Popular on-chain data analyst William Clemente says Bitcoin (BTC) will flip bullish when one metric reaches a key level.

In Blockware Intelligence’s latest newsletter, Clemente looks at the cost basis for short-term holders (STHs) of Bitcoin (BTC).

Cost basis, as it pertains to on-chain analytics, is the average price where a certain group of investors entered the market. Bitcoin investors are considered short-term holders if their coins are younger than five months.

“Bitcoin is below the short-term holder cost basis, which currently sits at $53,000. Until this is reclaimed, not bullish. Not saying I am a ‘giga bear,’ just cautious until the market shows me otherwise. Happy to flip bullish if reclaimed. Bearish confirmation would be a failed underside retest of the band.”

Identifying a bullish catalyst for Bitcoin, Clemente says that a growing amount of BTC is moving towards entities with very little history of selling. He says this particular metric is vastly different than what it was in May right before the massive correction.

“Illiquid supply has recovered nicely over the last week, showing that supply is moving to entities with low spending behavior. (hold >75% of the coins they take in) This is a lot different than what we saw in May, as the opposite effect took place.”

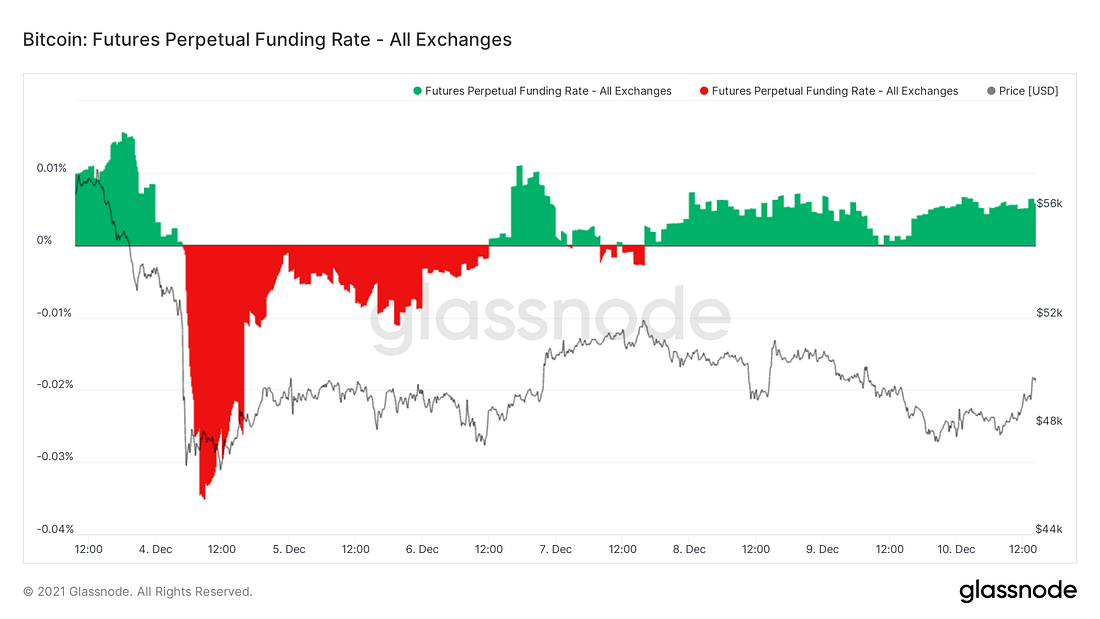

The analyst also says that BTC bulls can keep an eye on funding rates. According to Clemente, funding rates across crypto exchanges should maintain a neutral or negative trend before BTC can kick off a new bull run.

“If you’re a bull, you would like to see it continue to carve out a regime of mixed/negative, similar to what happened after September heading into October of last year. This would show uncertainty from perpetual traders and if you theoretically saw funding muted as price grinds up would mean the market was amidst a disbelief rally.

TLDR: want to see BTC continue to consolidate and carve out that regime of mixed/negative funding.”

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Angela Harburn