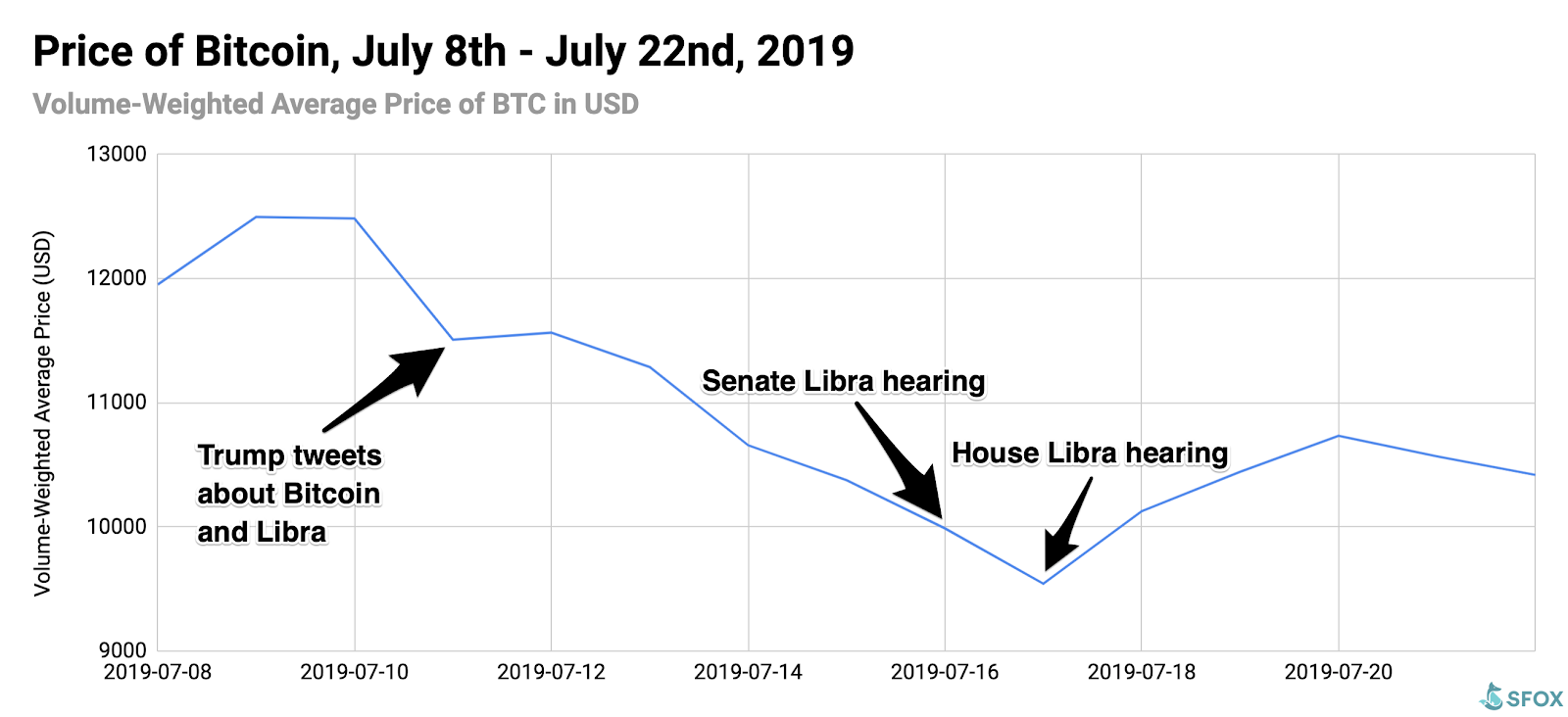

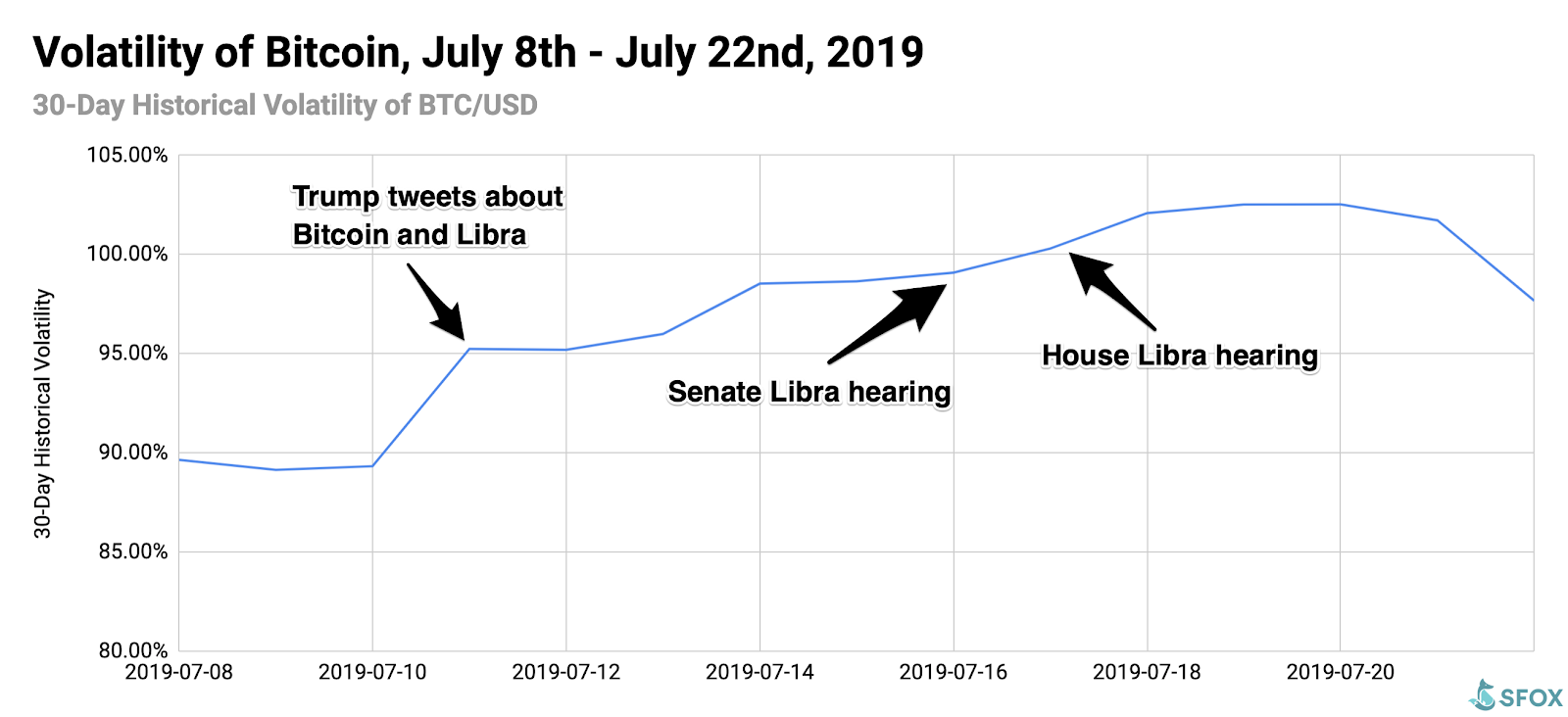

Trump and lawmakers on Capitol Hill scrutinized Facebook’s cryptocurrency initiative, Libra, bringing renewed attention to Bitcoin and the crypto sector at large (July 11th — 17th).

As SFOX detailed in a previous analysis, the week from July 11th to July 17th was dominated by Capitol Hill discussing the merits and dangers of Facebook’s project Libra, beginning with bearish presidential tweets about Libra and Bitcoin on the 11th and ending with Senate and Congressional hearings on the 16th and 17th, As perceived regulatory scrutiny around the crypto sector heightened, the price to buy bitcoin declined from its peak of $12,495.91 on July 9th.

If you missed the Senate and House’s hearings on Libra, SFOX rounded up the 10 most important takeaways for the crypto market.

The IRS sent more than 10,000 letters warning U.S. taxpayers that they may owe money on crypto taxes (July 26th).

Beginning in late July, the IRS reportedly sent 10,000 letters of varying severity warning certain taxpayers that they may owe taxes on taxable crypto events. This news came two weeks after a leaked slide deck revealed that the IRS is training its agents to uncover crypto wallets. This news reinforced the Facebook hearings’ narrative that the government is increasingly taking cryptocurrency seriously, which leads to further regulatory clarity allowing Bitcoin and crypto to continue maturing as an asset class.

The price to buy Vitcoin and other cryptoassets increased as the yuan fell to a new 10-year low (August 5th) and a China court ruled that Bitcoin constitutes virtual property (July 18th).

As the yuan traded against the dollar at 7 yuan per dollar for the first time in 10 years, the price of BTC climbed more than 7%, from $10,851.06 to $11,645.48. Combined with a Chinese court providing more apparent regulatory acceptance of crypto by ruling that Bitcoin constitutes legal property, this seems to suggest that some traders, potentially in both the US and China, may be viewing crypto and Bitcoin as a kind of safe haven during the ongoing US-China trade war.

