A popular crypto strategist says Bitcoin (BTC) is forming a structure that tends to give traders sleepless nights.

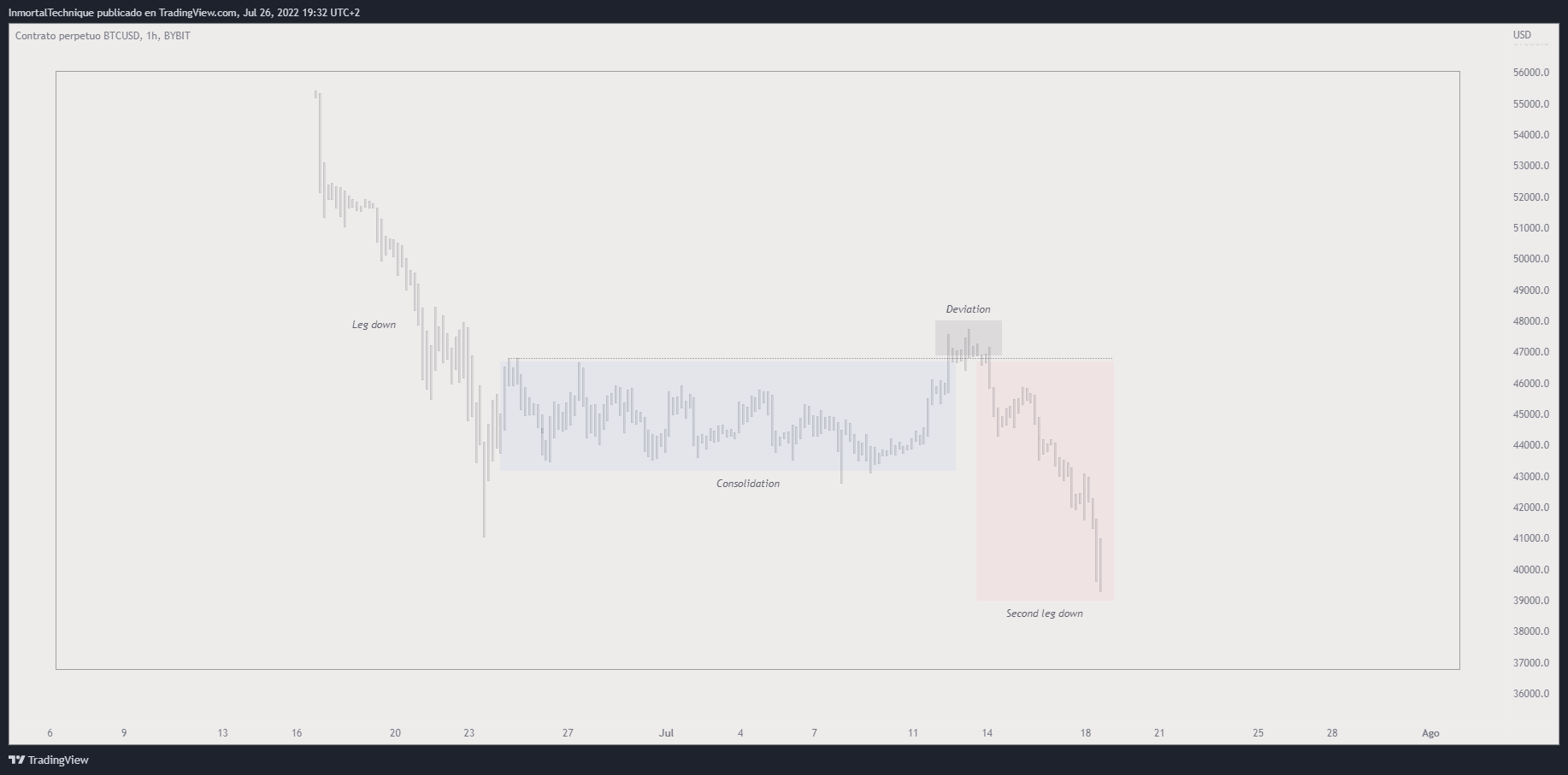

The pseudonymous analyst Inmortal tells his 174,000 Twitter followers about Bitcoin’s recent pattern of long consolidation followed by a brief rally and then a deeper decline in prices.

“Lately there is a structure that is giving nightmares to many traders. Let’s see why it happens and how to trade it.”

