Lex Moskovski, chief investment officer (CIO) of crypto-focused hedge fund Moskovski Capital, is listing what he thinks are positive signals in three on-chain metrics as Bitcoin bulls attempt to spark a new uptrend.

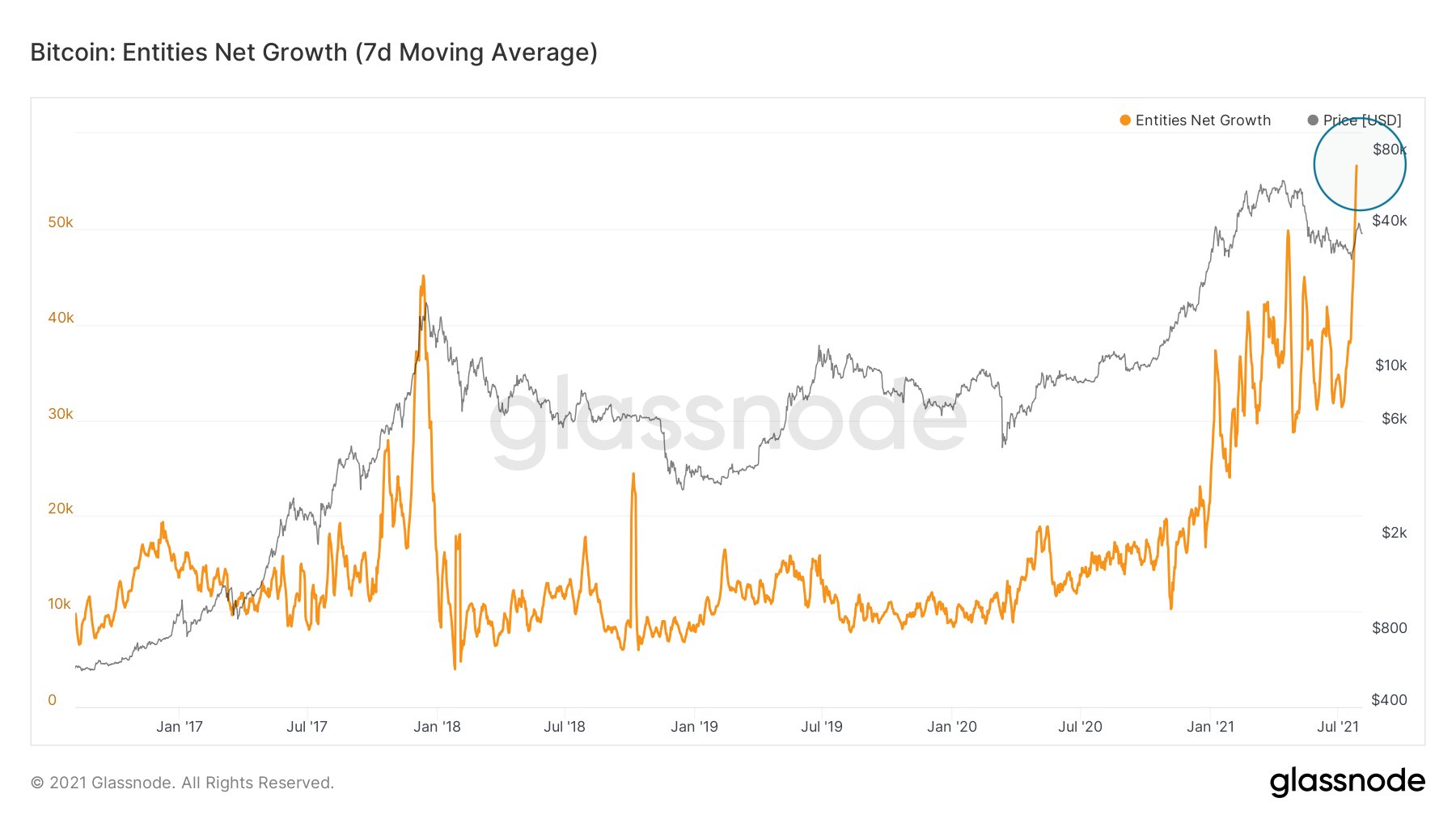

Moskoski says that Bitcoin entities, or active addresses on the BTC network, have recently reached a new all-time high (ATH).

“Bitcoin entities net growth reached ATH.

[There] wasn’t any period in its whole history when the number of active participants grew faster, averaged weekly.”

