HodlX Guest Post Submit Your Post

Transacting on the second-largest cryptocurrency is becoming more expensive as transaction fees surge. To put the situation in context, average Ethereum transaction fees have gone from under $0.10 in March to over $0.55 in June. With Ethereum gas fees on the rise, the fee spread between the largest and second-largest cryptocurrency is closing in fast.

What is Gas?

Similar to how internal combustion engine cars need gasoline to operate and drive, the Ethereum ecosystem needs gas to operate and process transactions. Gas is used universally in the Ethereum ecosystem, including the validation of various smart contracts and transactions. Ethereum gas fees are often denoted in Gwei, a unit of Ethereum. One Ethereum is equivalent to 1000000000 Gewi.

Since Ethereum is currently a proof-of-work blockchain, miners are responsible for processing and validating transactions on the Ethereum blockchain. Miners can dedicate computing power to solving mathematical puzzles to find the next block. The miner who finds the next block is rewarded with the block reward and transaction fees from the transactions included in the block. Transactions with a low gas limit may fail after being abandoned by miners.

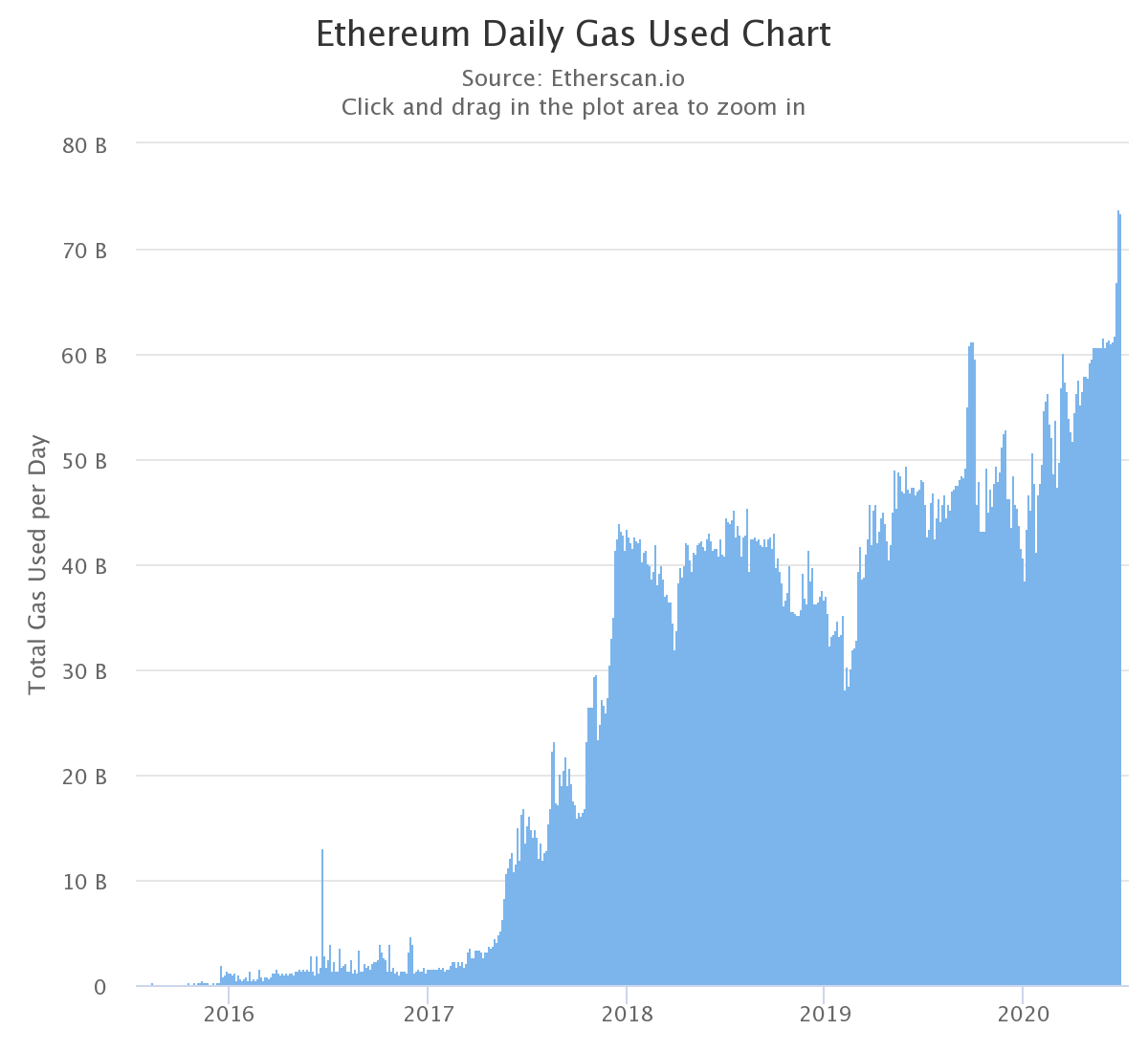

Gas fees are affected by blockchain demand, with miners prioritizing transactions with the highest gas price. Thus, as activity on the Ethereum blockchain increases, gas usage also increases. Since Ethereum transaction prices are calculated by the gas used x gas price, periods of high blockchain demand result in higher Ethereum transaction fees.