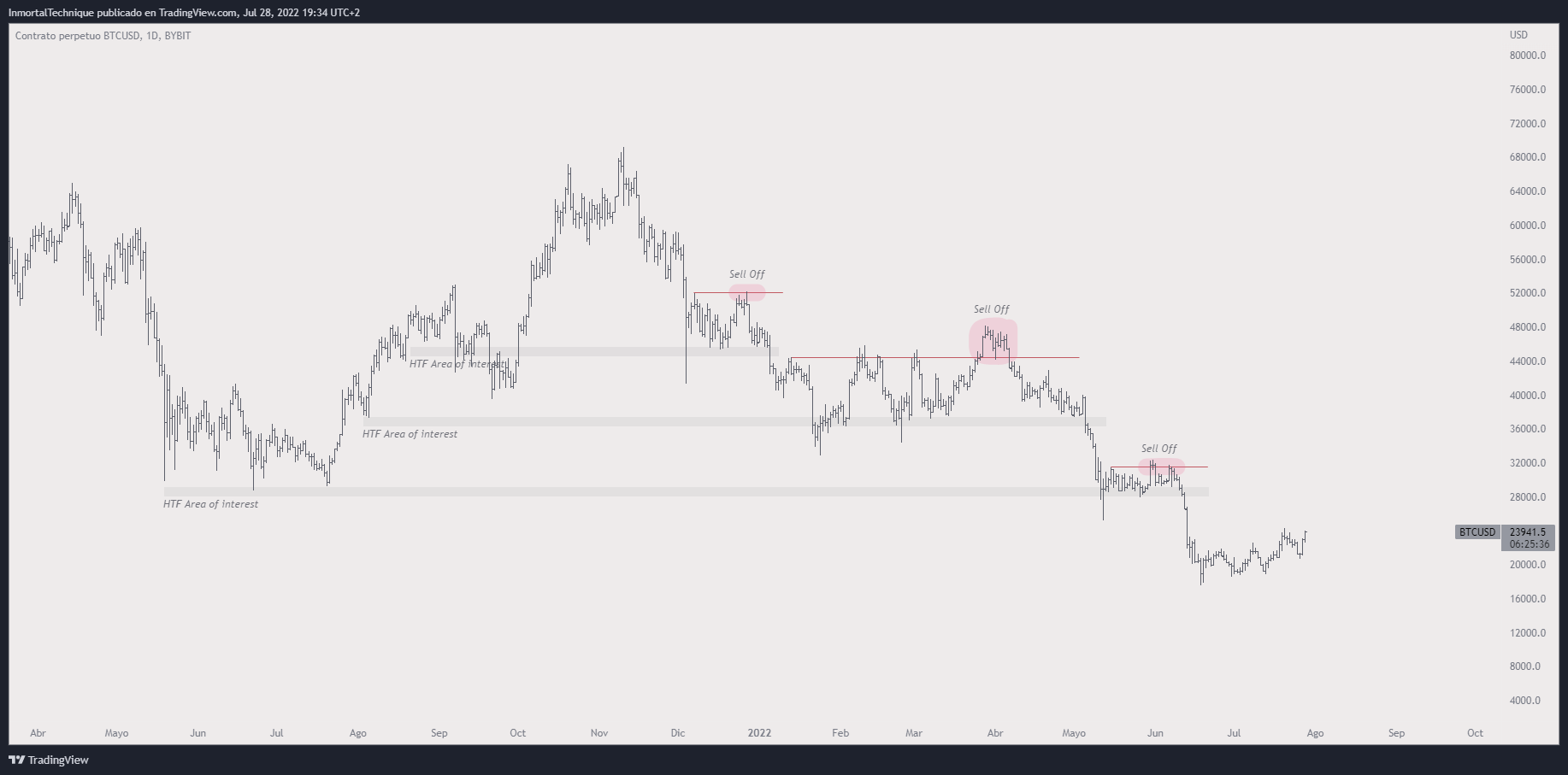

He says that the structure has become so common because, during the bear market, most people trade against the trend. The problem is that there is no real demand during the downturn so average investors fall into bull traps and eventually get liquidated.

“On the way down, price finds areas of interest with enough liquidity to make the price stops and form what looks like a bottom structure, price rallies a bit and people FOMO [fear of missing out] buy it while big players use these moves as an exit.

There [are] no new players and real demand to maintain an uptrend so price sells off at the first resistance level and make new lows.”

