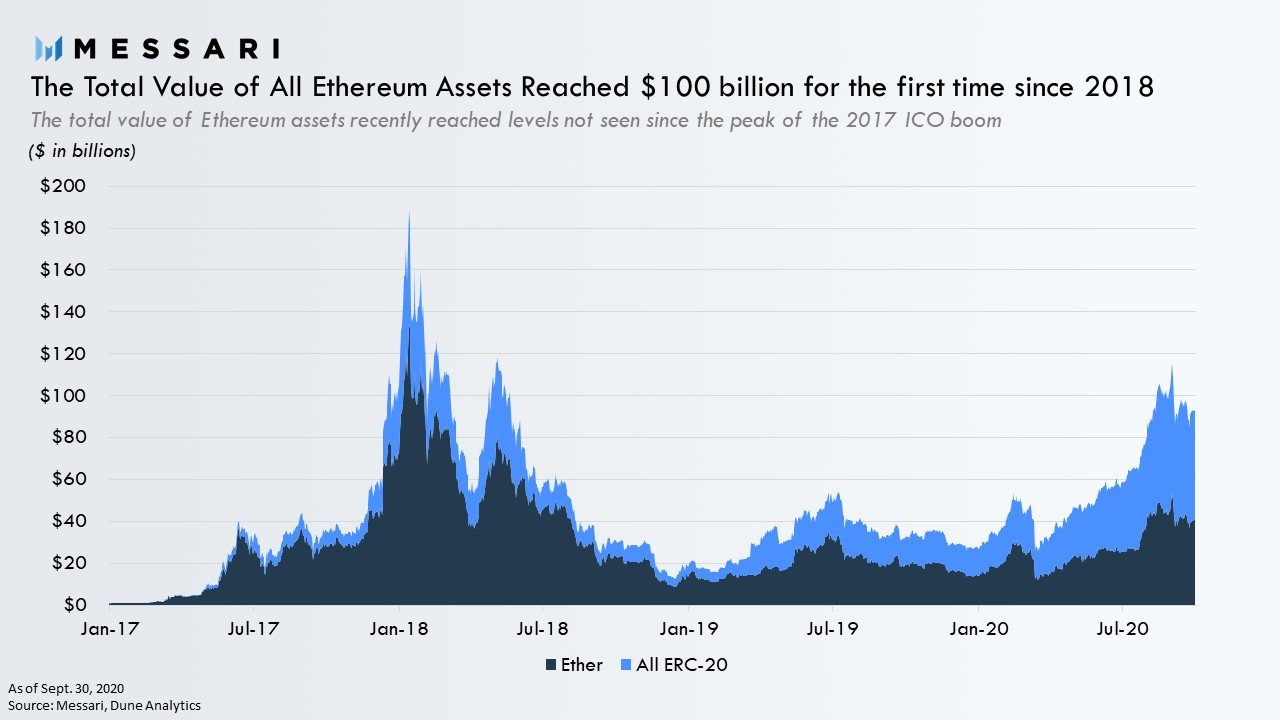

The total value of all assets in the Ethereum ecosystem has breached $100 billion dollars, according to the blockchain database startup Messari.

