Cryptocurrency has returned into the global spotlight as the price of Bitcoin briefly topped the key $10,000 level again this week, and some strong rallies have been seen in the altcoin space. The leading crypto, now trading around $9,804, has gained upwards of 34% YTD, making it the best-performing asset so far this year.

While crypto bulls have been cheering for the recent upward price action, many may have been wondering what factors contributed to the latest rally other than the upcoming reward halving event. We’ve sorted out some of the recent developments in the crypto space for market participants.

1. Near record low volatility

We want to highlight the drop in BTC’s volatility despite the recent positive price actions. Prices of cryptocurrency are generally more volatile than other assets, such as equity indexes and traditional commodities like energy and metals. Volatility could provide a measure of price uncertainty in markets. When volatility increases, traders may trim their cryptocurrency positions or delay investment decisions.

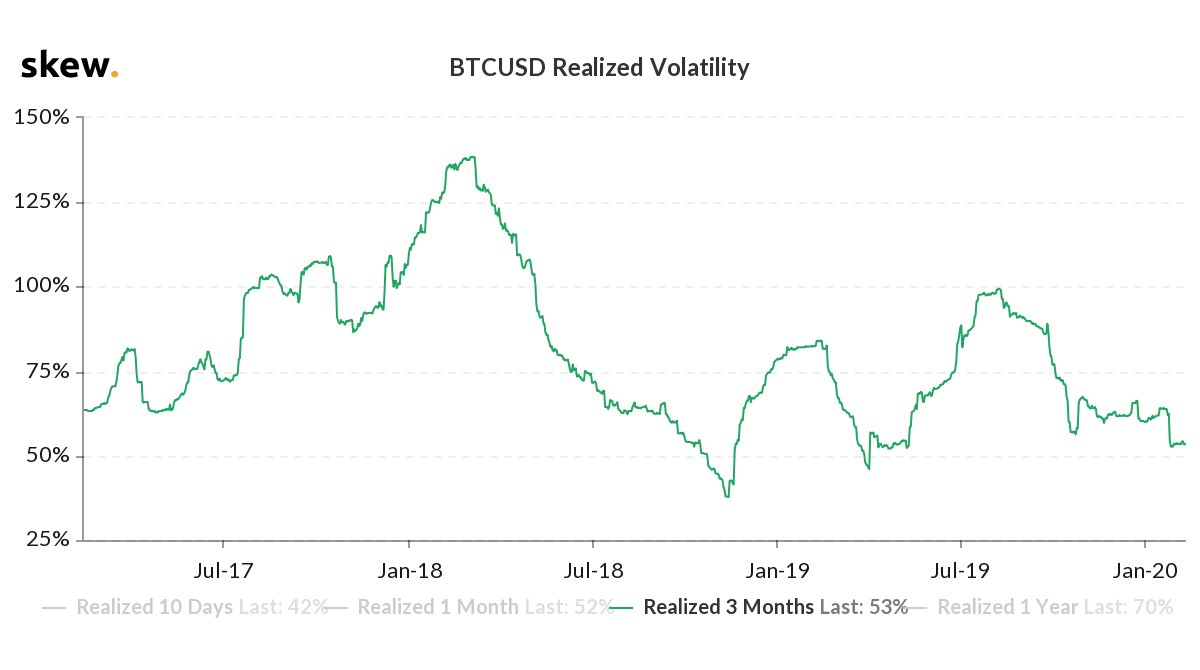

Figure 1 shows the 3-month realized volatility of BTCUSD, which recently dropped further near the record low in mid-November 2018. Generally, low volatility could encourage more HODLers to maintain their holdings; therefore, it’s considered a positive factor for the price.