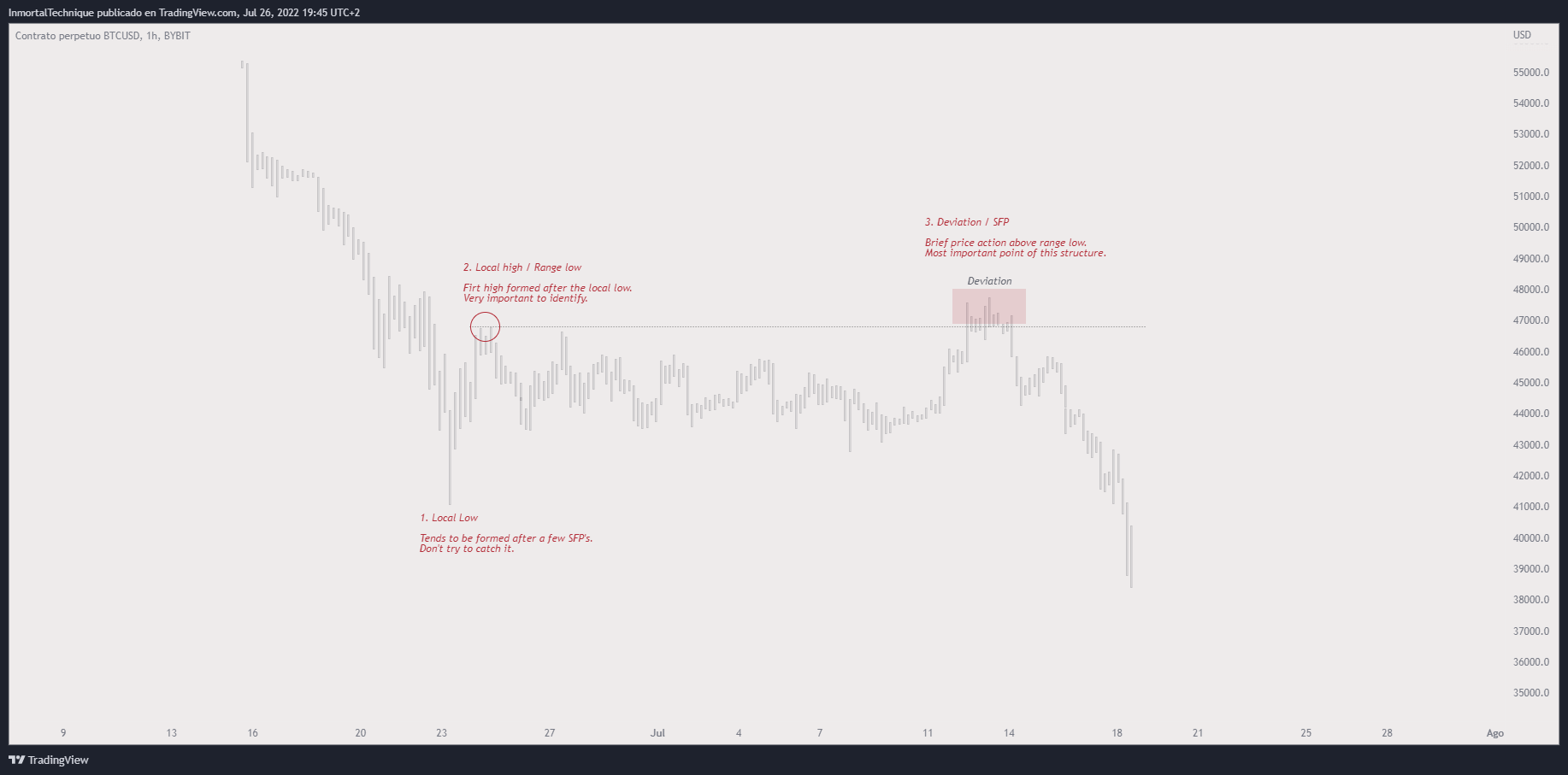

Inmortal then tells his followers how he thinks they could navigate this market structure.

“First part of this structure is the local low, but the most important point is the high that forms after that because after a boring consolidation, that will be the level where average investors will FOMO in and big players will fade them and sell…

After a deviation/SFP [swing failure pattern], we usually see a sell-off that drives us to range low (of consolidation, not local low), if the reaction is weak it’s likely to see new lows soon.”

The trader says that, just like other market structures, this one will also likely change when it repeats more often and more people notice it.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/CI Photos/phanurak rubpol