Gas Usage on the Rise

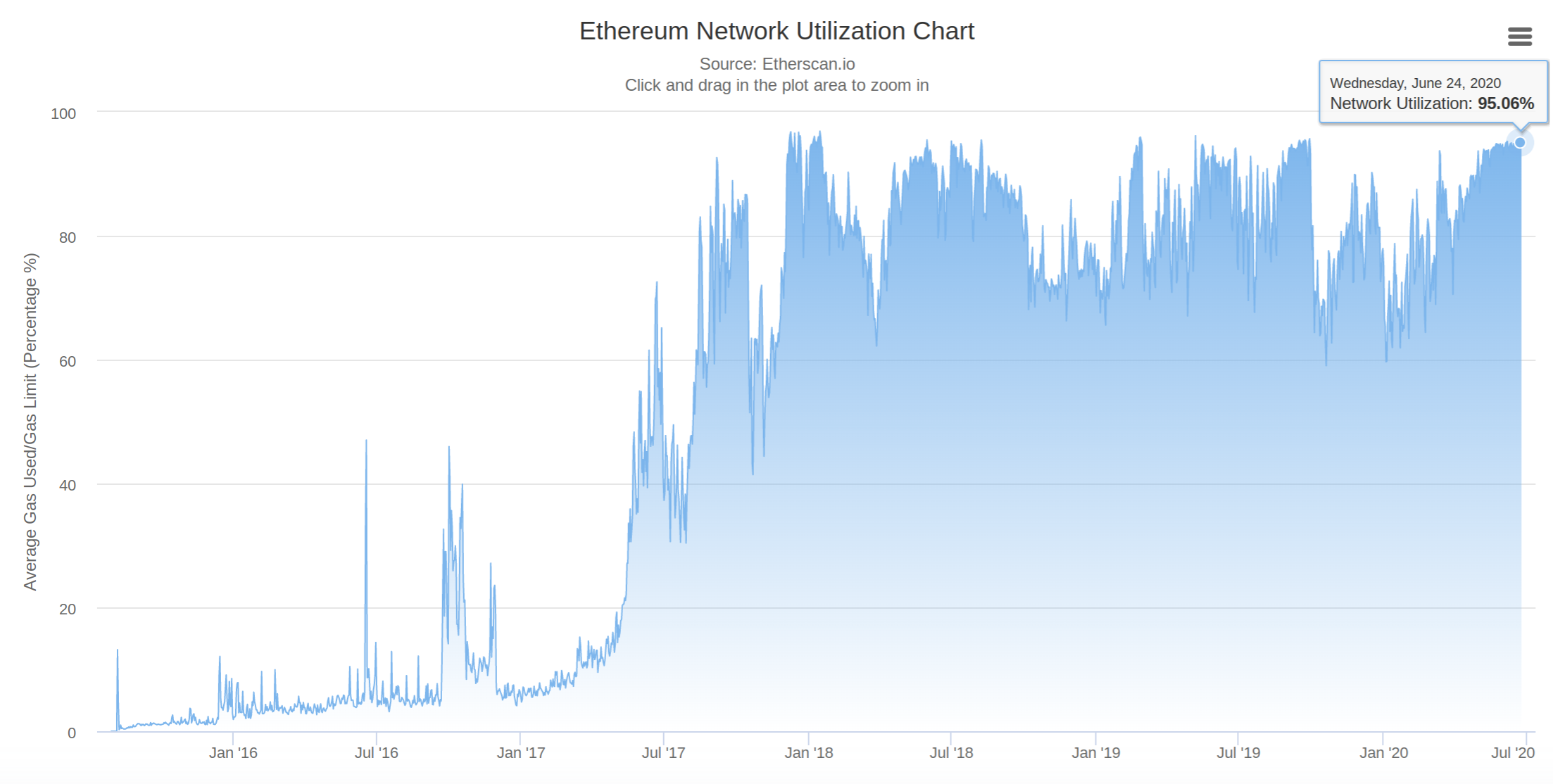

Ethereum daily gas usage has been on the rise since mid-2017 and has accelerated in recent months as on-chain transactions grow.

With transactions becoming more competitive, transactions will use more gas to be prioritized and validated by Ethereum miners, ultimately making the transactions more expensive for senders.

Ethereum Gas Guzzlers

