In the latest episode of the Keiser Report, journalists Max Keiser and Stacy Herbert are in Buenos Aires, Argentina to weigh in on the country’s current currency crisis, massive debt and the new administration’s dealings with central bankers at the International Monetary Fund. They signal Bitcoin as the key instrument that will shift Argentina’s course of action and monetary policy.

Says Keiser,

“What we’re seeing here is a resilience to the overlords like the IMF.

For the first time in history, a country like Argentina has a weapon to fight the carpet baggers at the IMF, the charlatans like Christine Lagarde. And that would be Bitcoin. I noticed on LocalBitcoins use in Bitcoin in Argentina is skyrocketing. This is where ground zero is in Bitcoin versus central bank. It’s happening right here in Buenos Aires, right here in Argentina.

[Bitcoin is] their way out of this morass to fight the Christine Lagarde’s, fight Donald Trump, fight the European Central Bank. Hard money. Bitcoin. And that’s what’s happening now. This is ground zero. This is where the revolution is really taking hold.”

A huge chunk of the country’s $57 billion loan from the IMF in 2018 has been used to prop up the plunging Argentine peso. But the $22 billion plug hasn’t stopped the crisis, forcing Argentinians to turn to hard assets like gold and real estate, as well as alternative assets like Bitcoin.

Adds Keiser,

“If you want to get out of the US Empire of Debt, you must buy gold, you must buy Bitcoin…

They should use that [$22 billion] to mine Bitcoin. If they want a hard currency, if they want to get out of the US empire, they should stop throwing good money after bad. They’ll never appease the IMF. The IMF is that crocodile that Winston Churchill called the act of appeasement that never gets satiated…you never appease the IMF, never appease the financial terrorists. Never.”

Says Herbert,

“The [Argentine peso] has fallen by over 50% here. Inflation is raging. I’ve seen numbers between 38% and 55% inflation rate.”

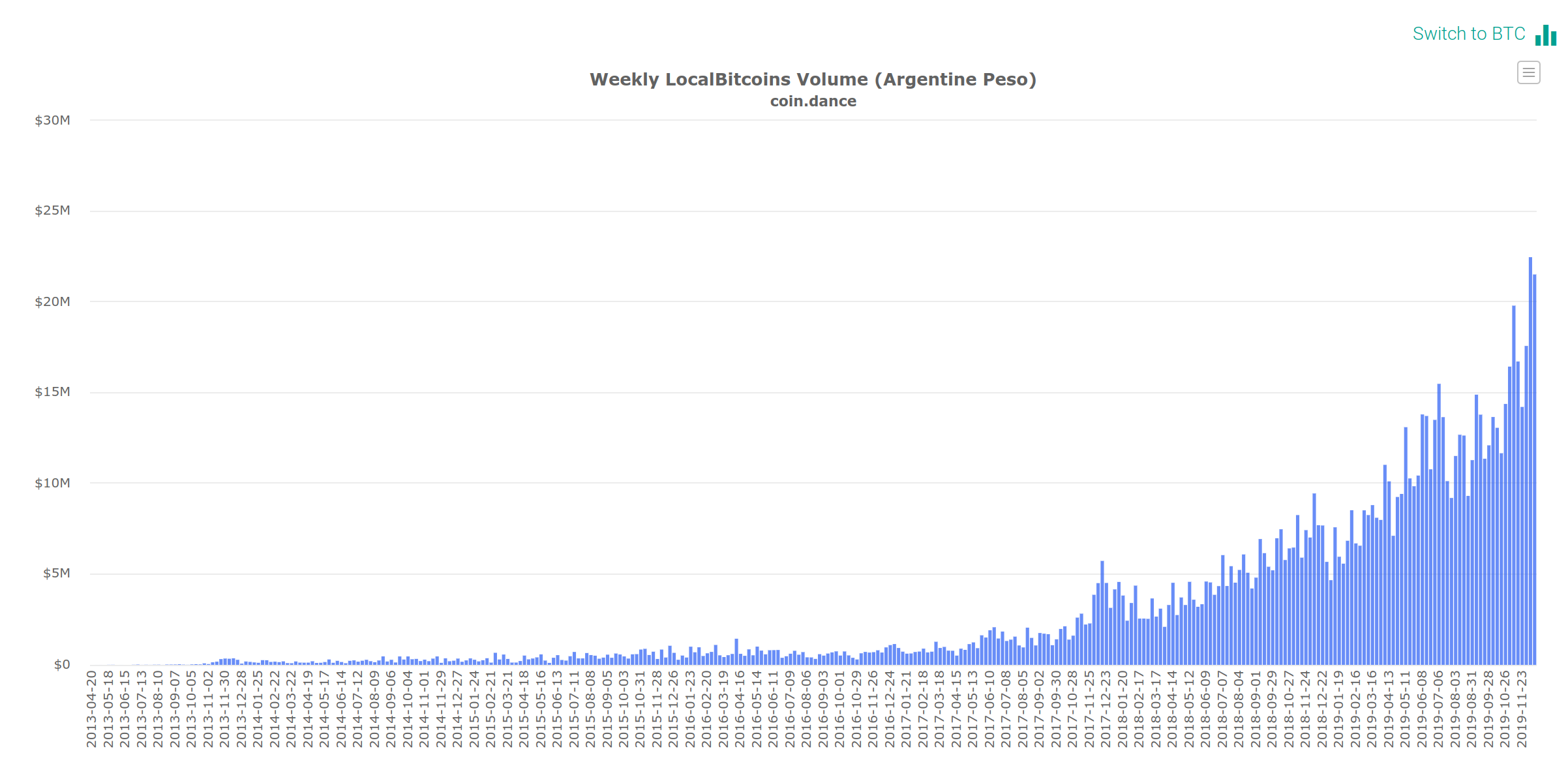

Meanwhile, consumers in Argentina have pushed purchases of Bitcoin to record highs. On peer-to-peer crypto trading platform LocalBitcoins, BTC weekly volume reached an all-time high of 22,466,140 pesos for the week ending December 7th, dropping to 21,513,195 for the week ending December 14th, according to data compiled by Coin.dance.

LocalBitcoins Volume in Argentina

Argentina’s new president Alberto Fernández has rejected an additional $11 billion in loans from the IMF.

Says Fernández via the AFP,

“We want them not to lend us more money, but to let us develop. Let’s discuss the time I need to develop, but don’t give me more money.”

Asks Keiser,

“Why would you have a world reserve currency based on paper that has no limit to print the paper. And then the people who print the paper get a fee for printing the paper. And anyone who is reliant on using that paper, like Argentina, is going to get, you know – “

Adds Herbert,

“Obliterated.”

Featured image: Shutterstock/Henrik Dolle