Popular on-chain analyst Will Clemente is eyeing several key indicators that suggest a potential bear trap for Bitcoin could play out in the near future.

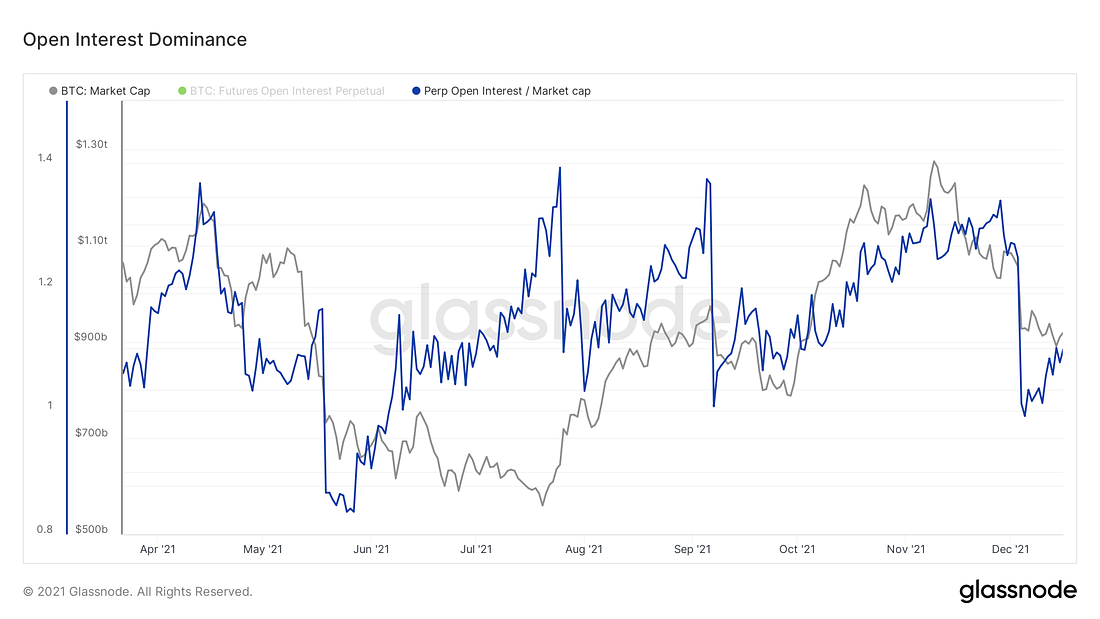

In a new edition of the weekly Blockware Intelligence Newsletter, Clemente looks at derivatives data to see whether traders are overly bullish or extremely bearish on BTC.

“We were cautious leading into the flush two weeks ago but reset the metric back to the lowest level since May earlier this year. Still overall in a healthy area, but have started to see a bit of [open interest] build-up since the flush.

Don’t think these are aggressive longs because aggregated funding has been muted and even flipped negative on Tuesday.”

Open interest is the total number of active derivative contracts held by traders. Market participants use the data as an indicator of sentiment and trader bias. According to Clemente, derivatives data shows that traders are not placing aggressive long positions, reducing the possibility of another market correction via a long squeeze, similar to what happened on December 4th.