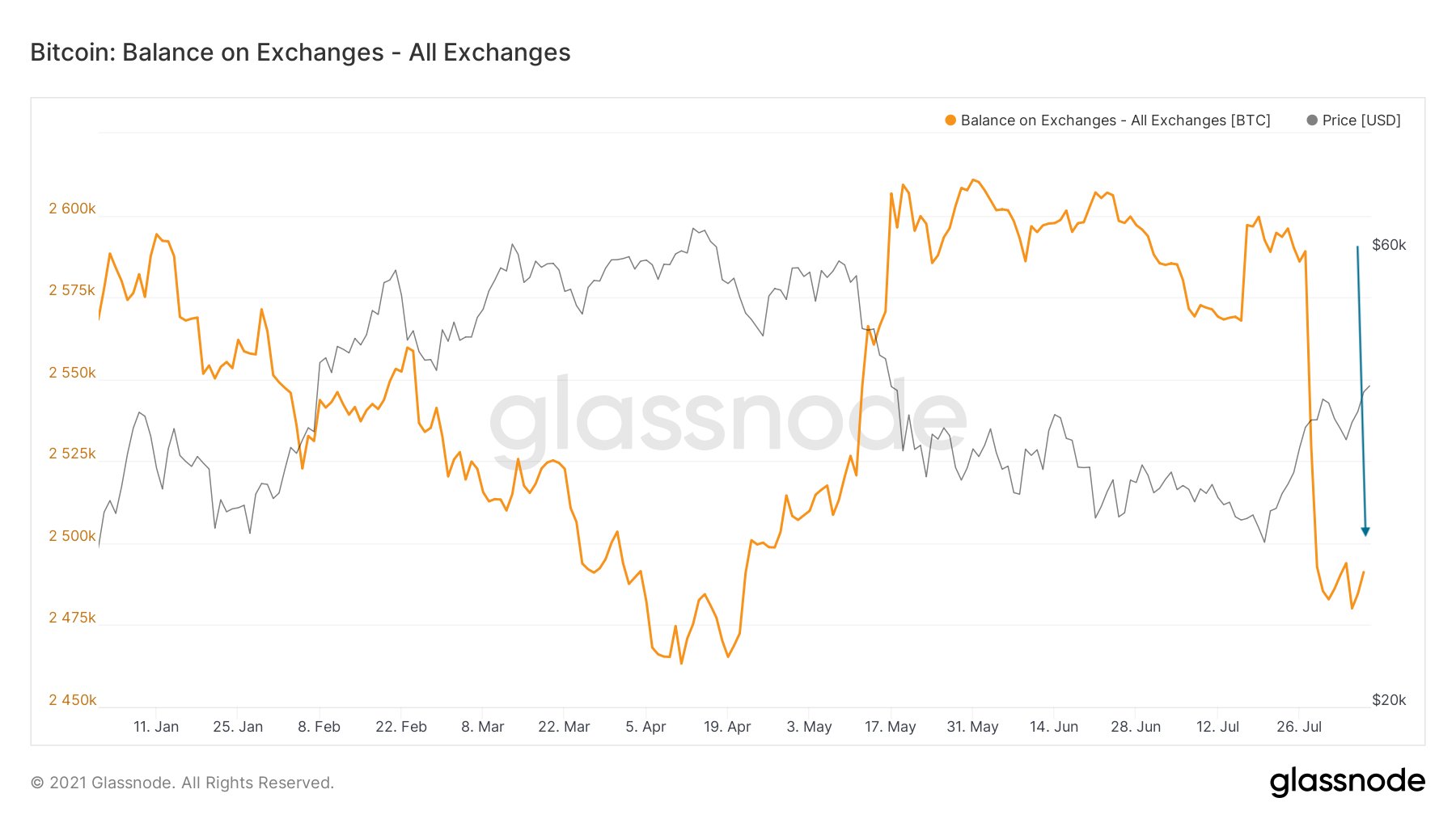

Moskovski also says that the number of Bitcoin on exchanges has plummeted to levels not seen since BTC was trading near its all-time highs in April. The crypto veteran says the metric broke down in a “Bart” pattern, or a formation that looks like the head of Bart Simpson from the cartoon series “The Simpsons.”

“Bitcoin supply on exchanges has been greatly reduced.

Back to trend?

Nice Bart, [by the way.]”

