Short-term holders appeared to drive Bitcoin’s implosion last week, according to Coin Metrics.

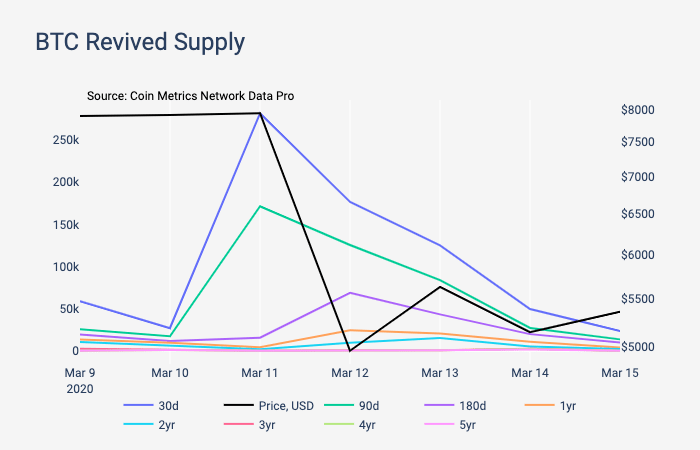

The crypto financial data firm reports that when Bitcoin’s price crashed between March 11th and 12th, there was little movement of Bitcoin that had been held by hodlers for over a year. On March 11, traders moved about 281,000 BTC that had been untouched for at least 30 days, but only moved 4,131 BTC that had been untouched for at least one year.

When Bitcoin is traded after not moving after 30 days, it’s referred to as “30-day revived supply.”

According to Coin Metrics,

“This signals that a vast majority of the activity on March 11th and March 12th involved BTC that had been held for less than a year.”

The one-year revived supply total on March 11th wasn’t particularly large.

Bitcoin’s price crash suggests that the digital asset is becoming more aligned with the legacy marketplace, according to Coin Metrics.

“BTC’s historic price drop was concurrent with the equity markets’ worst day since 1987.

On March 12th, the Pearson correlation between BTC and the S&P 500 soared to a new all-time high of 0.52. The previous all-time high was 0.32. This suggests cryptoasset markets are becoming more intertwined with existing markets, and are reacting to external events more than we have ever seen before.”

The report notes that in this crypto bear market, investors appear to be shifting assets to stablecoins.

Tether’s market cap increased by $300 million from March 10th to March 15th, and Coinbase’s USD Coin increased by $150 million.