As the Ethereum-based hotshot YFI prints a new all-time high, crypto traders are keeping their eyes peeled on a new decentralized finance (DeFi) asset.

The governance token of DeFi protocol Yearn.Finance skyrocketed to a high of $39,306 on Monday – representing an astronomical growth of over 124,000% since July, when it was trading at $31.65. YFI has cooled off since and it is now valued at $29,116, according to CoinMarketCap.

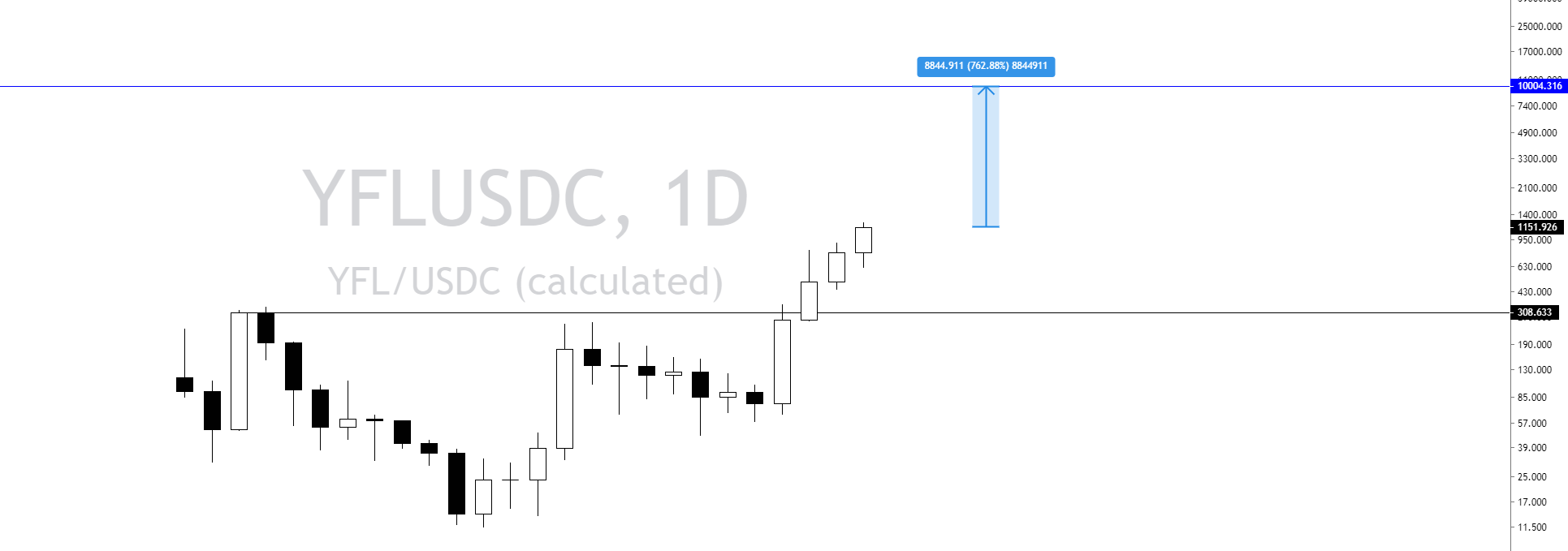

As YFI enters a corrective period, a pair of influential crypto analysts are already tracking the movements of a rival DeFi token. A trader known in the industry as Cantering Clark believes that the new coin may be en route to five figures.

“At this point, would a 10,000 YFL surprise anyone? It was in the teens two weeks ago. Circulating supply is 47,000 out of 50,000. This thing is going to move a lot more.”

YF Link is a fork of Yearn.Finance. The new digital asset targets LINK (Chainlink) holders and allows them to use their LINK holdings to directly take part in the DeFi mania via yield farming.

Trader Josh Rager says he’s also keeping tabs on YF Link (YFL). He says the coin has yet to realize its price potential and is placing a short-term target at $1,400.

https://twitter.com/Josh_Rager/status/1300905634704035846

Despite his optimism, Rager is also warning traders to be extremely careful in the exuberant DeFi market.

“Just assume that any new altcoin that you trade on Uniswap can go to $0 at any moment. That’s a fact and will help you practice proper risk management.”

YLF is currently trading at $1,224, according to CoinMarketCap. Bitcoin is currently trading at $11,884 after once again meeting resistance at $12,000.