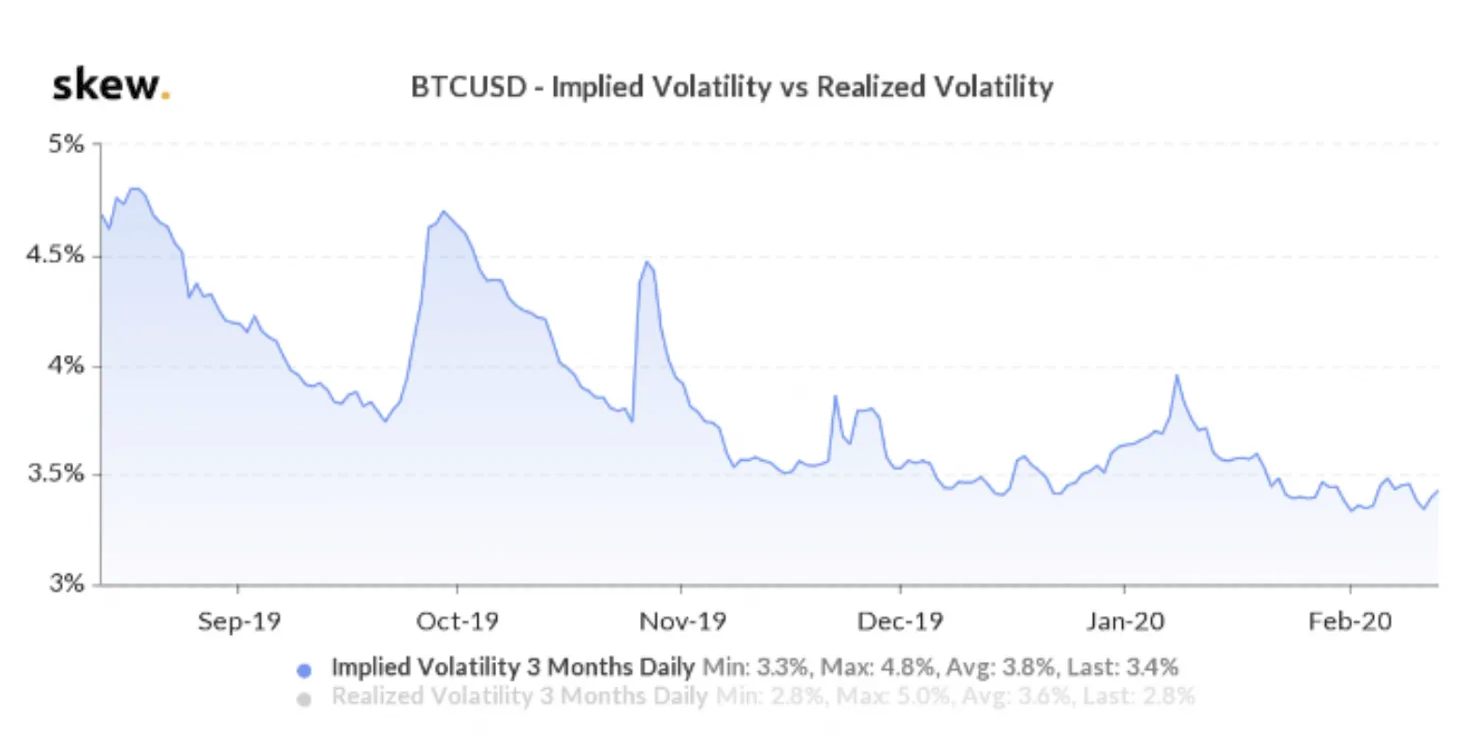

However, we’ve also noticed that BTCUSD’s implied volatility has been hovering in recent lows, although it seems to have picked up by a small fraction. In the options market, implied volatility is the expected volatility of an underlying asset over the life of the option, in this case, Bitcoin.

Supply and demand for the options could directly influence implied volatility. When the market’s expectations rise, the need for options increases and implied volatility will also increase. Conversely, when sentiments cool down, expectations decrease, demand for options decreases, implied volatility will also decrease.

In this case, the low implied volatility in the BTCUSD options market could somewhat indicate that the medium-term expectations of BTCUSD may not be as high as the current rally suggested. The changes in volatility could be something Bitcoin watchers would like to keep a close eye on.

