Popular on-chain analyst Will Clemente says that a Bitcoin supercycle is in the cards as long-term BTC holders are changing the market structure of the leading cryptocurrency.

Clemente tells his 205,900 Twitter followers that the illiquid supply ratio, a metric that tracks the number of illiquid coins relative to overall BTC supply, has been in a strong uptrend ever since Bitcoin recovered from the pandemic-induced panic last year.

“If I had to use one chart to argue that we are in a ‘Supercycle’ it would be this. Macro HODLing (hold on for dear life) behavior has shifted after March of last year. Makes a convincing case for the end of the 4-year cycle.

A Bitcoin supercycle is a thesis suggesting that BTC will continue rallying and print fresh all-time highs instead of entering a bear market and having massive 80% drawdowns just like what happened during the end of the 2013 and 2017 bull cycles.

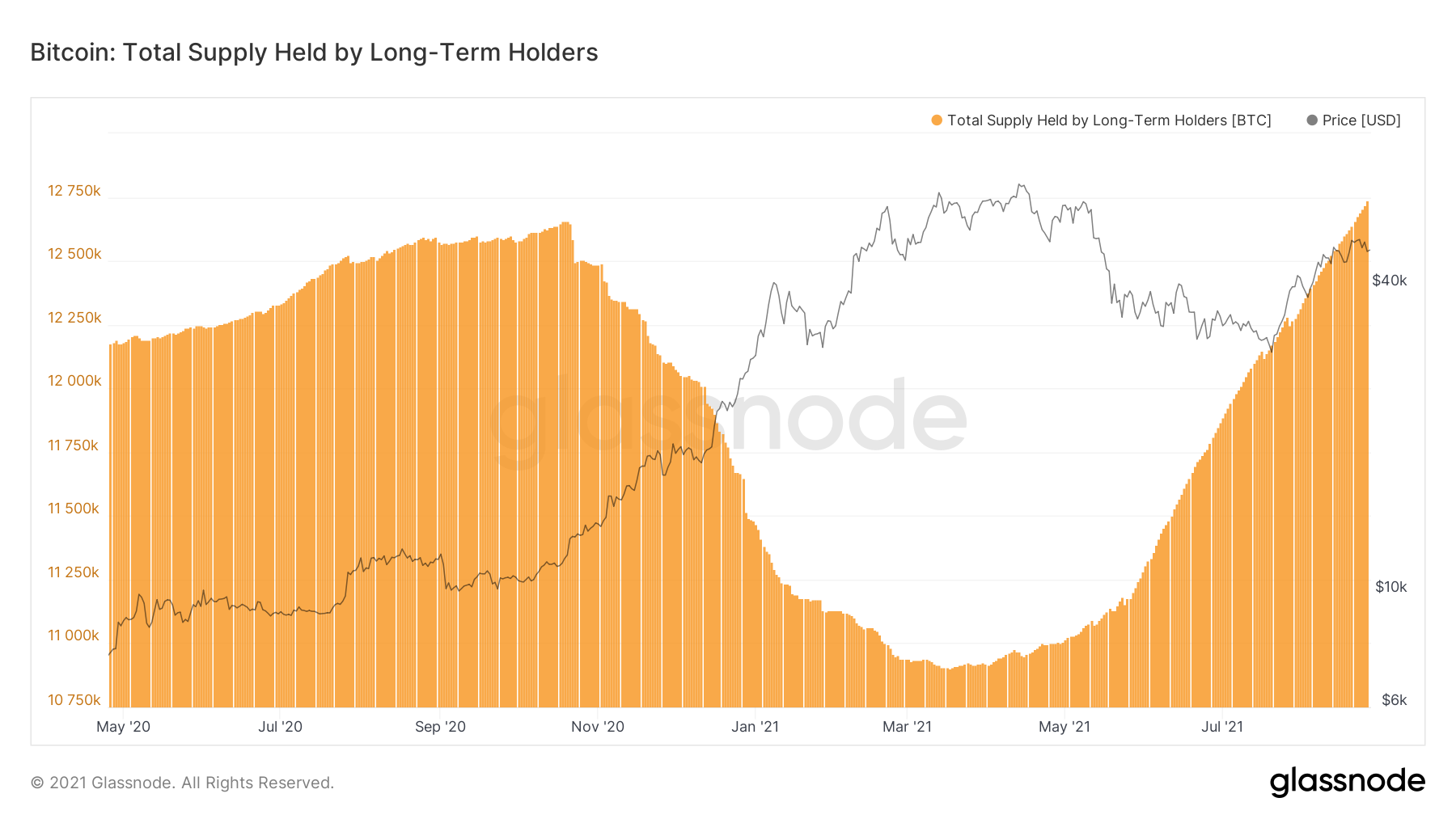

According to Will Clemente, long-term holders, or entities that have kept their BTC dormant for at least five months, are changing the narrative for this cycle.

“Structurally, this time actually is different. Long-term Bitcoin holders set the floor.”

Clemente also highlights that the number of coins owned by long-term holders has made a sharp recovery since the May 2021 crash and is now at an all-time high.

“We’ve got a new all-time high in Bitcoin supply held by long-term investors. These entities now hold 12,731,020 Bitcoins. As a percentage of circulating supply, these long-term investors now possess 67.7% of supply. When factoring out lost coins (using adjusted supply instead of circulating) this number is as high as 84.5% of supply.”

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/AleksandrMorrisovich