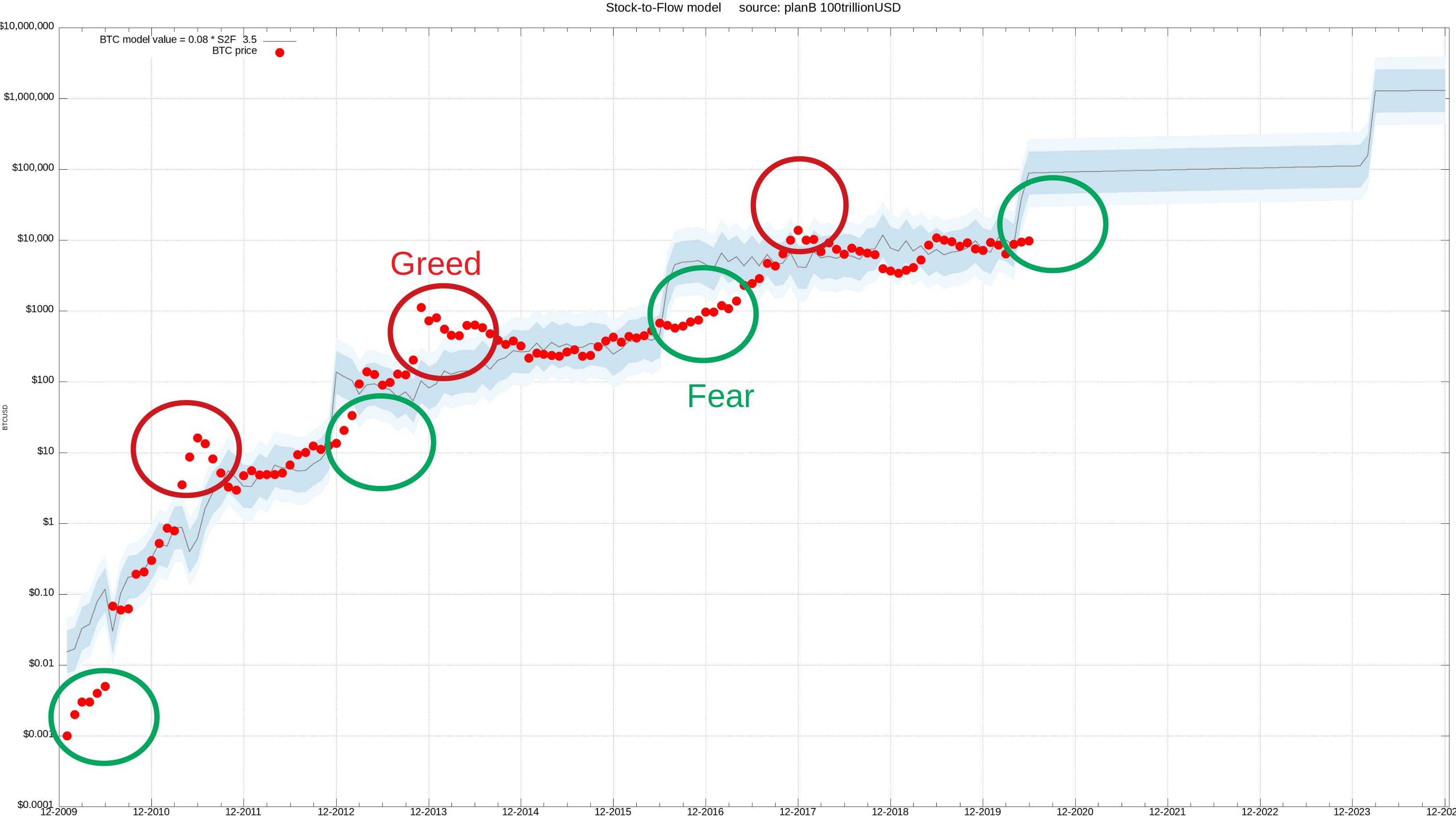

The most controversial analyst in crypto says Bitcoin has officially entered a zone that preceded each and every one of its previous parabolic bull runs.

According to the pseudonymous analyst PlanB, BTC is now in the early days of the “fear zone” phase.

The last time this happened in June of 2015, Bitcoin was valued at about $246. Over the next two-and-a-half years, BTC gradually entered its third epic rally that brought the crypto king to an all-time high of $20,089 on December 17th, 2017 – an 8,066% increase.

PlanB’s analysis is among the most bullish and contentious in all of crypto. The latest version of his stock-to-flow model suggests BTC will hit $288,000 by the end of 2024.

Stock-to-flow has long been used to plot the price movements of precious metals. But critics say the model, which outlines Bitcoin’s scarcity by dividing the total supply by the number of new coins created each year, holds no predictive power because the cryptocurrency’s supply schedule is already known far in advance.

Economist Alex Krüger says the model is over-hyped and the amount of overall demand there is for BTC is what matters most.

“The Stock to Flow model is to bulls, what the Tether Manipulation paper is to bears. Both based on fancy looking statistical models (more so the latter). Both are flawed. Doubt whoever believes in these extremes will change their minds. The mind believes what it wants to believe.”

Amazing how so many bring up S2F these days whenever anyone mentions bitcoin supply. I did not have S2F in mind when I wrote this tweet, and no, I don't think it is very important, it is massively over-hyped.

— Alex Krüger (@krugermacro) November 6, 2019

PlanB says demand is not required to predict price, pointing to other widely-used and respected models that don’t take it into account.

“Some say S2F(X) model must be wrong because BTC price is determined solely by scarcity (supply) and demand does not play a role.

However, Nobel prize winning Capital Asset Pricing Model (CAPM) determines asset returns solely based on risk (volatility, dd)… no demand, no supply.”

Although the analyst says BTC has now entered the fear zone phase, he cautions that this doesn’t mean BTC is ready to take off immediately. He’s waiting for Bitcoin’s relative strength index (RSI), which measures the pace of price movements for a given asset, to rise above 60. Right now, the RSI is at 57.

Friendly reminder: we're not in #btc bull territory yet (RSI>60) pic.twitter.com/lLrPhxO3I1

— PlanB (@100trillionUSD) May 28, 2020

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong