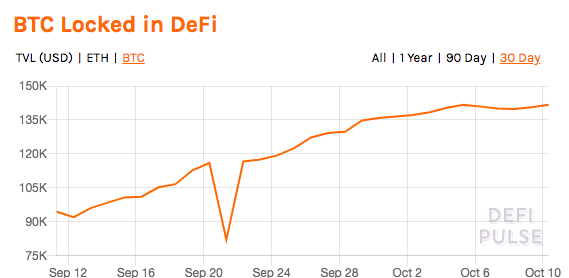

The total number of Bitcoin locked in decentralized finance (DeFi) protocols has reached an all-time high as DeFi markets begin to show signs of recovery.

DeFi analytics platform DeFi Pulse reveals that Bitcoin holders have converted 141,683 BTC worth over $1.5 billion into ERC-20 tokens to participate in the nascent yet fast-growing decentralized finance space.

Due to the incompatibility between the Bitcoin and Ethereum blockchains, BTC users have to convert their holdings into Ethereum-based tokens to leverage the capabilities of DeFi platforms. A popular choice among Bitcoin holders is to exchange their BTC into wrapped Bitcoin (wBTC) on a 1:1 basis. With wBTC, Bitcoin holders can explore the many advantages of DeFi including the ability to offer up the synthetic token as collateral to earn interest on lending platforms such as Compound (COMP) and Aave (LEND).

At time of writing, there are around 95,700 wBTC stored on the Ethereum blockchain.

The surge in the number of BTC locked in DeFi comes just as the decentralized finance sector shows signs of life. After suffering a brutal three-week pullback that saw its value plummet by approximately 60% from the all-time high of $43,873, yield-farming protocol yearn.finance (YFI) has bounced nearly 15% in the last 24 hours according to CoinMarketCap. Aave and decentralized oracle network Chainlink (LINK) are also in the green, up over 17% and 13%, respectively, over the same stretch.

The DeFi rally appears to coincide with a bigger push that involves the broader crypto market. Crypto analyst Kevin Svenson tells his 11,000 followers that the recent move in crypto is forcing him to reconsider his stance.

“Even though I’ve been more neutral recently, things (so far) seem more bullish than I expected.

S&P Futures breaking out right now.

Bitcoin getting above resistance.

ETH breakout soon?

LINK potential bullish setup.

If global market keeps moving up, it will get bullish again.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/medvedsky.kz