2. Search of Bitcoin in China and worldwide surged

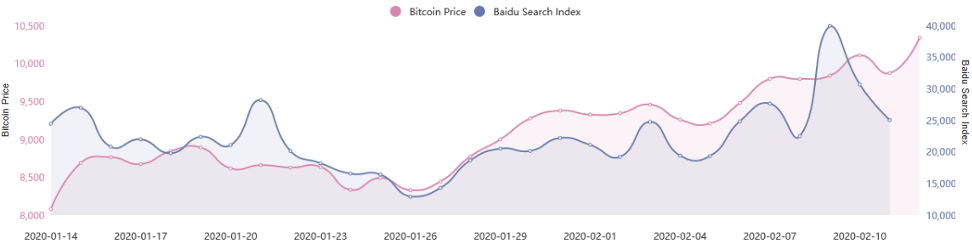

Social has been one of the critical factors when it comes to cryptocurrency analysis, and the social sentiments of the crypto communities in China have long been considered a barometer of the broader crypto space. The views of Chinese crypto watchers could give meaningful insight when it comes to price analysis.

The Baidu search index for the term “Bitcoin” in Chinese has surged to a recent high of 40,000 before settling down in near 25,000. At the same time, data from Google Trends also shows a similar pattern, with the search of the term “Bitcoin” topping 100, as soon as BTC reclaimed the 10,000 level. However, the surge could bring pros and cons, and sometimes it sends a mixed signal to the market.

A study by Sergey Krutolevich, research scientist at RoninAi,

“Spikes in conversation volume often precede spikes in search volume by one full day, and new price highs by one to three days. Indicating beyond just a clear correlation between social sentiment and crypto market prices, the former is, in fact, directly affecting the latter.”

However, if one has stayed in the market long enough, it will probably be familiar that when the FOMO buyers rush into the markets, it’s often considered a sell signal for those who came in earlier.

3. Drop in market dominance

Another interesting phenomenon alongside with the BTC rally is the decline of the BTC market dominance. The below figure compares the market dominance of BTC during a one-year time frame. BTC’s market dominance has been in a downtrend since 2020, and the decline has been even steeper recently despite the gains in price. Comparatively, ETH’s market dominance has been rising at the time that BTC has been dropping.

We believe that capital allocations could be one of the reasons behind this divergence. Part of the capital could have left Bitcoin and gone into the altcoin space at the beginning of the year, as major altcoins have plummeted to near/at multi-year lows in 4Q19. That could draw attention from value-driven investors to get into altcoin trades.

Are we in the middle of an “Alt Season” or are markets expecting an incoming one? Those remain arguable questions. However, the fact is that the total ex-BTC market cap has been increasing steadily since January. Altcoin watchers won’t want to miss the development of that, as it seems to retest the May-July tops (figure 6).

4. Virus and the expectations of QE

The COVID-19 outbreak remained the single largest uncertainty for the global economy. Its effect ripples through global markets and assets, and cryptocurrency is no exception. Central banks in Asia have started to take measures to stimulate growth hammered by the virus. Just this week, the People’s Bank of China issued the first batch of special re-lending funds for national and regional banks, aimed to help small and medium-sized enterprises in China.

Although the virus’s impact on the US economy remains limited for now, in the event of an economic downturn the Fed has already put an aggressive quantitative easing program on the table.

In recent testimony before the Senate Banking Committee, Fed Chair Jerome Powell said,

“The Fed had two recession-fighting tools: buying government bonds, known as QE, and communicating clearly with markets about interest-rate policy, routinely considered as “forward guidance.”

Powell added,

“We will use those tools? – I believe we will use them aggressively should the need arise to do so.”

While we do not expect the Fed to be the first one to restart QE soon, due to the virus-driven economic downturn, it’s easy to see the easing narrative from policymakers around the world. If that easing story intensified, that could lead the markets to refocus on Bitcoin as a store of value and as a tool to counter stagnant growth, and that could translate into increasing demand for crypto.

Conclusion

The recent BTC and altcoin rallies have drawn much of the markets’ attention. As we are getting closer to the Bitcoin reward halving event, the bullish sentiment has been more noticeable. Besides the halving, crypto watchers won’t want to neglect the four factors mentioned above when it comes to medium-term trend analysis to get a complete picture.

This post originally appeared on OKEx Academy. Read more.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

About OKEx

OKEx is a world-leading digital asset exchange headquartered in Malta, offering comprehensive digital assets trading services including token trading, futures trading, perpetual swap trading and index tracker to global traders with blockchain technology. Currently, the exchange offers over 400 token and futures trading pairs enabling users to optimize their strategies.

Follow us on Twitter.

Check our latest press material on Press Room.

Featured Image: Shutterstock/Fabian Junge

Follow Us on Twitter Facebook Telegram