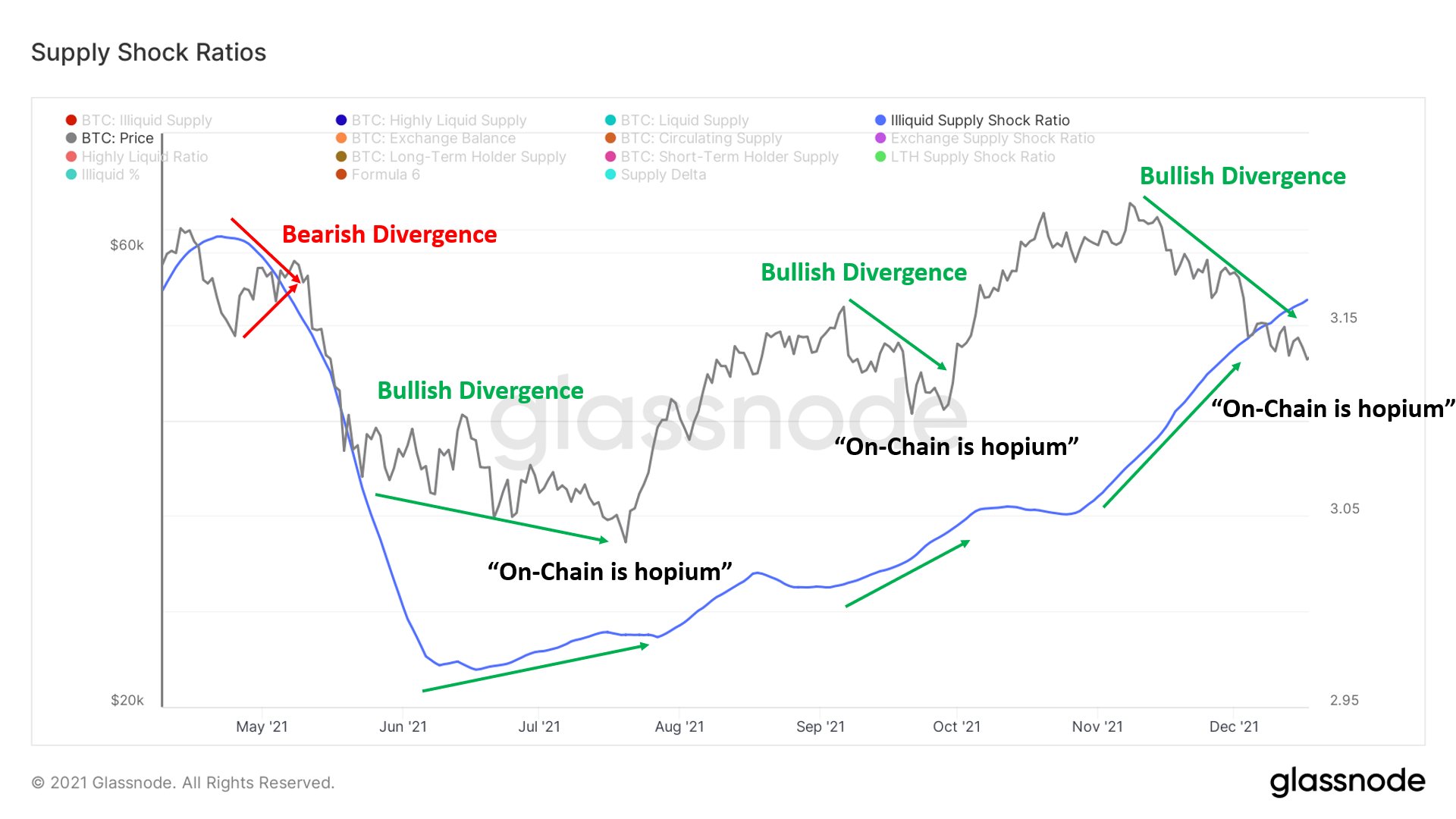

Clemente also adds that he’s seeing a divergence between the illiquid supply shock ratio, which compares the movement of coins from liquid (weak hands) entities to illiquid (strong hands) entities, and price.

“Would be pretty funny to me if this bullish divergence plays out like the last two.

Just watching price action to confirm that it is playing out. Patience is key.”

According to Clemente, the data that he’s seeing from on-chain metrics and derivatives markets suggests that Bitcoin could be placing a major bear trap.

“The last time I called for a major Bitcoin short squeeze was on July 23rd, the day before we squeezed off the summer lows.

We are currently not there YET, but the setup is becoming more likely [in my opinion].”

While Clemente is looking at the possibility of a Bitcoin rally, he also says that the 30-day moving average of the spent output profit ratio (SOPR) indicates that market participants are currently nursing losses.

“The 1 threshold (black line) serves as the median between a state of profit and loss. When below, market participants are realizing losses in aggregate. When above, market participants are realizing profits in aggregate.

In 2017, BTC didn’t break below the 1 threshold on 30DMA of SOPR once, and once below, continually got rejected off each underside retest of 1.”

Clemente says he’ll remain cautious on BTC until the SOPR moves above 1 to indicate that market participants are in profits.

At time of writing, Bitcoin is up 1.07%, priced at $47,502.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Inked Pixels