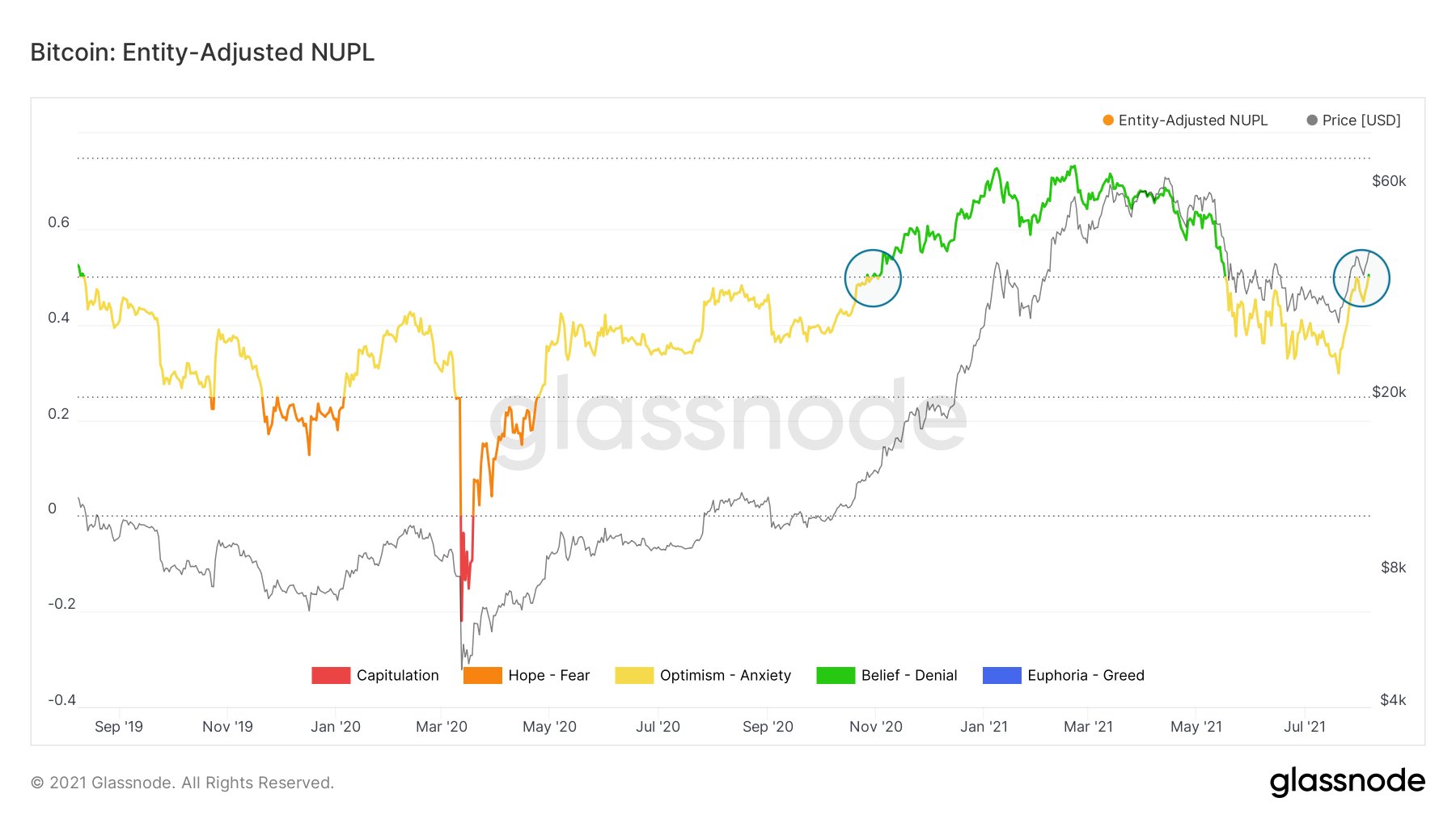

Moskovski adds that he has his eye on data from Glassnode that shows the growth of entity-adjusted NUPL (net unrealized profit and loss).

According to Glassnode, its “entity-adjusted” metrics give a more accurate measurement of how many active users are on the Bitcoin network by taking into account the fact that a single entity can control multiple addresses and that BTC addresses can hold funds from a group of people.

The NUPL metric compares the total value of the market to the value of all open positions of traders and investors.

Moskovski says that the NUPL metric has just flashed a green signal, indicating that Bitcoin has begun trending toward a more bullish “belief” phase of a market cycle.

“Bitcoin ea-NUPL flashed green on an upward move first time since Oct, 27th 2020.

We’ve entered the Belief phase.”

At time of writing, Bitcoin is trading at $44,338, according to CoinGecko.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Peshkova