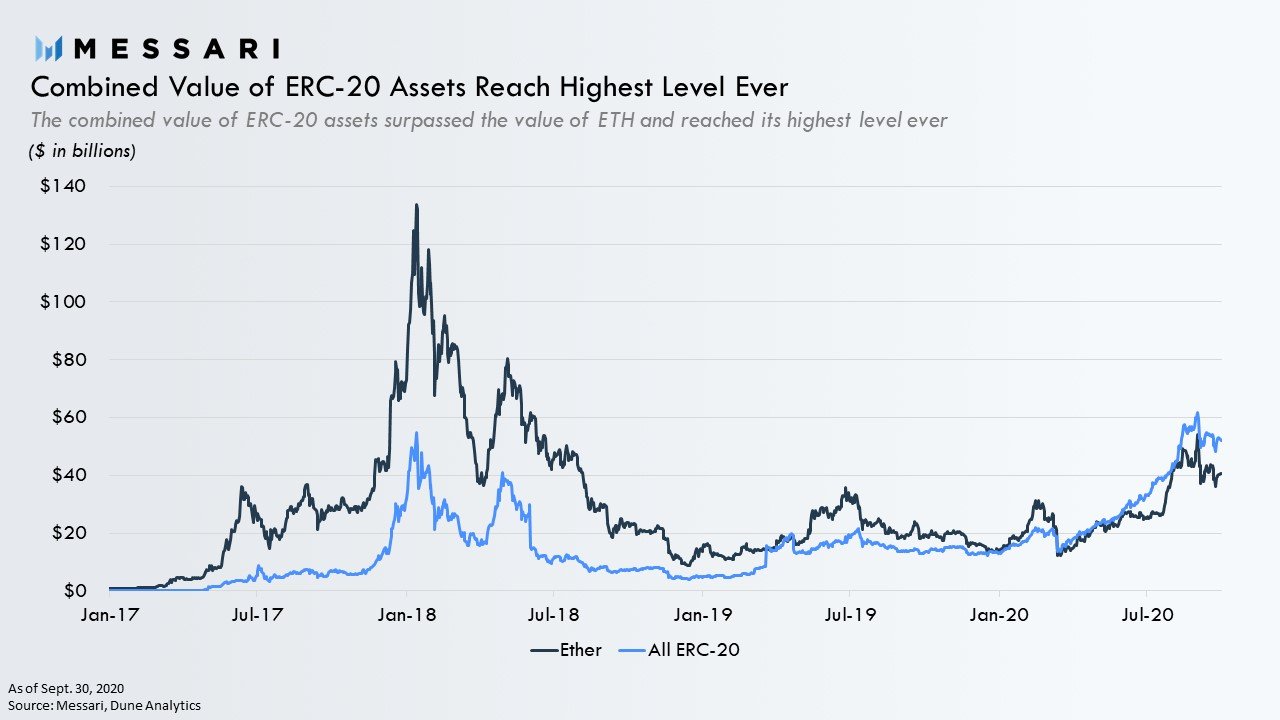

Messari is detailing the evolution of value in the leading smart contract platform. The firm says the market cap of ERC-20 tokens on Ethereum – which is made up of stablecoins, decentralized finance (DeFi) coins, utility and exchange tokens among many others – started to grow in 2017. Messari senior research analyst Ryan Watkins highlights the growth trend, which reached a historic milestone in July.

“…I highlighted that the market cap of ERC-20 tokens reached parity with ETH for the first time ever, further illustrating this evolution.

The trend hasn’t stopped since and the market cap of ERC-20 tokens now surpasses the market cap of ETH by a significant margin.”

Watkins notes that in recent months, the total value of all ERC-20 tokens has skyrocketed to a level not seen in over two years.

“In Q3 the total value of all Ethereum assets surpassed $100 billion for the first time since 2018 – the peak of ICO boom.

The combined market cap of ERC-20 tokens now surpasses that of ETH by a significant margin.”

The growth of value in Ethereum has prompted many questions regarding the future of the second-largest cryptocurrency, says Watkins. One question in particular involves Ethereum’s lackluster price performance relative to DeFi’s meteoric rise.

The growth in ERC-20 tokens this year has prompted many questions about the future of Ethereum.

— Ryan Watkins (@RyanWatkins_) October 15, 2020

Is this just the natural order of the Ethereum tech stack value capture? https://t.co/Y6hxJKmZab

Another concern for Watkins is the possibility that the issuance of certain tokens on Ethereum such as USDT (Tether) and other stablecoins may not be beneficial for the long-term health of the ETH.

Bloomberg Intelligence commodity analyst Mike McGlone recently said he believes that ETH will lose the second spot in terms of market capitalization to USDT.

“The rapid rise in the market cap of stablecoins indicates that central bank digital currencies (CBDCs) are a matter of time, in our view. It should take something significant to stall the increasing adoption of Tether, the top stablecoin, which is on pace to match the capitalization of Ethereum in a bit less than a year, based on the regression trend since the start of 2019.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Panuwatccn