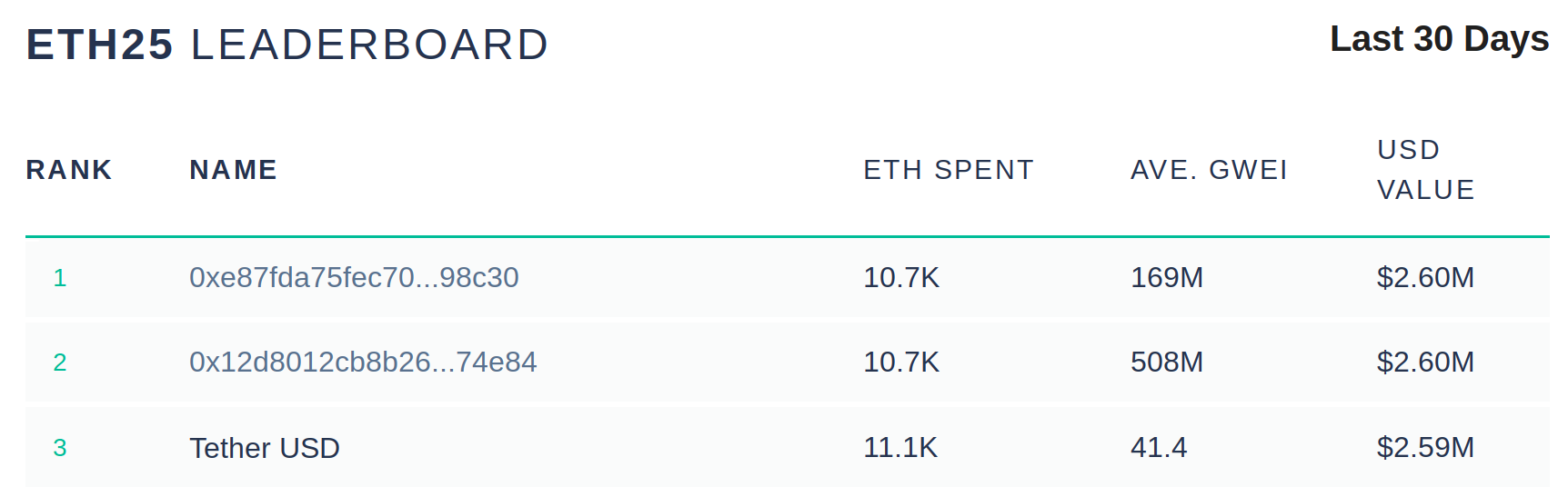

According to ETH Gas Station, Tether (USDT) transactions via the Ethereum blockchain account for 10,500 ETH in fees in the last 30 days. Tether (USDT) is the largest stablecoin with a current market cap of $9.2 billion, according to CoinMarketCap. The massive stablecoin operates on several blockchains, including the Ethereum blockchain as an ERC-20 token.

