One widely followed crypto analyst says that Bitcoin (BTC) traders don’t need to be concerned about ongoing geopolitical tensions, as the charts may be telling a different story.

The pseudonymous analyst known as TechDev tells his 362,600 Twitter followers that while macroeconomic and geopolitical factors are suggesting uncertainty in the markets, he says he prefers to go against the consensus.

“I get it. [Geopolitical] and macro doesn’t look good. Doom is popular.

The crowd is certain ‘It’s over.’

Contrarians are ‘living under rocks.’

You’re angry, emotional, toxic.

The charts tell me we’re going a lot higher.

I think we are, especially because you don’t.”

To support his thesis, the crypto analyst points out several indicators signaling a Bitcoin bull run is on the horizon.

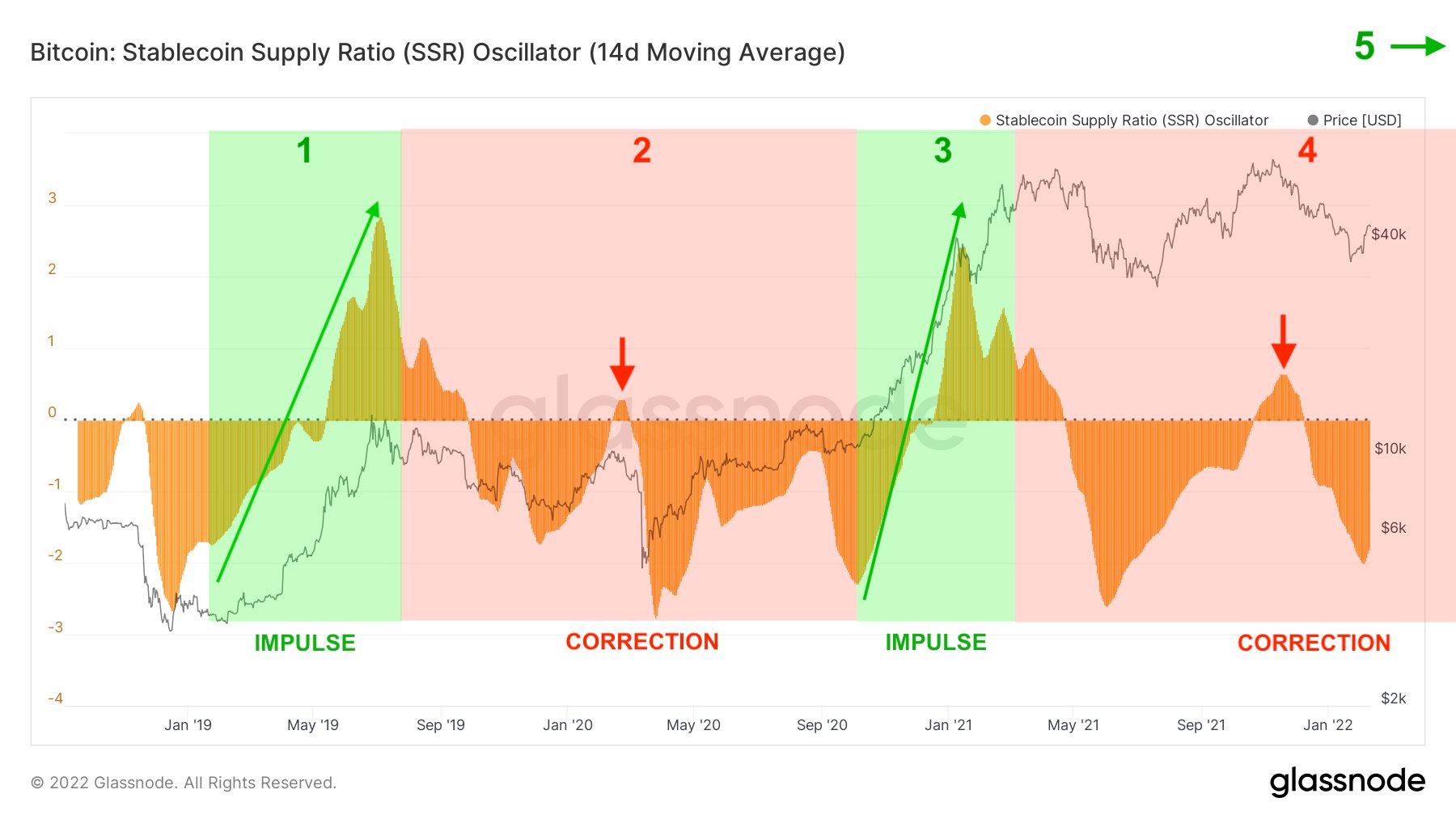

TechDev says he’s looking at the relative strength index (RSI), a momentum indicator, as well as other metrics including dormancy flow, which depicts the activity of old coins, and the stablecoin supply ratio (SSR) which compares the market cap of stablecoins to BTC.

According to the crypto analyst, these technical indicators suggest that Bitcoin is likely at the tail end of a year-long corrective period.

“Why Bitcoin has not impulsed since early 2021:

+ Wave symmetry

+ Declining volume

+ Tops at blue with price below since

+ Corrective RSI

+ Dormancy Flow down + near bottom

+ SSR Oscillator down + near bottom

We’re ending a year+ correction.

Not starting one.”

Zooming in on the SSR, the analyst reiterates that it reached a level strongly suggesting that Bitcoin has bottomed out and is gearing up for more rallies.

“This Bitcoin cycle’s impulses and corrections visualized by the Stablecoin Supply Ratio Oscillator.

Ready for the next wave.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/alphaspirit.it