Ripple has emerged as one of the largest fintech companies in the world, according to a recent report from CB Insights.

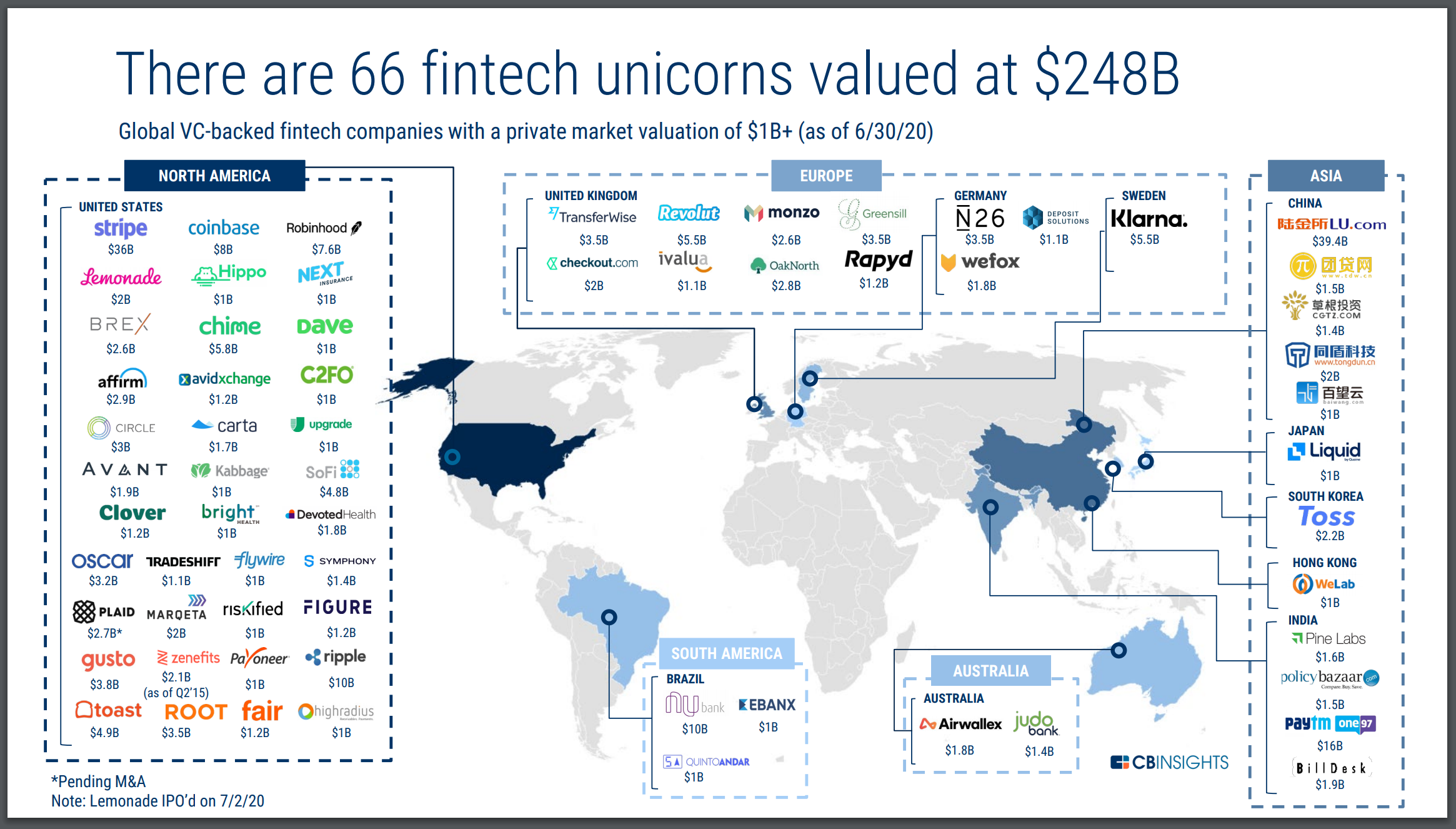

The global market intelligence firm compiled data on the largest VC-backed fintech companies worth $1 billion or more, naming a total of 66 companies on the list.

San Francisco-based Ripple, with its $10 billion valuation, is behind only San Francisco-based Stripe, Shanghai-based Lufax, and India-based Paytm One97 which are valued at $36 billion, $39.4 billion, and $16 billion respectively.

Late last year, Ripple raised $200 million in a Series C funding round, spearheaded by SBI Group, Tetragon and Route 66 Ventures. That same year, the company purchased a $50 million stake in remittance platform MoneyGram.

Ripple says it has more than 300 clients using its payments technology to move money across borders. Its digital asset portfolio alone is worth a fortune.

The company owns more than half of the total supply of the crypto asset XRP. At time of publishing, XRP’s total market cap is $11.6 billion, according to CoinMarketCap.

In an interview with Financial Times, CEO Brad Garlinghouse addressed whether XRP is needed to keep the company cash flow positive.

“Well, XRP is one source. I don’t know how to answer that because if you took away our software revenues, that would make us less profitable. If you took away all our XRP, that makes us less profitable. So I don’t think about it as one thing…

We would not be profitable or cash flow positive [without selling XRP], I think I’ve said that. We have now.”

Ripple says it sold $81.39 million in XRP in the third quarter of this year to support its crypto-based remittance platform, On-Demand Liquidity. It also purchased $45.55 million XRP to fuel the product’s liquidity.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/hallojulie