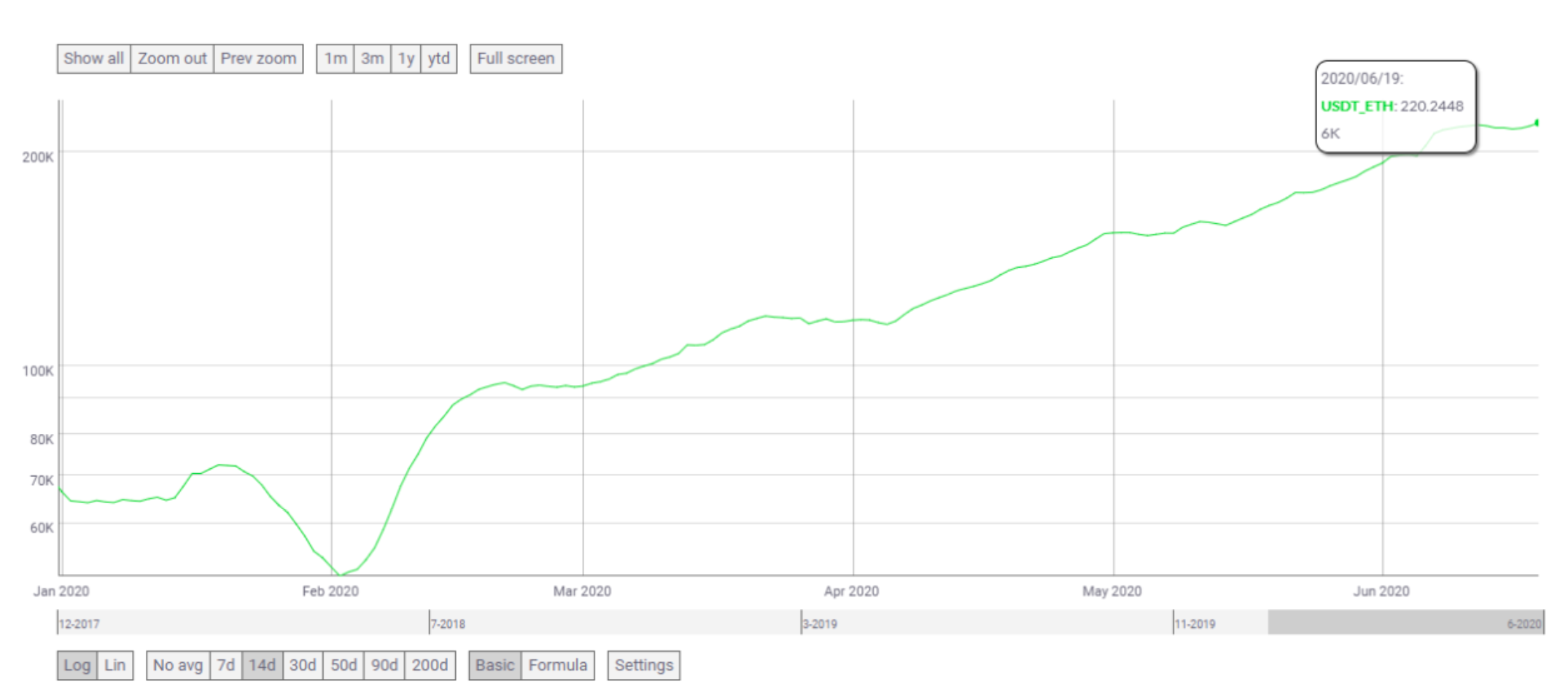

In addition to being the largest ERC-20 token by market cap on the Ethereum blockchain, Tether (USDT) has seen a recent surge in demand as transactions on the Ethereum blockchain soar. According to data by CoinMetrics, the 14-day average for Tether (USDT) transactions on the Ethereum blockchain is continuing in an upward trend.

Ethereum Network Utilization

Etherscan’s network utilization chart clearly shows that network utilization is growing, surpassing 95%. With network utilization growing, competition for transactions will also increase. As a result, it won’t be surprising to see gas prices, and ultimately transaction fees grow.

Miners to the Rescue

Being a proof-of-work network, Ethereum miners can vote to make changes to the network. According to Bitfly, operator of Ethereum mining pool Ethermine, miners are currently voting on increasing the block gas limit by 2,500,000 to 12,500,000. Bitfly notes that this should boost Ethereum’s TPS (transactions per second) capacity by approximately 9 TPS. Increasing the TPS should help Ethereum deal with congestion and scalability problems as usage and adoption increases. However, increasing the TPS by only nine transactions per second may only be a short-term solution.

Adit Gupta is the founder and editor-in-chief at The Crypto Associate, a crypto media publication.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/View Apart