Blockchain data provider Glassnode says a Bitcoin signal that preceded a monster BTC rally that saw gains of over 9,200% between 2015 and 2017 is back.

The on-chain market analysis firm says the Puell Multiple is hovering at a level that may offer a stellar risk-reward ratio.

“The Bitcoin Puell Multiple has dropped back into the green ‘buy’ zone after almost three weeks. For investors with long-term time horizons, these levels below the 0.5 line have historically marked excellent entry points into BTC.”

The Puell Multiple predicts boom-and-bust cycles from the standpoint of miner profitability by dividing the daily supply of Bitcoin in US dollars by the 365-day moving average of BTC’s daily issuance value. Based on Glassnode’s chart, long-term investors who buy and hold whenever BTC’s Puell Multiple falls below 0.5 have historically seen significant gains.

The indicator flashed just as BTC bottomed after the coronavirus-induced selloff in March. The technical signal also marked the bottom in 2019, 2015, and 2012.

But crypto analysts aren’t convinced a big bull run will happen in the near term. Trader and technician JackSparrow tells his 49,000 followers on Twitter that he believes BTC is likely to go through another significant move to the downside. The pseudonymous analyst predicts a Bitcoin retracement in the coming months with the possibility of revisiting support at $6,000.

$BTC monthly

With or without a final rally, the remainder of the summer seems to be for a correction

Either July becomes a May '19 like rocket candle (or inverse Nov '18 like)

Or, if not, I think we'll sell-off to 6K range throughout summer

Still long – waiting for movement pic.twitter.com/aoIiU3lOli

— //Bitcoin ?ack ? (@BTC_JackSparrow) June 21, 2020

Meanwhile, analysts are contemplating the odds that the decentralized finance (DeFi) movement will fuel an Ethereum bull run.

Joseph Todaro, managing partner at digital asset management firm BlockTownCap, says he believes DeFi is the one big catalyst that can send Ethereum (ETH) to a valuation of $9,000 per coin.

https://twitter.com/JosephTodaro_/status/1272941691088052225

Former Wall Street bond trader John Todaro echoes Joseph Todaro’s sentiment. TradeBlock’s head of research says he expects ETH supply to plummet as more tokens are locked in DeFi platforms.

“There’s a lot of excitement around new DeFi tokens. Reminder that most of that collateral locked up across those platforms is in Ethereum. As that outstanding ether supply comes down and demand from DeFi platforms hits escape velocity, ETH will rally hard.”

Meanwhile, strategists are also debating if and when XRP will emerge from its extended slumber.

A new in-depth analysis of XRP’s performance in Japan shows Ripple’s native crypto asset continues to give off bearish readings.

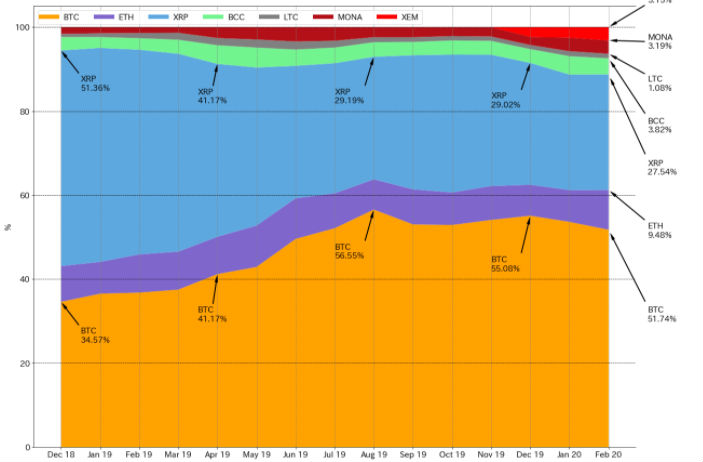

In 2018, XRP’s monthly dominance stood at 51.36% in contrast to BTC’s 34.57%, according to BitBank analyst Yuya Hasegawa. By February 2020, XRP’s dominance nosedived to 27.54% while BTC’s dominance rose to 51.74%.

Hasegawa believes Bitcoin will continue to flex its muscles in a coronavirus world, and he expects XRP to eventually recover as the world adjusts to a rise in digital payments.

“As movements across borders are strictly limited, the demand for cross-border payments and remittances have an opportunity to grow. XRP’s issuer, Ripple, already has a scalable infrastructure to implement fast and cheap cross-border remittances, and its use cases are quietly growing in some parts of the world.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/asharkyu