HodlX Guest Post Submit Your Post

After March’s turbulent action in crypto markets, we thought you would be interested in the data that shows just how active the month was. Below is a digest of our March Exchange Review, which explores, using original data, how exchanges fared in March – including: how volumes hit an all-time high on March 13th, how spot volumes have been surging since January and how institutional interest has plummeted.

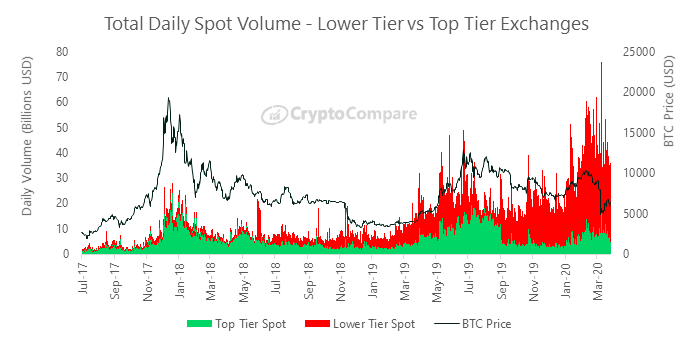

13th March Market Crash Saw Highest Daily Volumes Ever

The massive market crash on March 12th-13th saw daily volumes hit $75.9bn in a single day (13th March) – the single greatest daily volume recorded in cryptoasset history.

Most of this figure came from lower-tier exchanges ($54.3bn), with volume from Top Tier exchanges totalling $21.6bn (28.5%) – one of the highest Top Tier volumes recorded.

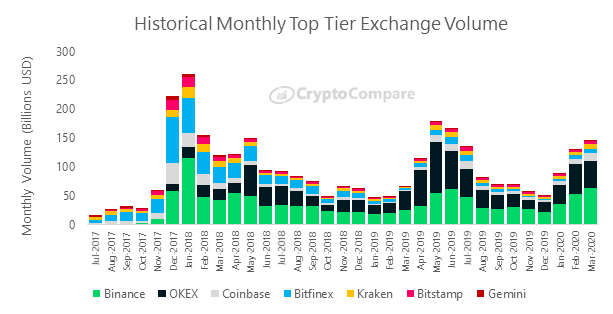

Spot Volumes Have Surged in Q1 2020

Since December 2019, volumes from Top Tier exchanges have continued to increase month on month. In March, volume from many of the largest Top Tier exchanges increased 35% on average (vs February).

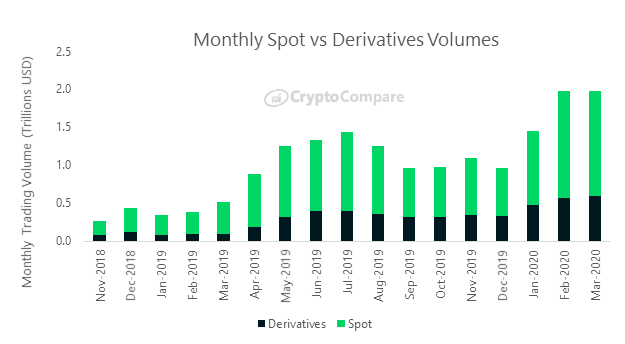

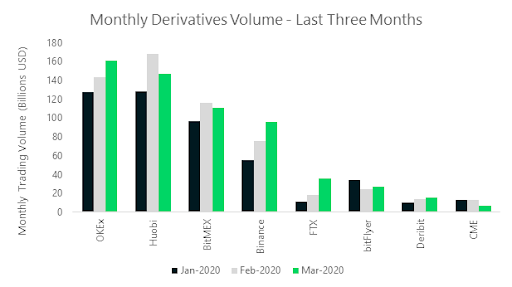

Derivatives Volumes Hit All-Time High in March 2020

Derivatives volumes totalled $600bn in March, up 5% since February. The largest derivatives players include OKEx, BitMEX, Huobi and Binance, with these four representing a combined $514bn (86% of the derivatives market for March).

Newer Derivatives Exchanges Binance and FTX Saw Volumes Soar

Binance and FTX saw monthly volumes surge 27% (to $95.8bn) and 94% (to $35.8bn) respectively in March. Binance and FTX initially together represented 14% market share in January, but now represent approximately 22% in March.

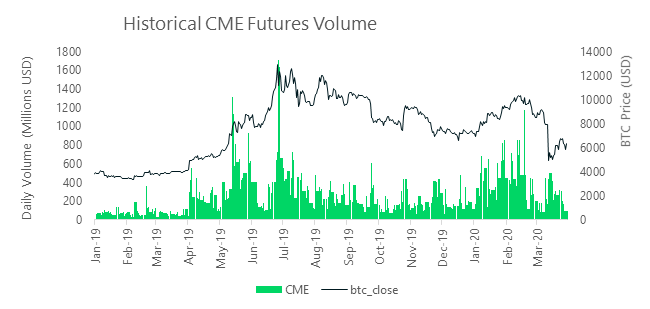

Institutional Derivatives Volumes Plummeted

Institutional appetite for derivatives products appeared to decline rapidly following the BTC crash, with CME losing 44% of volume compared to February. Trading volumes totalled $7.36bn in March compared to $13.1bn in February.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/asharkyu