If you have a few dollar bills or a bit of Bitcoin, and you want to buy a cup of coffee, opting for the latter payment option can trigger a capital gains tax.

Crypto advocates and entrepreneurs from the New York-based nonprofit Wall Street Blockchain Alliance (WSBA) are joining a chorus of digital asset enthusiasts who are pushing to make crypto payments as commonplace as credit cards or cash. They’ve issued a letter to the Internal Revenue Service, urging the agency to do more to incentivize consumers to spend their Bitcoin, Litecoin or Bitcoin Cash on bagels or tea. Their solution: drop the capital gains tax on small purchases.

Currently the IRS classifies crypto as property – not currency. And the smallest purchases could trigger a capital gain – or loss. That means paperwork and accounting.

From pizza to popcorn to movie tickets, crypto users have to fill out Form 8949 to report “sales and other dispositions of capital assets.”

Critics argue that the current guidelines place an unfair burden on people who are trying to exercise their right to use the payment method of their choice and that by taxing the use of Bitcoin for bubblegum is discriminatory, impedes widespread adoption and scares off the average consumer.

Today’s guidelines also protect legacy payment giants like Visa, Mastercard and PayPal which process transactions tied to US dollars. Unlike Bitcoin, Visa allows a shopper to buy dental floss or a pair of underwear without having to report and pay capital gains, effectively handing traditional systems a competitive advantage over innovative platforms that use crypto to move money.

Dated January 2020, the WSBA letter states,

“Given that the underlying purpose of many cryptoassets, ranging from traditionally decentralized options such as bitcoin to more centrally organized stablecoins, is to serve as an alternative currency option, the current accounting taxonomy, classification and tax treatment seems inappropriate. Classifying cryptoassets as property creates additional compliance and reporting requirements that seems to neither add value to the taxpayer nor merchants accepting cryptoassets as payment for goods or services. Realizing that there is no definitive cryptoasset guidance as yet issued by the Financial Accounting Standards Board (FASB), the IRS could consider establishing a de minimis exemption for both individuals and merchants.”

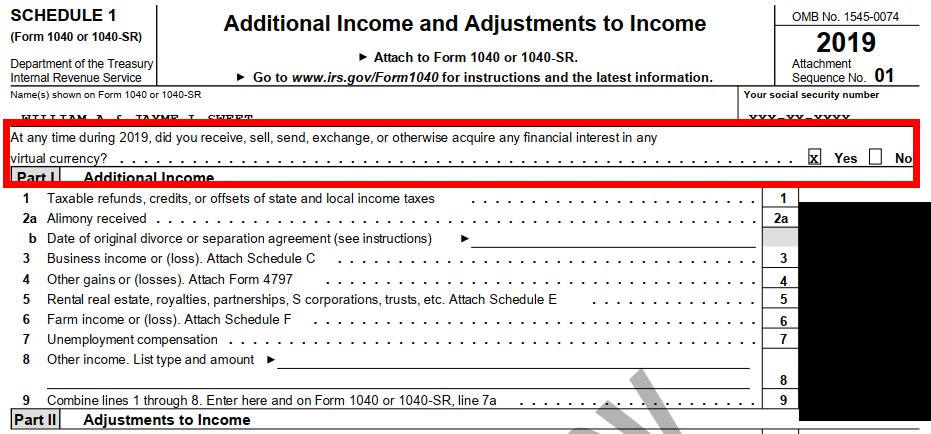

As of now, US taxpayers are expected to declare their cryptocurrency transactions for 2019. They are also being asked, for the first time, to tell the IRS if they have interacted with Bitcoin or any of its many digital cousins through the purchase, sale, exchange or acquisition of cryptocurrencies in 2019.

The blockchain alliance also drills down on crypto as a new technology with many facets. While convenient for the IRS to simplify digital currencies by tagging all of them as property, the WSBA says that decision purposefully overlooks a number of distinctions and complexities.

“For example, if an exchange holds various cryptoassets as an integral component of its core business operations, such as crypto ATM firms or crypto exchanges might, these cryptoassets serve a different purpose than those held by other market actors.

Additionally, cryptoassets that are traded on a continuous basis versus those held as part of a longer-term portfolio diversification strategy serve different purposes, and seemingly should be treated differently from a tax and reporting perspective. Building on the differentiation inherent to how various cryptoassets are used by taxpayers there seems to be a need for increased clarification connected to what criteria should be used to determine tax treatment, i.e. ordinary income versus capital gains.”

You can check out the full WSBA letter here.

Featured Image: Shutterstock/Marchie