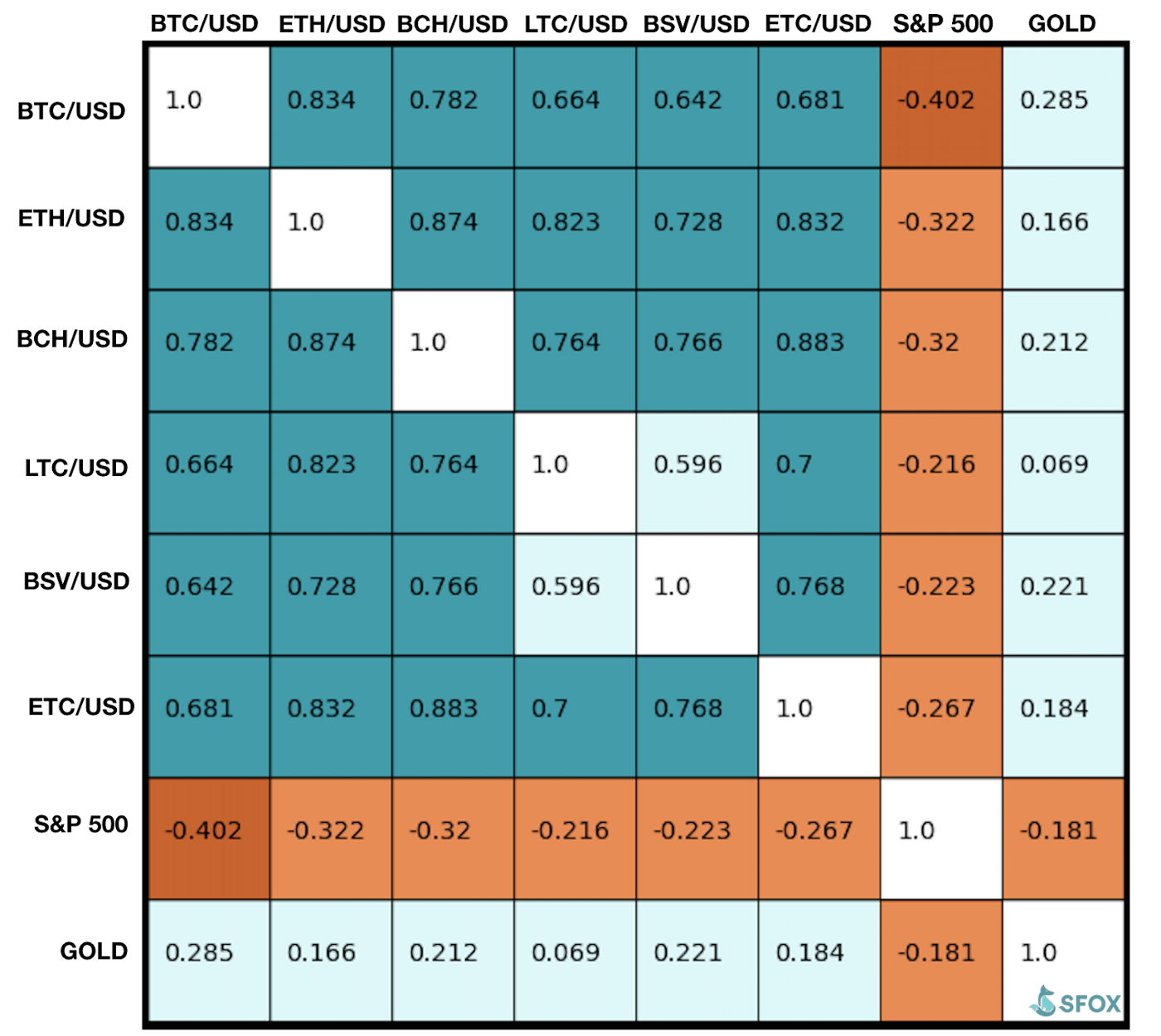

The S&P 500 is currently negatively correlated with all leading cryptocurrencies.

Similar to the figures SFOX reported in May 2019, BTC, ETH, BCH, LTC, BSV, and ETC all showed negative correlations with the S&P 500 this past month. Negative correlations with the S&P 500 ranged from BTC, at a correlation of -0.402, to LTC, at a correlation of -0.216.

30-Day Correlations of BTC, ETH, BCH, LTC, BSV, ETC, the S&P 500 and Gold

Notably, all of these cryptoassets were more negatively correlated with the S&P 500 than gold was (the gold: S&P 500 correlation was -0.181). In light of this, a case could be made that traders may increasingly be viewing cryptocurrencies, especially Bitcoin, as a hedge against global markets – perhaps even more so than gold. (This is a stretch imo. “A case can be made.”)

Bitcoin was the only major cryptoasset with positive month-over-month returns as of August 5th, 2019.

While other cryptocurrencies have stumbled and yielded month-over-month losses since last month’s crypto rally, BTC, as of this past Monday, has shown positive month-over-month returns.

You can check out the full SFOX report here.

Follow Us on Twitter Facebook Telegram