HodlX Guest Post Submit Your Post

In a move that seemed hard to imagine last year, widespread cryptocurrency market crashes have seen the price of Bitcoin tumble under $27,000, with another major altcoin, Luna, being wiped out completely.

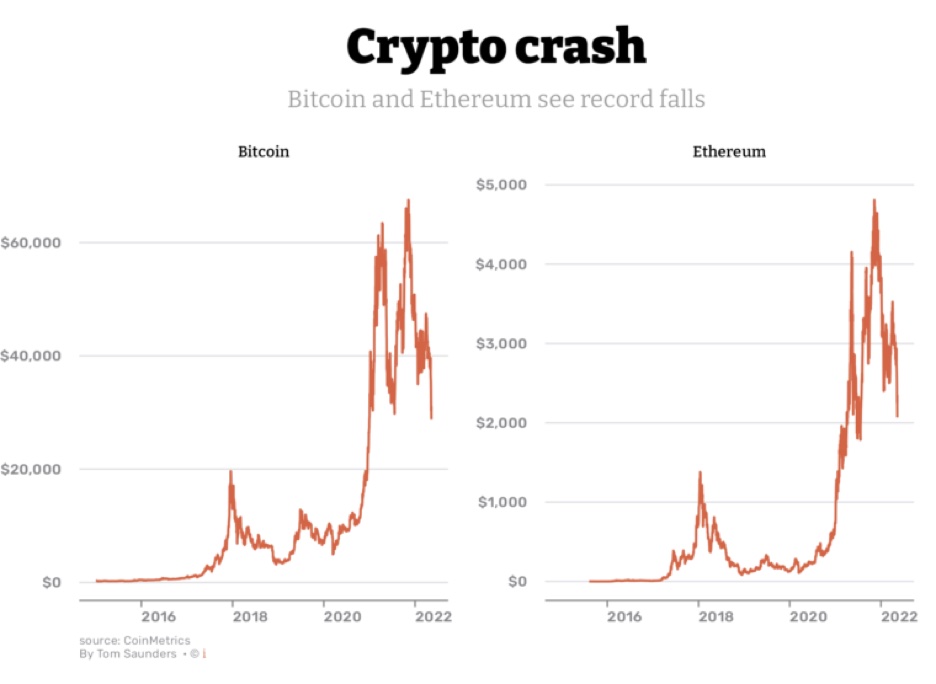

The collapse has pushed BTC/USD more than 55% adrift from its all-time high, which was recorded as recently as November 2021. But what does this recent collapse mean for investors? And could a recovery be expected?

Source: iNews

As we can see from the charts above, the cryptocurrency market crash has impacted coins in similar ways, but what’s causing the downturn?

Fundamentally, investor sentiment surrounding cryptocurrencies has changed in the wake of the downturn. As inflation rates have increased, investors have become altogether warier of high-risk investments, and the volatility that surrounds the crypto market makes it an ever-present risk to portfolios.

Maxim Manturov, head of investment advice of Freedom Finance Europe, notes that the bullish sentiment surrounding Bitcoin has been accelerated by favorable short-term market conditions brought on by the Covid-19 pandemic.

Manturov explained,

“If we compare the situation from summer 2021 when Bitcoin grew on inflation expectations and was to some extent a temporary digital alternative to gold and the current situation, one important difference is worth highlighting. On the 15th of March, the Fed started the process of raising rates and ending QE.

“This has been the fundamental reason for all Bitcoin and cryptocurrency growth in the last two years. And with higher rates, an asset class like cryptocurrency may be less attractive.”

In addition to the recent downturn, previously solid projects like Luna shed 99% of its market value, tumbling from a price of $6.75 to just two cents wiping out the portfolios of countless investors.

In the case of Luna, the crash was caused by the asset’s link to TerraUSD (UST), which is a stablecoin linked to the dollar. In the build-up to the crash, UST decoupled from the dollar, sending the price of Luna plummeting.

As a result, Luna’s market cap fell from $40 billion to around $200 million.

Although Luna’s collapse was sparked by an issue that doesn’t impact the wider market, it’s reasonable to suggest that the cryptocurrency’s spectacular decline impacted more widespread market sell-offs in recent days.

Bitcoin’s inability to shake off traditional markets

Another key cause behind the crypto market’s struggles is the landscape’s inability to differentiate itself from traditional stock markets. This can be a source of frustration for crypto enthusiasts who believe that the blockchain framework behind coins means that crypto assets should be decentralized and thus immune to global market movements.

Recent years have shown that cryptocurrencies are intrinsically linked to the stock market. When the Covid-19 pandemic caused global markets to crash in March 2020, Bitcoin also fell 57% amid the sell-offs. Likewise, when stocks recovered and underwent a significant rally, so too did Bitcoin.

Now, as the optimism surrounding the stock market’s recovery wears off, so too has the outlook for crypto. As the Federal Reserve and other central banks have opted to raise interest rates in the wake of inflation, investors have begun to shy away from crypto opting to avoid the famously volatile ecosystem in matters of wealth preservation.

Bitcoin’s most recent downturn comes in the wake of the Dow and Nasdaq’s worst daily drops since the 2020 crash. Compounding inflation issues has been the unsettling news of Russia’s invasion of Ukraine, which has resulted in greater inflation issues, supply chain problems and spiraling oil prices.

This has been compounded by the re-emergence of Covid-19 in China, which has prompted financial anxieties in Asia. While crypto advocates believe that Bitcoin will ultimately decouple from the stock market in the future, there’s little doubting that the two are intrinsically linked today.

Is a crypto winter upon us?

The most recent decline in the cryptocurrency market has been a particularly tough one for investors to handle, with suggestions growing that the landscape is entering a fresh ‘crypto winter.’

Crypto winters aren’t uncommon and usually take place between Bitcoin halving cycles which occur every four years, with the most recent taking place in May 2020. The most recent crypto winter occurred between 2018 and mid-2020.

Although the name is met with negative connotations, a crypto winter merely refers to a period of hibernation for many cryptocurrencies in which prices generally stagnate, with very few bull runs to enjoy.

Despite this, crypto winters don’t have to be a bad thing, and they can actually contribute to strengthening the cryptocurrency ecosystem. For instance, the long-term periods of stagnation help to shake out the weaker crypto projects over time, leaving only the most stable, sustainable and efficient coins, blockchains and decentralized finance projects for investors to buy into when the bull market returns.

Although the crypto winter points to a sustained period whereby the value of Bitcoin will struggle to generate momentum for price rallies, there’s no reason to suggest that BTC will be unable to return to its previous highs in the future. The cryptocurrency market’s continued adoption by institutions suggests that the future remains bright for the crypto market.

Dmytro Spilka is a finance writer based in London and founder of Solvid and Predicto. His work has been published in Nasdaq, Kiplinger, VentureBeat, Financial Express and The Diplomat.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/KhDuy Vo